Question: faster pls Question Six a) Olympus Plc is a large UK based company manufacturing hand-held electronic devices such as mobile phones and tablet computers. The

faster pls

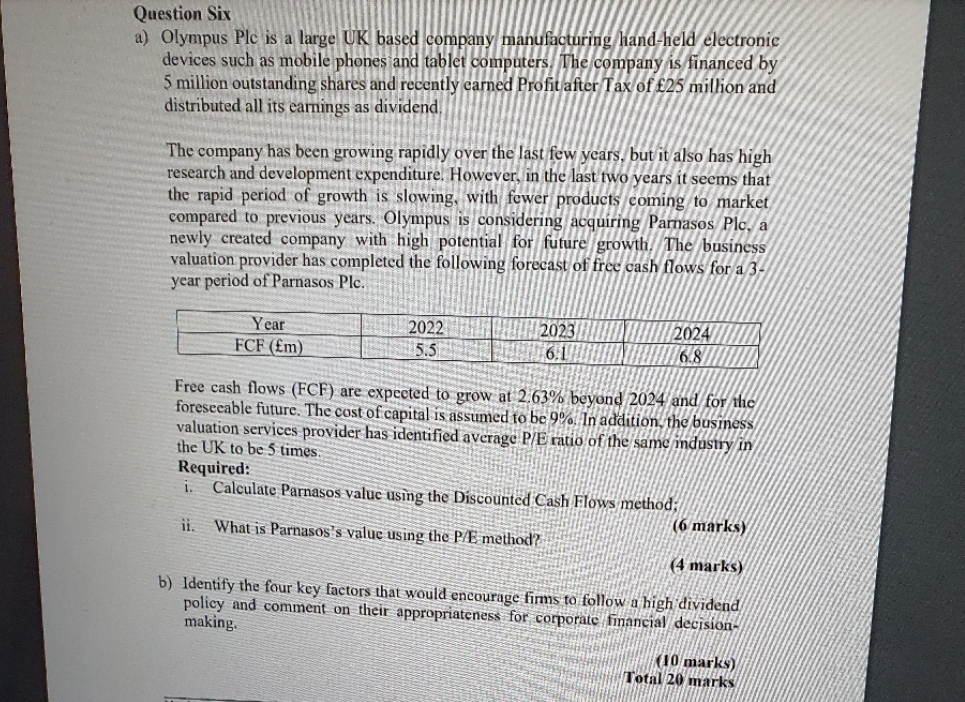

Question Six a) Olympus Plc is a large UK based company manufacturing hand-held electronic devices such as mobile phones and tablet computers. The company is financed by 5 million outstanding shares and recently earned Profit after Tax of $25 million and distributed all its earnings as dividend, The company has been growing rapidly over the last few years, but it also has high research and development expenditure. However, in the last two years it seems that the rapid period of growth is slowing, with fewer products coming to market compared to previous years. Olympus is considering acquiring Parnasos Plo, a newly created company with high potential for future growth. The business valuation provider has completed the following forecast of free cash flows for a 3- year period of Parnasos Plc. Year 2022 2023 /2024 FCF (fm) 15.5 6.1 16.8 Free cash flows (FCF) are expected to grow at 2.63% beyond 2024 and for the foreseeable future. The cost of capital is assumed to be 9%% In addition, the business valuation services provider has identified average P/B ratio of the same industry in the UK to be 5 times Required: i. Calculate Parnasos value using the Discounted Cash Flows method; (6 marks) ii. What is Parnasos's value using the P/E method? (4 marks) b) Identify the four key factors that would encourage firms to follow a high dividend policy and comment on their appropriateness for corporate financial decision- making. (10 marks) Total 20 marks

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts