Question: FASB Codification Case #5 Lease Classification Facts Starbucks, a coffee company, entered into a contract with DFW Airport to lease space near boarding areas for

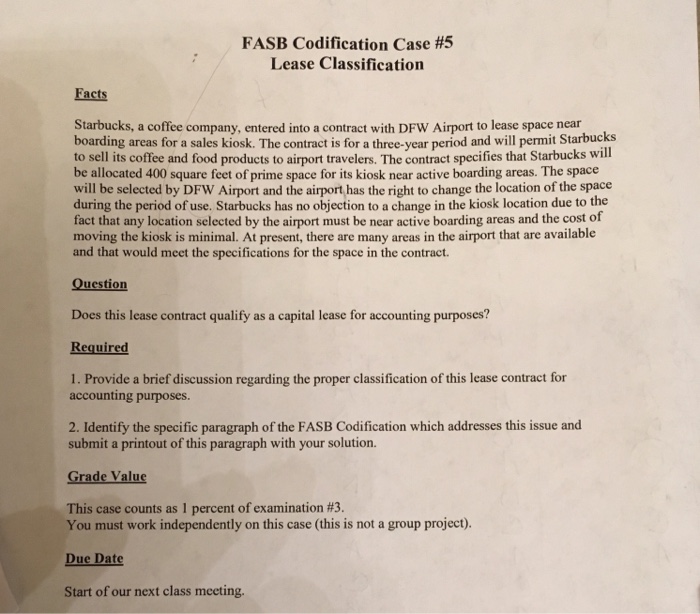

FASB Codification Case #5 Lease Classification Facts Starbucks, a coffee company, entered into a contract with DFW Airport to lease space near boarding areas for a sales kiosk. The contract is for a three-year period and will permit Starbucks to sell its coffee and food products to airport travelers. The contract specifies that Starbucks will be allocated 400 square feet of prime space for its kiosk near active boarding areas. The space will be selected by DFW Airport and the airport has the right to change the location of the space during the period of use. Starbucks has no objection to a change in the kiosk location due to the fact that any location selected by the airport must be near active boarding areas and the cost of moving the kiosk is minimal. At present, there are many areas in the airport that are available and that would meet the specifications for the space in the contract. Question Does this lease contract qualify as a capital lease for accounting purposes? Required 1. Provide a brief discussion regarding the proper classification of this lease contract for accounting purposes. 2. Identify the specific paragraph of the FASB Codification which addresses this issue and submit a printout of this paragraph with your solution Grade Value This case counts as 1 percent of examination #3. You must work independently on this case (this is not a group project). Due Date Start of our next class meeting

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts