Question: fassstt pleassse Question You are given two n-year par value 1,000 bonds A and B (face vale equals redemption amount). Bond A has 14% semiannual

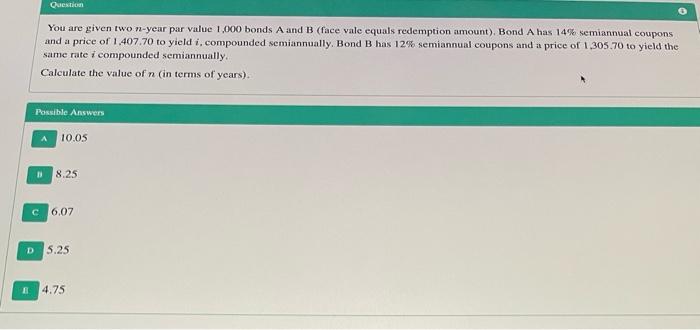

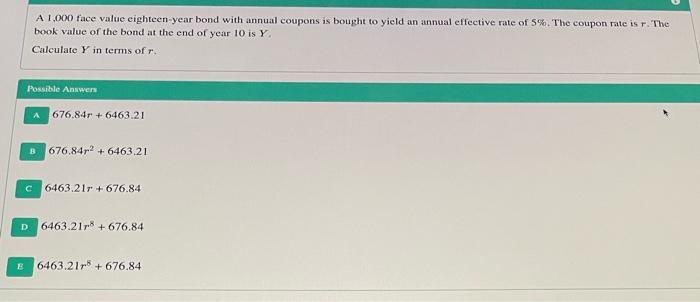

Question You are given two n-year par value 1,000 bonds A and B (face vale equals redemption amount). Bond A has 14% semiannual coupons and a price of 1.407.70 to yield i, compounded semiannually. Bond B has 12% semiannual coupons and a price of 1.305.70 to yield the same rate i compounded semiannually. Calculate the value of n (in terms of years). Possible Answers 10.05 8.25 6.07 D 5.25 4.75 A1.000 face value eighteen-year bond with annual coupons is bought to yield an annual effective rate of 5%. The coupon rate is T. The book value of the bond at the end of year 10 is Y Calculate Y in terms of r. Possible Answers 676.845 + 6463.21 B 676,842 +6463.21 6463.217 +676.84 D 6463.218 +676.84 E 6463.2175 +676.84

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts