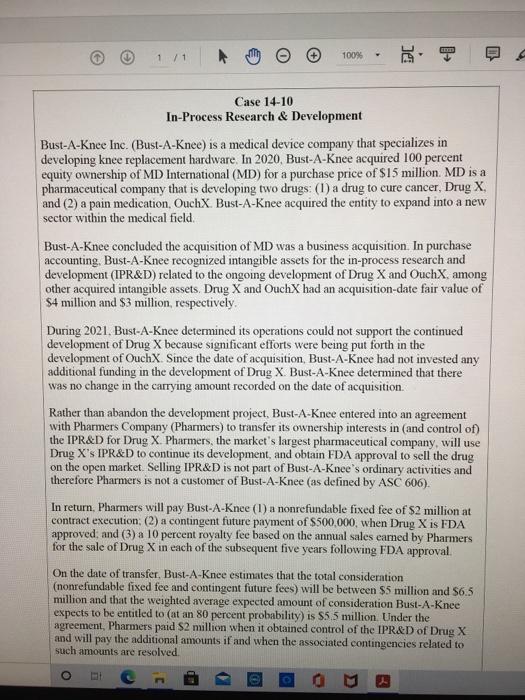

Question: FD 1 / 1 100% de: m3 Case 14-10 In-Process Research & Development Bust-A-Knee Inc. (Bust-A-Knee) is a medical device company that specializes in developing

FD 1 / 1 100% de: m3 Case 14-10 In-Process Research & Development Bust-A-Knee Inc. (Bust-A-Knee) is a medical device company that specializes in developing knee replacement hardware. In 2020, Bust-A-Knee acquired 100 percent equity ownership of MD International (MD) for a purchase price of $15 million MD is a pharmaceutical company that is developing two drugs: (1) a drug to cure cancer, Drug X and (2) a pain medication. OuchX Bust-A-Knee acquired the entity to expand into a new sector within the medical field Bust-A-Knee concluded the acquisition of MD was a business acquisition. In purchase accounting, Bust-A-Knee recognized intangible assets for the in-process research and development (IPR&D) related to the ongoing development of Drug X and OuchX among other acquired intangible assets. Drug X and OuchX had an acquisition-date fair value of S4 million and $3 million, respectively. During 2021. Bust-A-Knee determined its operations could not support the continued development of Drug X because significant efforts were being put forth in the development of Ouchx Since the date of acquisition, Bust-A-Knee had not invested any additional funding in the development of Drug X. Bust-A-Knee determined that there was no change in the carrying amount recorded on the date of acquisition. Rather than abandon the development project. Bust-A-Knee entered into an agreement with Pharmers Company (Pharmers) to transfer its ownership interests in (and control of) the IPR&D for Drug X. Pharmers, the market's largest pharmaceutical company, will use Drug X's IPR&D to continue its development, and obtain FDA approval to sell the drug on the open market. Selling IPR&D is not part of Bust-A-Knee's ordinary activities and therefore Pharmers is not a customer of Bust-A-Knee (as defined by ASC 606). In return, Pharmers will pay Bust-A-Knee (1) a nonrefundable fixed fee of $2 million at contract execution (2) a contingent future payment of $500,000, when Drug X is FDA approved, and (3) a 10 percent royalty fee based on the annual sales earned by Pharmers for the sale of Drug X in each of the subsequent five years following FDA approval. On the date of transfer, Bust-A-Knee estimates that the total consideration (nonrefundable fixed fee and contingent future fees) will be between $5 million and $6.5 million and that the weighted average expected amount of consideration Bust-A-Knee expects to be entitled to (at an 80 percent probability) is $5.5 million. Under the agreement, Pharmers paid $2 million when it obtained control of the IPR&D of Drug X and will pay the additional amounts if and when the associated contingencies related to such amounts are resolved O A. Explain the issue as you see it and what challenges there are in addressing the matter in this specific instance and more broadly. B. Ultimately you must decide on how you want to treat the issue and support your decision with relevant research and citations which you feel support your argument. C. link directly to any accounting standards or sources of information you use in your analysis. 3 1 C

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts