Question: fastlorwardacademy.com / lms / AFTR - 2 0 2 4 - Exam / 9 2 1 5 8 1 9 1 s 2 3 -

fastlorwardacademy.comlmsAFTRExam

s

CCHS Liv...

KDE Licensure

MyAccount Americ...

FastForwardAcademy

Expungement Certif...

You Will Love Histor...

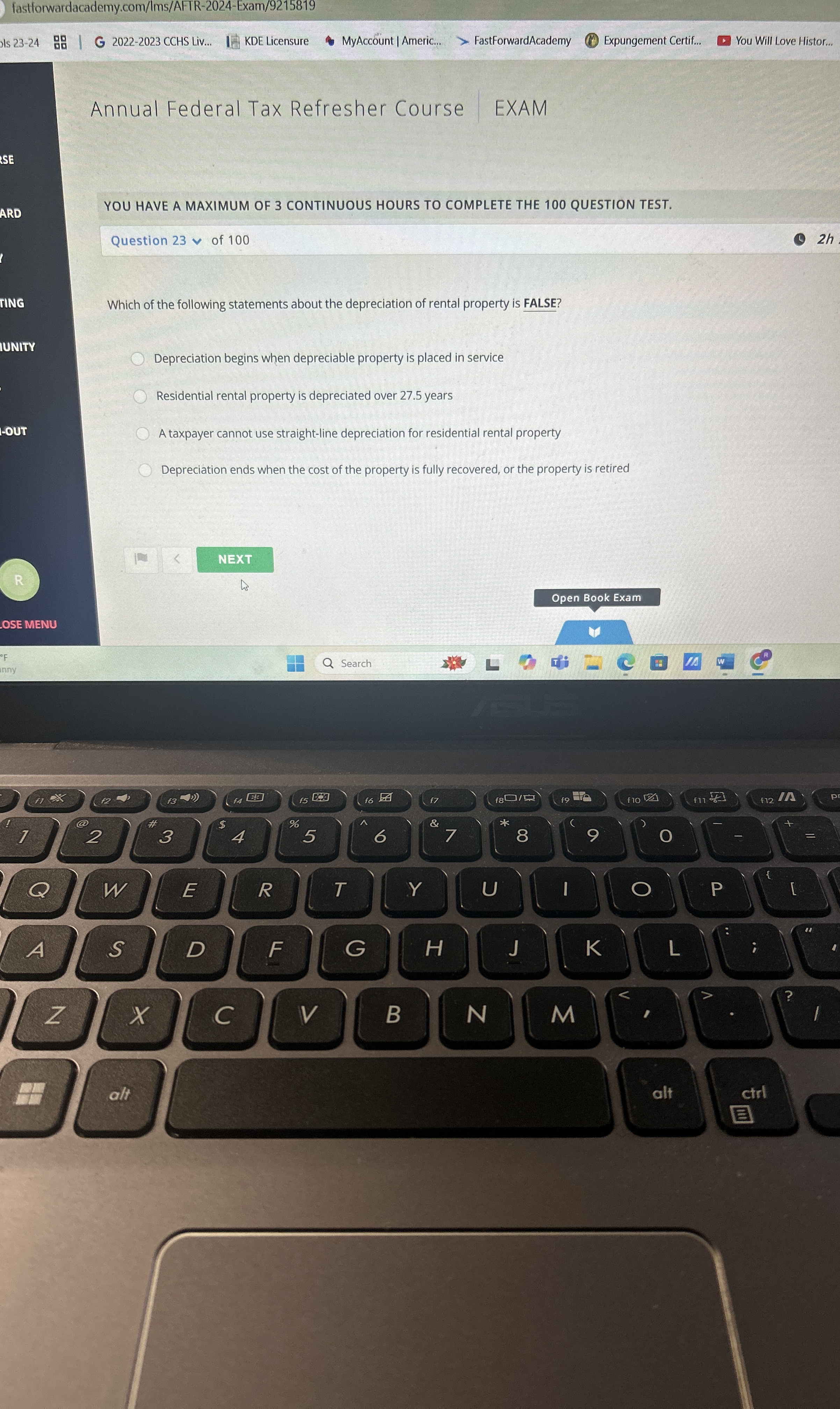

Annual Federal Tax Refresher Course

EXAM

YOU HAVE A MAXIMUM OF CONTINUOUS HOURS TO COMPLETE THE QUESTION TEST.

Question of

Which of the following statements about the depreciation of rental property is FALSE?

Depreciation begins when depreciable property is placed in service

Residential rental property is depreciated over years

A taxpayer cannot use straightline depreciation for residential rental property

Depreciation ends when the cost of the property is fully recovered, or the property is retired

Open Book Exam

OSE MENU

Search

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock