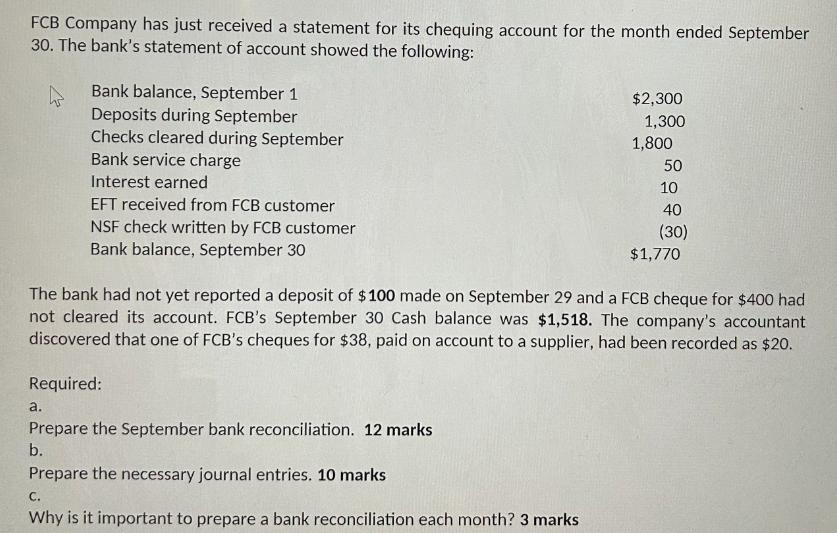

Question: FCB Company has just received a statement for its chequing account for the month ended September 30. The bank's statement of account showed the

FCB Company has just received a statement for its chequing account for the month ended September 30. The bank's statement of account showed the following: Bank balance, September 1 Deposits during September Checks cleared during September Bank service charge Interest earned EFT received from FCB customer NSF check written by FCB customer Bank balance, September 30 $2,300 1,300 1,800 50 10 40 (30) $1,770 The bank had not yet reported a deposit of $100 made on September 29 and a FCB cheque for $400 had not cleared its account. FCB's September 30 Cash balance was $1,518. The company's accountant discovered that one of FCB's cheques for $38, paid on account to a supplier, had been recorded as $20. Required: a. Prepare the September bank reconciliation. 12 marks b. Prepare the necessary journal entries. 10 marks C. Why is it important to prepare a bank reconciliation each month? 3 marks

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts