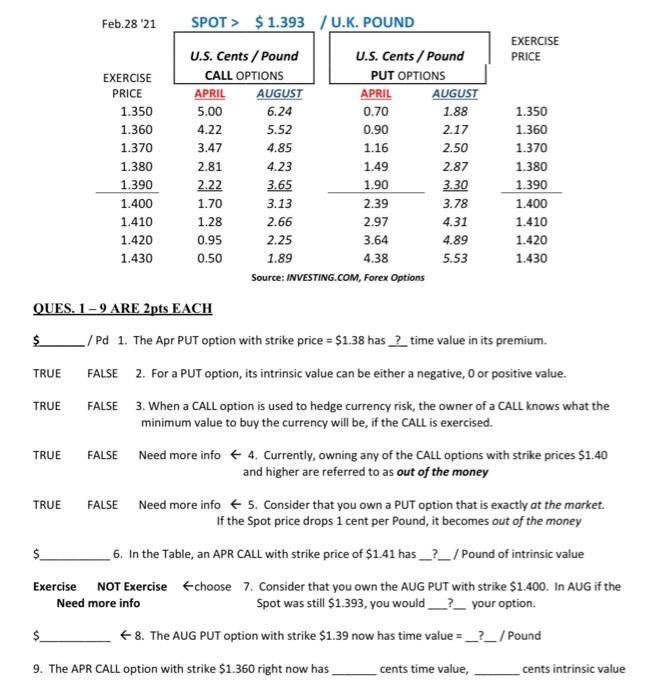

Question: Feb.28 21 SPOT > $ 1.393 / U.K. POUND EXERCISE PRICE U.S. Cents / Pound U.S. Cents / Pound EXERCISE CALL OPTIONS PUT OPTIONS PRICE

Feb.28 21 SPOT > $ 1.393 / U.K. POUND EXERCISE PRICE U.S. Cents / Pound U.S. Cents / Pound EXERCISE CALL OPTIONS PUT OPTIONS PRICE APRIL AUGUST APRIL AUGUST 1.350 5.00 6.24 0.70 1.88 1.360 4.22 5.52 0.90 2.17 1.370 3.47 4.85 1.16 2.50 1.380 2.81 4.23 1.49 2.87 1.390 2.22 3.65 1.90 3.30 1.400 1.70 3.13 2.39 3.78 1.410 1.28 2.66 2.97 4.31 1.420 0.95 2.25 3.64 4.89 1.430 0.50 1.89 4.38 5.53 Source: INVESTING.COM, Forex Options QUES. 1 - 9 ARE 2pts EACH 1.350 1.360 1.370 1.380 1.390 1.400 1.410 1.420 1.430 $ TRUE TRUE /Pd 1. The Apr PUT option with strike price = $1.38 has 2 time value in its premium. FALSE 2. For a PUT option, its intrinsic value can be either a negative, or positive value. FALSE 3. When a CALL option is used to hedge currency risk, the owner of a CALL knows what the minimum value to buy the currency will be, if the CALL is exercised. FALSE Need more info + 4. Currently, owning any of the CALL options with strike prices $1.40 and higher are referred to as out of the money FALSE Need more info + 5. Consider that you own a PUT option that is exactly at the market. If the Spot price drops 1 cent per Pound, it becomes out of the money 6. In the Table, an APR CALL with strike price of $1.41 has _?_/Pound of intrinsic value TRUE TRUE $ Exercise NOT Exercise choose 7. Consider that you own the AUG PUT with strike $1.400. In AUG if the Need more info Spot was still $1.393, you would _?_your option. $ 8. The AUG PUT option with strike $1.39 now has time value = _?_/ Pound 9. The APR CALL option with strike $1.360 right now has cents time value, cents intrinsic value

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts