Question: FCF 2 - Free Cash Flow Practice Problems Your company is considering an expansion into a new product area. The company has collected the following

FCF Free Cash Flow Practice Problems

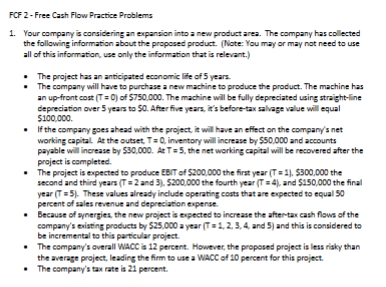

Your company is considering an expansion into a new product area. The company has collected

the following information about the proposed product. Note: You may or may not need to use

all of this information, use only the information that is relevant.

The project has an anticipated economic life of years. PLEASE DO

The company will have to purchase a new machine to produce the product. The machine has

an upfront cost of $ The machine will be fully depreciated using straightline

depreciation over years to $ After five years, it's beforetax salvage value will equal

$

If the company goes ahead with the project it will have an effect on the company's net

working capital. At the outset, inventory will increase by $ and accounts

payable will increase by $ At the net working capital will be recovered after the

praject is campleted.

The praject is expected to produce EBIT of $ the firat year T $ the

second and third years and FCF Free Cash Flow Practice Problems

Your company is considering an expansion into a new product area. The company has collected

the following information about the proposed product. Note: You may or may not need to use

all of this information, use only the information that is relevant.

The project has an anticipated economic life of years.

The company will have to purchase a new machine to produce the product. The machine has

an upfront cost of $ The machine will be fully depreciated using straightline

depreciation over years to $ After five years, it's beforetax salvage value will equal

$

If the company goes ahead with the project it will have an effect on the company's net

working capital. At the outset, inventory will increase by $ and accounts

payable will increase by $ At the net working capital will be recovered after the

praject is campleted.

The praject is expected to produce EBIT of $ the firat year T $ the

second and third years and PLEASE DO IT IN EXCEL IF POSSIBLE

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock