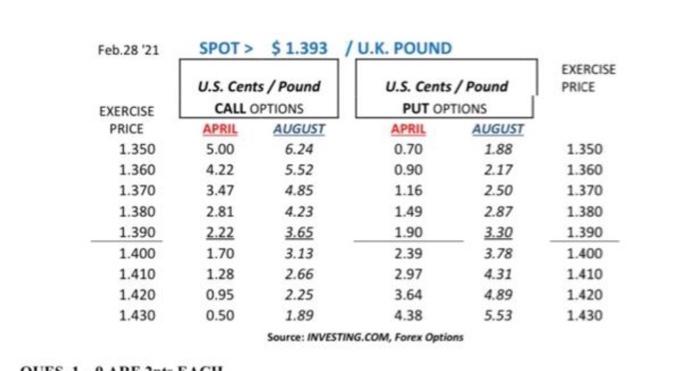

Question: Feb.28 21 SPOT > $ 1.393 / U.K. POUND EXERCISE PRICE 5.00 6.24 3.47 EXERCISE PRICE 1.350 1.360 1.370 1.380 1.390 1.400 1.410 1.420 1.430

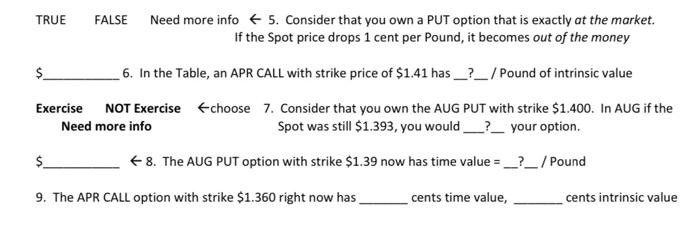

Feb.28 21 SPOT > $ 1.393 / U.K. POUND EXERCISE PRICE 5.00 6.24 3.47 EXERCISE PRICE 1.350 1.360 1.370 1.380 1.390 1.400 1.410 1.420 1.430 U.S. Cents/Pound U.S. Cents / Pound CALL OPTIONS PUT OPTIONS APRIL AUGUST APRIL AUGUST 0.70 1.88 4.22 5.52 0.90 2.17 4.85 1.16 2.50 2.81 4.23 1.49 2.87 2.22 3.65 1.90 3.30 1.70 3.13 2.39 3.78 1.28 2.66 2.97 4.31 0.95 2.25 3.64 4.89 0.50 4.38 5.53 Source: INVESTING.COM, Forex Options 1.350 1.360 1.370 1.380 1.390 1.400 1.410 1.420 1.430 1.89 OTTE Inn TICI TRUE FALSE Need more info + 5. Consider that you own a PUT option that is exactly at the market. If the Spot price drops 1 cent per Pound, it becomes out of the money $ 6. In the Table, an APR CALL with strike price of $1.41 has _?_/Pound of intrinsic value Exercise NOT Exercise choose 7. Consider that you own the AUG PUT with strike $1.400. In AUG if the Need more info Spot was still $1.393, you would _?_ your option. $ 8. The AUG PUT option with strike $1.39 now has time value = _?_/Pound 9. The APR CALL option with strike $1.360 right now has cents time value, cents intrinsic value Feb.28 21 SPOT > $ 1.393 / U.K. POUND EXERCISE PRICE 5.00 6.24 3.47 EXERCISE PRICE 1.350 1.360 1.370 1.380 1.390 1.400 1.410 1.420 1.430 U.S. Cents/Pound U.S. Cents / Pound CALL OPTIONS PUT OPTIONS APRIL AUGUST APRIL AUGUST 0.70 1.88 4.22 5.52 0.90 2.17 4.85 1.16 2.50 2.81 4.23 1.49 2.87 2.22 3.65 1.90 3.30 1.70 3.13 2.39 3.78 1.28 2.66 2.97 4.31 0.95 2.25 3.64 4.89 0.50 4.38 5.53 Source: INVESTING.COM, Forex Options 1.350 1.360 1.370 1.380 1.390 1.400 1.410 1.420 1.430 1.89 OTTE Inn TICI TRUE FALSE Need more info + 5. Consider that you own a PUT option that is exactly at the market. If the Spot price drops 1 cent per Pound, it becomes out of the money $ 6. In the Table, an APR CALL with strike price of $1.41 has _?_/Pound of intrinsic value Exercise NOT Exercise choose 7. Consider that you own the AUG PUT with strike $1.400. In AUG if the Need more info Spot was still $1.393, you would _?_ your option. $ 8. The AUG PUT option with strike $1.39 now has time value = _?_/Pound 9. The APR CALL option with strike $1.360 right now has cents time value, cents intrinsic value

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts