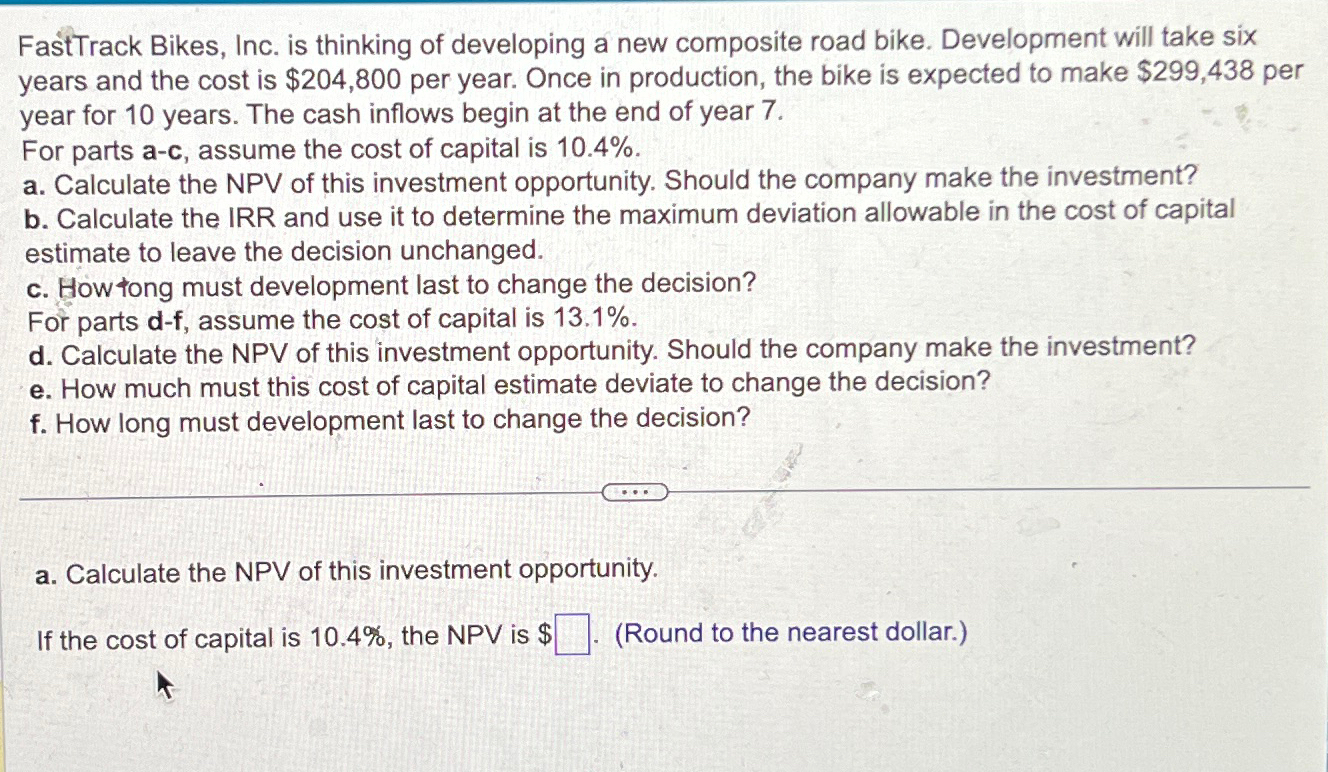

Question: FastTrack Bikes, Inc. is thinking of developing a new composite road bike. Development will take six years and the cost is $ 2 0 4

FastTrack Bikes, Inc. is thinking of developing a new composite road bike. Development will take six years and the cost is $ per year. Once in production, the bike is expected to make $ per year for years. The cash inflows begin at the end of year

For parts ac assume the cost of capital is

a Calculate the NPV of this investment opportunity. Should the company make the investment?

b Calculate the IRR and use it to determine the maximum deviation allowable in the cost of capital estimate to leave the decision unchanged.

c How tong must development last to change the decision?

For parts assume the cost of capital is

d Calculate the NPV of this investment opportunity. Should the company make the investment?

e How much must this cost of capital estimate deviate to change the decision?

f How long must development last to change the decision?

a Calculate the NPV of this investment opportunity.

If the cost of capital is the NPV is $Round to the nearest dollar.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock