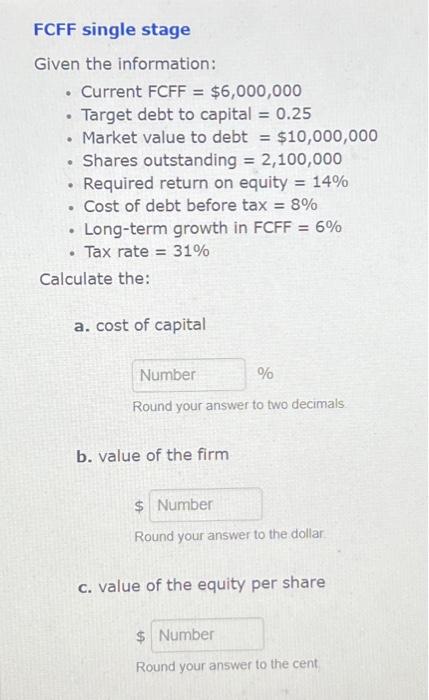

Question: FCFF single stage Given the information: - Current FCFF =$6,000,000 - Target debt to capital =0.25 - Market value to debt =$10,000,000 - Shares outstanding

FCFF single stage Given the information: - Current FCFF =$6,000,000 - Target debt to capital =0.25 - Market value to debt =$10,000,000 - Shares outstanding =2,100,000 - Required return on equity =14% - Cost of debt before tax =8% - Long-term growth in FCFF =6% - Tax rate =31% Calculate the: a. cost of capital b. value of the firm c. value of the equity per share Round your answer to the cent. FCFF single stage Given the information: - Current FCFF =$6,000,000 - Target debt to capital =0.25 - Market value to debt =$10,000,000 - Shares outstanding =2,100,000 - Required return on equity =14% - Cost of debt before tax =8% - Long-term growth in FCFF =6% - Tax rate =31% Calculate the: a. cost of capital b. value of the firm c. value of the equity per share Round your answer to the cent

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts