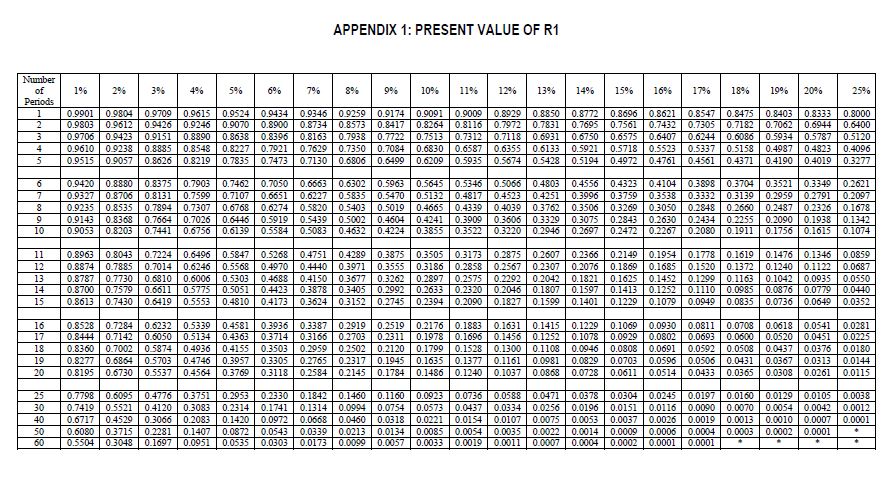

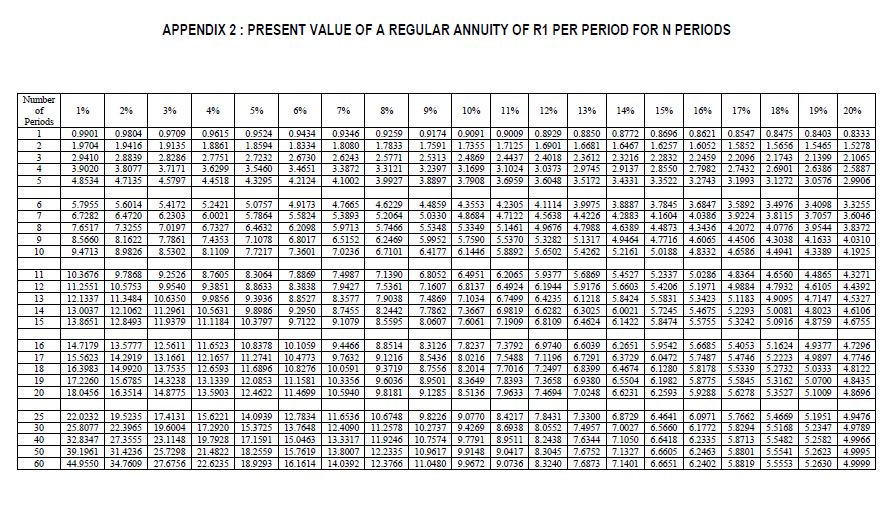

Question: fAPPENDIX 2 : PRESENT VALUE OF A REGULAR ANNUITY OF R1 PER PERIOD FDR N PERIODS M10111! at 195 256 37'. 496 5% 575 754

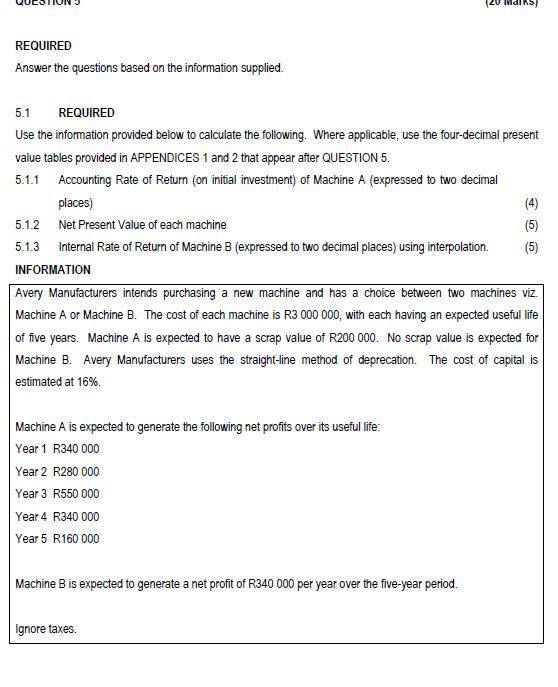

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock