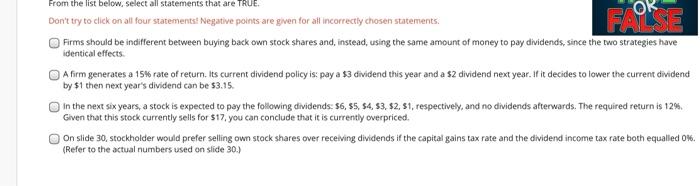

Question: FAOKE From the list below. Select all statements that are TRUE. Don't try to click on all four statements Negative points are given for all

FAOKE From the list below. Select all statements that are TRUE. Don't try to click on all four statements Negative points are given for all incorrectly chosen statements. Firms should be indifferent between buying back own stock shares and instead, using the same amount of money to pay dividends, since the two strategies have identical effects A firm generates a 15% rate of return. Its current dividend policy is: pay a $3 dividend this year and a $2 dividend next year. If it decides to lower the current dividend by $1 then next year's dividend can be $3.15. In the next six years, a stock is expected to pay the following dividends: 56, 55, 54, 53, 52, 51, respectively, and no dividends afterwards. The required return is 12% Given that this stock currently sells for $17, you can conclude that it is currently overpriced. On slide 30. stockholder would prefer selling own stock shares over receiving dividends if the capital gains tax rate and the dividend income tax rate both equalled 0%. (Refer to the actual numbers used on slide 30.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts