Question: Feasibility Study for a New Software Project Your CEO has asked you as a systems analyst to conduct a feasibility study for a new software

Feasibility Study for a New Software Project

Your CEO has asked you as a systems analyst to conduct a feasibility study for a new software project that will help reduce costs, reduce errors, improve overall flexibility, provide an ease of interacting with business partners, increase the speed of transaction activity, and improve overall management planning control. You have received the following data regarding the tangible benefits and associated costs for this proposed project:

Cost Benefit Analysis Data | |

Tangible Benefits: | |

Cost reduction or avoidance | $12,500 |

Error reduction | $3,500 |

Increased Flexibility | $5,500 |

Increased speed of activity | $7,500 |

Improvement management/planning control | $15,000 |

Ease of interfacing with business partners | $16,000 |

Total Tangible Benefits | $60,000 |

One Time Cost: | |

Development Costs | $2,000 |

New Hardware | $1,000 |

Software License or Purchase cost | $19,500 |

User Training | $3,500 |

Site Preparation | $4,000 |

Total One Time Cost | $30,000 |

Recurring Cost: | |

Software Maintenance | $2,500 |

Incremental Data Storage | $2,500 |

Communications | $9,000 |

Supplies | $7,000 |

Other | $4,000 |

Total Recurring Cost | $25,000 |

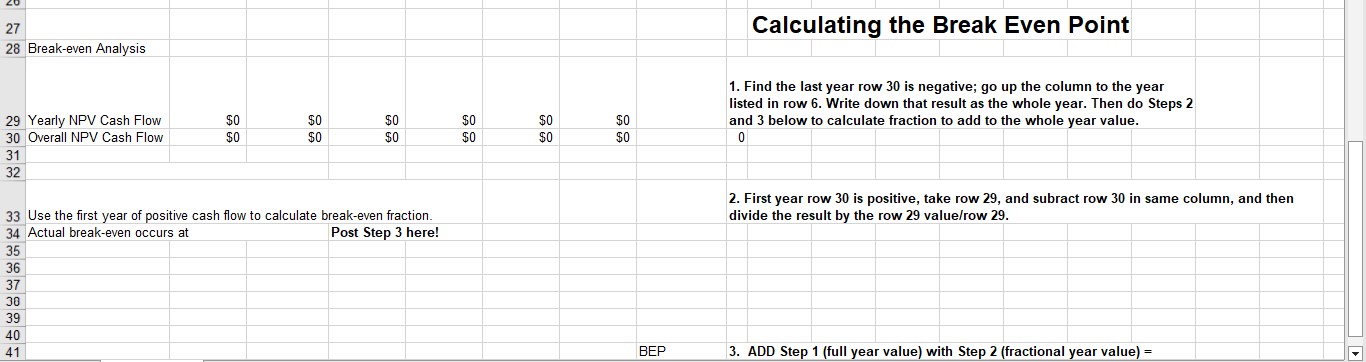

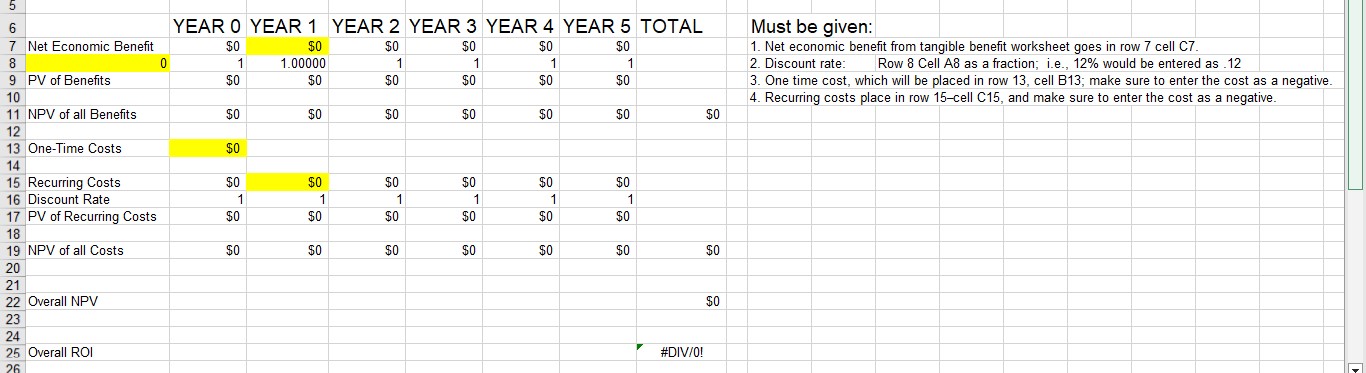

Step 1: You are to conduct an economic benefit review by performing a cost benefit analysis by calculating the Net Present Value (NPV), Return on Investment (ROI), and Break-Even Point (BEP). The company wants to consider the time value of money when performing these calculations. The discount rate utilized for investments is 12 percent. You will utilize the Cost Benefit Analysis Template in MS Excel to complete these calculations (IMAGES BELOW). Please save your work on this Excel file.

Step 2: Additionally, you will provide an analysis in a MS Wrd document that indicates whether or not it makes economical sense to accept this new software project. Explain your rationale for your conclusion and recommendation based on the cost benefit analysis conducted. This paragraph should be at least 75 wrds in length.

Step 3: In another paragraph, please explain what are some other feasibility factors to consider before accepting this project as it relates to schedule, operational, and technical feasibility. This should be in the same MS Word document as step 2 and should be at least 125 wrds in length.

Step 4. Please submit both the MS Wrd Document and MS Excel file in order to get credit for this case assignment.

27 Calculating the Break Even Point 28 Break-even Analysis 1. Find the last year row 30 is negative; go up the column to the year listed in row 6. Write down that result as the whole year. Then do Steps 2 29 Yearly NPV Cash Flow $0 $0 $0 $0 $0 and 3 below to calculate fraction to add to the whole year value. 30 Overall NPV Cash Flow $0 $0 $0 $0 $0 $0 0 31 32 2. First year row 30 is positive, take row 29, and subract row 30 in same column, and then 33 Use the first year of positive cash flow to calculate break-even fraction. divide the result by the row 29 value/row 29. 34 Actual break-even occurs at Post Step 3 here! 35 36 37 30 39 40 41 BEP 3. ADD Step 1 (full year value) with Step 2 (fractional year value) =5 YEAR 0 YEAR 1 YEAR 2 YEAR 3 YEAR 4 YEAR 5 TOTAL Must be given: 7 Net Economic Benefit $0 $0 $0 $0 $0 $0 1. Net economic benefit from tangible benefit worksheet goes in row 7 cell C7. 0 1 1.00000 2. Discount rate: Row 8 Cell A8 as a fraction; i.e., 12% would be entered as . 12 PV of Benefits $0 $0 $0 $0 $0 $0 3. One time cost, which will be placed in row 13, cell B13; make sure to enter the cost as a negative. 10 4. Recurring costs place in row 15-cell C15, and make sure to enter the cost as a negative. 11 NPV of all Benefits $0 $0 $0 $0 $0 $0 $0 12 13 One-Time Costs $0 14 15 Recurring Costs $0 $0 $0 $0 50 16 Discount Rate 17 PV of Recurring Costs 18 19 NPV of all Costs $0 $0 $0 $0 $0 $0 20 21 22 Overall NPV $0 23 24 25 Overall ROI #DIV/O! 26

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts