Question: FCF and WACC Review Problems Part 2 1. Based on the information given below, calculate the WACC of the company: 11.065%. - Its capital structure

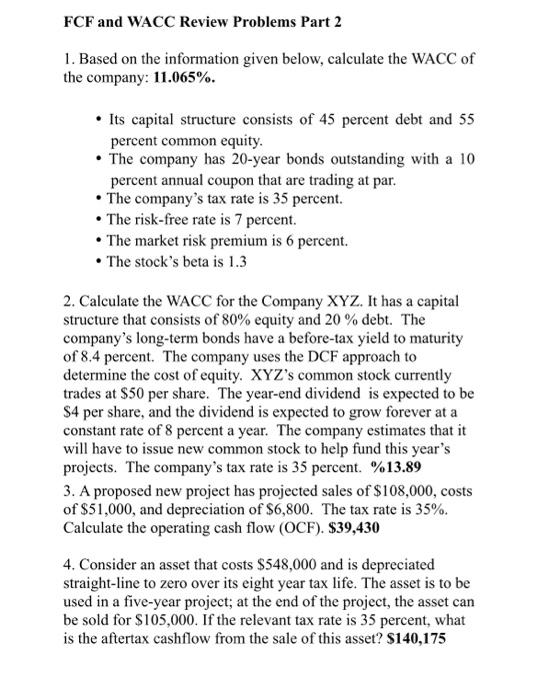

FCF and WACC Review Problems Part 2 1. Based on the information given below, calculate the WACC of the company: 11.065%. - Its capital structure consists of 45 percent debt and 55 percent common equity. - The company has 20-year bonds outstanding with a 10 percent annual coupon that are trading at par. - The company's tax rate is 35 percent. - The risk-free rate is 7 percent. - The market risk premium is 6 percent. - The stock's beta is 1.3 2. Calculate the WACC for the Company XYZ. It has a capital structure that consists of 80% equity and 20% debt. The company's long-term bonds have a before-tax yield to maturity of 8.4 percent. The company uses the DCF approach to determine the cost of equity. XYZ's common stock currently trades at $50 per share. The year-end dividend is expected to be $4 per share, and the dividend is expected to grow forever at a constant rate of 8 percent a year. The company estimates that it will have to issue new common stock to help fund this year's projects. The company's tax rate is 35 percent. \%13.89 3. A proposed new project has projected sales of $108,000, costs of $51,000, and depreciation of $6,800. The tax rate is 35%. Calculate the operating cash flow (OCF). $39,430 4. Consider an asset that costs $548,000 and is depreciated straight-line to zero over its eight year tax life. The asset is to be used in a five-year project; at the end of the project, the asset can be sold for $105,000. If the relevant tax rate is 35 percent, what is the aftertax cashflow from the sale of this asset? $140,175

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts