Question: Fast answer please sur Just need option No need explain I will rate you Calculate the current value of the XYZ stock based on the

Fast answer please sur

Just need option

No need explain

I will rate you

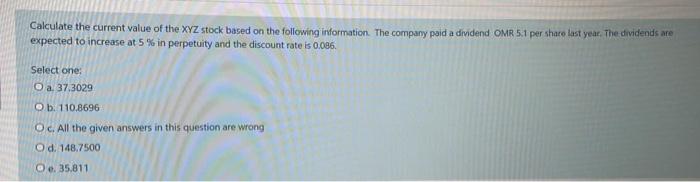

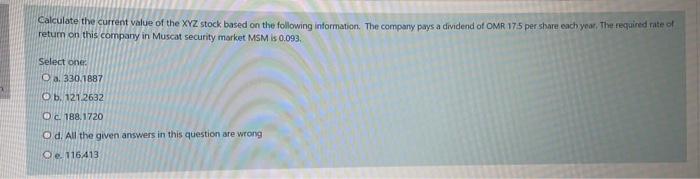

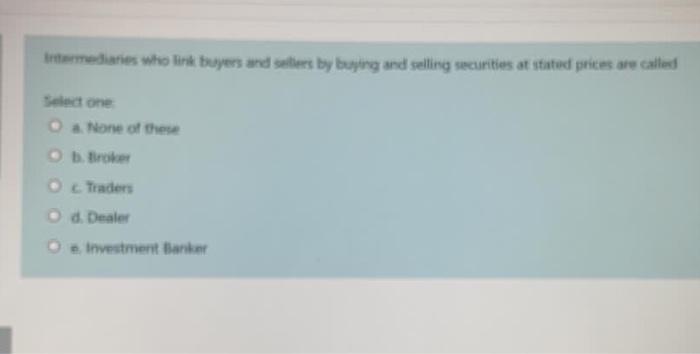

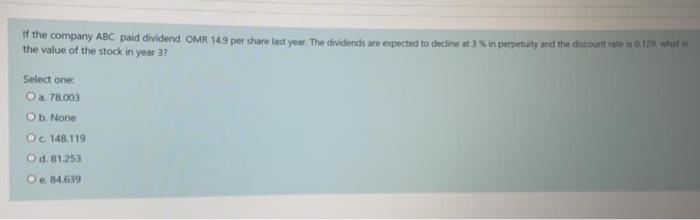

Calculate the current value of the XYZ stock based on the following information. The company paid a dividend OMR 5.1 per share last year. The dividends are expected to increase at 5% in perpetuity and the discount rate is 0.086 Select one: O a37.3029 O b: 110.8696 Oc. All the given answers in this question are wrong O d. 148.7500 O e. 35,811 Calculate the current value of the XYZ stock based on the following information. The company pays a dividend of OMR 175 per share each year, the required rate of return on this company in Muscat security market MSM is 0.093, Select one O a. 330.1887 O b. 121.2632 Oc 188.1720 Od. All the given answers in this question are wrong Oe. 116413 Intermediaries who link buyers and sales by buying and selling securities at stated prices are called Select one . None of these bro Traders d. Dealer Investment Banker If the company ABC paid dividend OMR 14.9 per share last year. The dividends are expected to decline at 3 in perpetuity and the discount staa12 whe the value of the stock in year 37 Select one: O a 78.003 Ob. None . Oc 148.119 d. 81.253 O e 84.639 Underwriting is an assurance of 's marketability of... Select one: O a. None of these O b. Treasury Bill O c. Shares O d. Bonds O e. Debentures

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts