Question: FAST answer please just need option Question 15 2 pts The following case study is associated with more than one question. The table below provides

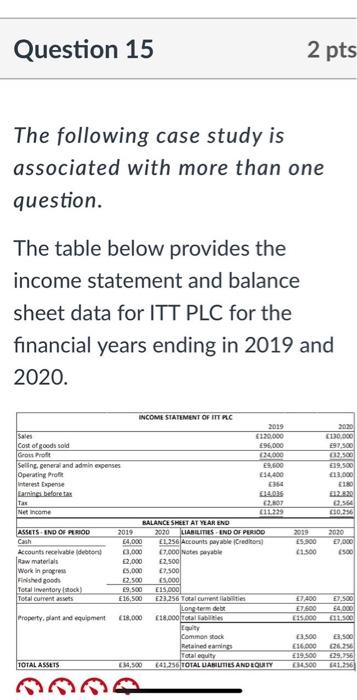

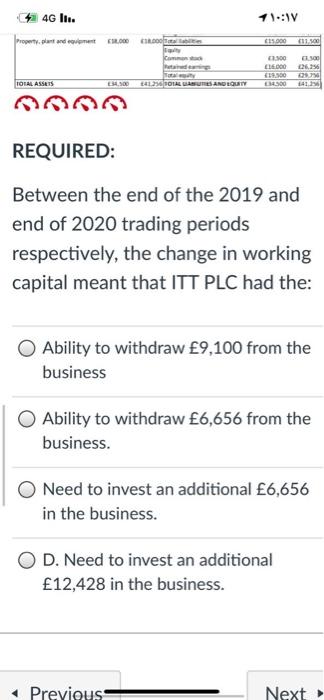

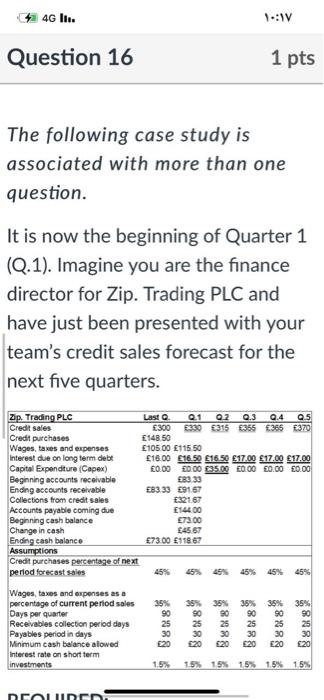

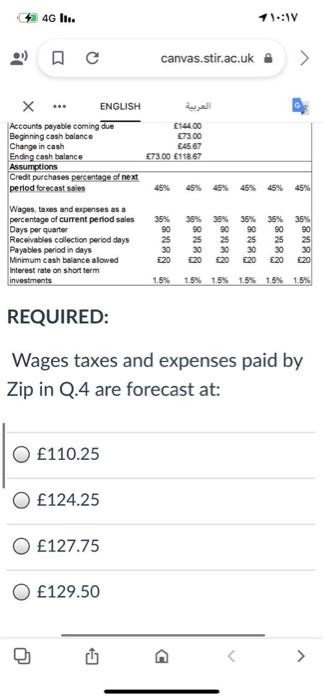

Question 15 2 pts The following case study is associated with more than one question. The table below provides the income statement and balance sheet data for ITT PLC for the financial years ending in 2019 and 2020. 2000 130.000 197.500 12.500 19,500 13.000 DAR 01026 INCOME STATEMENT OF IT PLC 2019 Sales $120,000 Cost of goods sold 96,000 GoPro 2000 Selling general and an expenses E9.00 Operating Prote 14.000 interest Expense Darning before 08.02 Tax 2.07 Net Income 11:29 BALANCE SHEET AT YEAR END ASSETS - END OF PERIOD 2019 2020 LIABILITIES - UND OF PERIOD Cash 4,000 EL 256 Accounts payable Credits 5.900 Accounts receivable debton 0.000 67.000 es payable 1.500 Raw materials 52.000 2.500 Work in progress 5,000 7,500 Finished goods 12.500 5.000 Total Inventory sock E9,500 E15.000 Total current assets E16,500 E23.256 Total currentibsties 7400 Long term debe E7,600 Property, plant and equipment 18.000 18.000 Total abilities 15.000 eity Common stock 3.500 Retained earning 16.000 Totality 219.500 TOTAL ASSETS $4,500 641.256 TOTAL UASUTIES AND EQUITY 34.500 2020 7.000 E7.500 4.000 011.500 E3,500 26250 29.56 141.256 TI 4G lli. 1 : Property, plant and 2.00 CIS 11. e EO 100 E 16 09 TOTAL ASSETS 3.500 14120 SOLAE GUTES AND LUTY REQUIRED: Between the end of the 2019 and end of 2020 trading periods respectively, the change in working capital meant that ITT PLC had the: Ability to withdraw 9,100 from the business Ability to withdraw 6,656 from the business. Need to invest an additional 6,656 in the business. O D. Need to invest an additional 12,428 in the business. 4G lli. : Question 16 1 pts The following case study is associated with more than one question. It is now the beginning of Quarter 1 (Q.1). Imagine you are the finance director for Zip. Trading PLC and have just been presented with your team's credit sales forecast for the next five quarters. Zip. Trading PLC Last Q.1 0.2 0.3 0.4 Q.5 Credit sales 300 330 315 355 365 E370 Credit purchases E148.50 Wages, taxes and expenses 105.00 115 50 Interest due on long term debt 16.00 16.50 16.50 17.00 17.00 17.00 Capital Expenditure (Capex) 50.00 50.00 35.00 0.00 50.00 50.00 Beginning accounts receivable 583 33 Ending accounts receivable E83 33 591.67 Collections from credit sales E32167 Accounts payable coming due 144.00 Beginning cash balance E73.00 Change in cash 4567 Ending cash balance 73.00 11867 Assumptions Credit purchases percentage of next period forecast sales 45% 35% 90 Wages taxes and expenses as a percentage of current period sales Days per quarter Receivables collection period days Payables period in days Minimum cash balance allowed Interest rate on short term investments 68886 % 90 25 30 35% 35% 90 90 25 25 30 30 20 520 36% 35% 90 90 25 30 520 E20 20 15% 15% 15% 15% 1.5% 15% DELUDOS 4G lli. 1 : D C canvas.stir.ac.uk 144.00 73.00 4567 73.00 11867 45% X ... ENGLISH Accounts payable coming due Beginning cash balance Change in cash Ending cash balance Assumptions Credit purchases percentage of next period forecast sales Wages, taxes and expenses as a percentage of current period sales Days per quarter Receivables collection period days Payables period in days Minimum cash balance alowed interest rate on short term Investments 45% 35% 90 25 30 E20 35% 35% 35% 90 90 90 25 25 25 30 30 30 220 220 $ 8888 35% 35% 90 25 30 E20 88083 1.5% 15% 15% 15% 1.5% 15% REQUIRED: Wages taxes and expenses paid by Zip in Q.4 are forecast at: O 110.25 124.25 127.75 129.50

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts