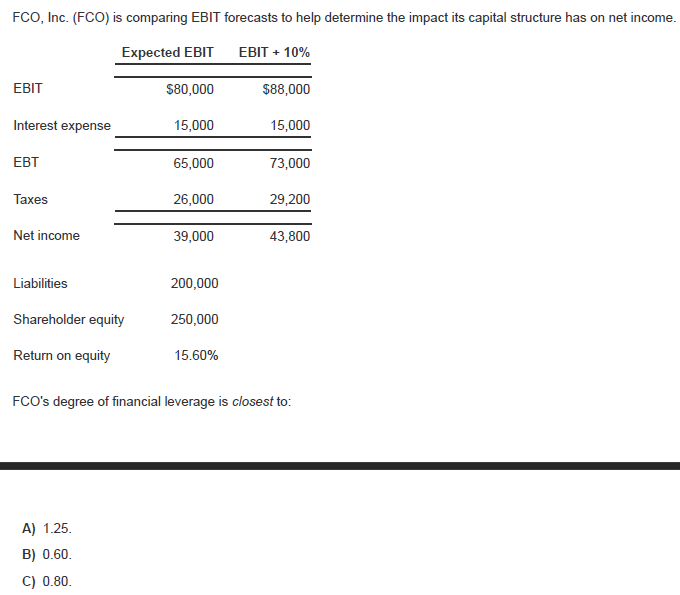

Question: FCO, Inc. (FCO) is comparing EBIT forecasts to help determine the impact its capital structure has on net income. Expected EBIT EBIT + 10% EBIT

FCO, Inc. (FCO) is comparing EBIT forecasts to help determine the impact its capital structure has on net income. Expected EBIT EBIT + 10% EBIT $80,000 $88,000 Interest expense 15,000 15,000 EBT 65,000 73,000 Taxes 26,000 29,200 Net income 39,000 43,800 Liabilities 200,000 Shareholder equity 250,000 Return on equity 15.60% FCO's degree of financial leverage is closest to: A) 1.25. B) 0.60. C) 0.80

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts