Question: Fast please like for sure QUESTION #4 (5 Marks) Lesson 4-Fee Structure On January 4, 2007, David bought 350 units of the Savissa Growth Fund,

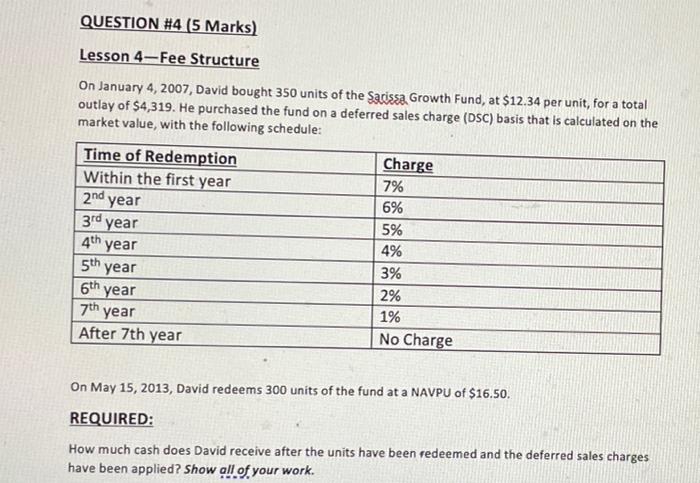

QUESTION #4 (5 Marks) Lesson 4-Fee Structure On January 4, 2007, David bought 350 units of the Savissa Growth Fund, at $12.34 per unit, for a total outlay of $4,319. He purchased the fund on a deferred sales charge (DSC) basis that is calculated on the market value, with the following schedule: Time of Redemption Charge Within the first year 7% year 6% 5% 4th year 4% 5th year 3% 2% 1% After 7th year No Charge 2nd 3rd year 6th year 7th year On May 15, 2013, David redeems 300 units of the fund at a NAVPU of $16.50. REQUIRED: How much cash does David receive after the units have been redeemed and the deferred sales charges have been applied? Show all of your work

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts