Question: FASB Codification Project- In 2. Log on to FASB Codification data base using log in credentials in Course Materials 3. Research the codification and answer

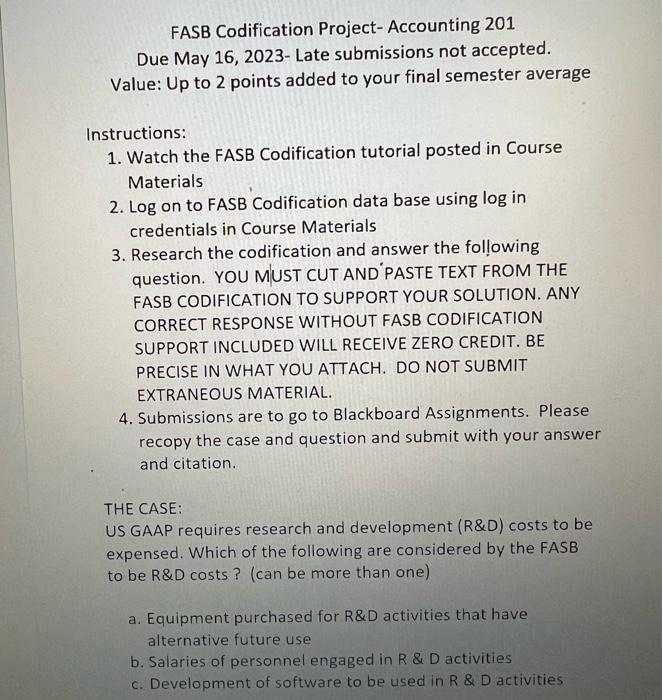

FASB Codification Project- Accounting 201 Due May 16, 2023-Late submissions not accepted. Value: Up to 2 points added to your final semester average Instructions: 1. Watch the FASB Codification tutorial posted in Course Materials 2. Log on to FASB Codification data base using log in credentials in Course Materials 3. Research the codification and answer the following question. YOU MUST CUT AND'PASTE TEXT FROM THE FASB CODIFICATION TO SUPPORT YOUR SOLUTION. ANY CORRECT RESPONSE WITHOUT FASB CODIFICATION SUPPORT INCLUDED WILL RECEIVE ZERO CREDIT. BE PRECISE IN WHAT YOU ATTACH. DO NOT SUBMIT EXTRANEOUS MATERIAL. 4. Submissions are to go to Blackboard Assignments. Please recopy the case and question and submit with your answer and citation. THE CASE: US GAAP requires research and development (R\&D) costs to be expensed. Which of the following are considered by the FASB to be R\&D costs ? (can be more than one) a. Equipment purchased for R&D activities that have alternative future use b. Salaries of personnel engaged in R \& D activities c. Development of software to be used in R \& D activities

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts