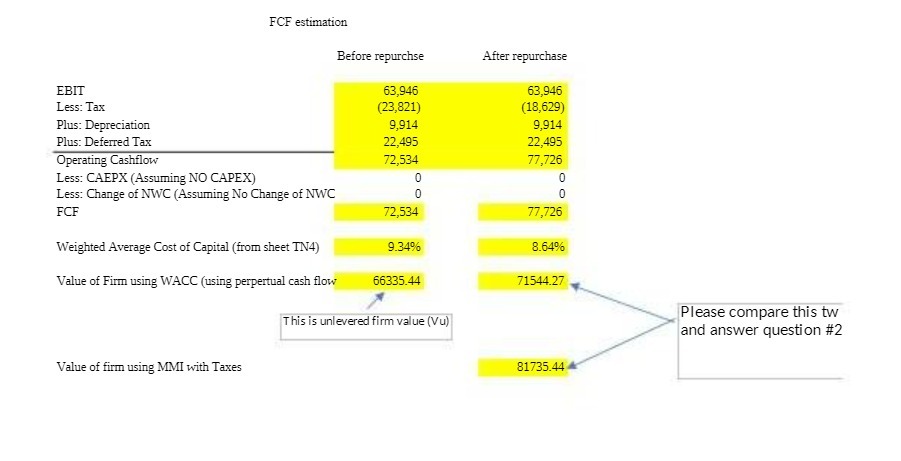

Question: FCF estimation Before repurchse After repurchase EBIT 63,946 63,946 Less: Tax (23,821) (18,629) Plus: Depreciation 9,914 9,914 Plus: Deferred Tax 22,495 22,495 Operating Cashflow 72,534

FCF estimation Before repurchse After repurchase EBIT 63,946 63,946 Less: Tax (23,821) (18,629) Plus: Depreciation 9,914 9,914 Plus: Deferred Tax 22,495 22,495 Operating Cashflow 72,534 77,726 Less: CAEPX (Assuming NO CAPEX) 0 oo Less: Change of NWC (Assuming No Change of NWC 0 FCF 72,534 77,726 Weighted Average Cost of Capital (from sheet TN4) 9.34% 8.64% Value of Firm using WACC (using perpertual cash flow 66335.44 71544.27 This is unlevered firm value (Vu) Please compare this tw and answer question #2 Value of firm using MMI with Taxes 81735.44

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock