Question: FeEdit Format View Help The following is what I need for Walt Disney Co (DIS) 1. The story part of the valuation, including the summary

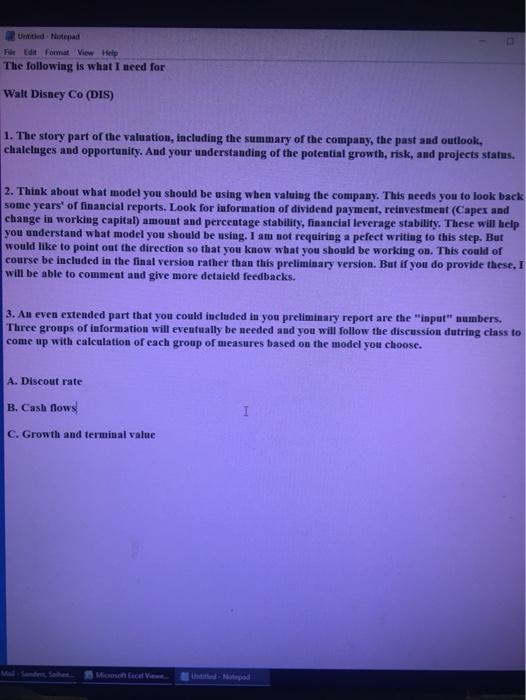

FeEdit Format View Help The following is what I need for Walt Disney Co (DIS) 1. The story part of the valuation, including the summary of the company, the past and outlook, chalenges and opportunity. And your understanding of the potential growth, risk, and projects statas. 2. Think about what model you should be using when valuing the company. This needs you to look back some years' of financial reports. Look for information of dividend payment, reinvestment (Capex and change in working capital) amount and percentage stability, financial leverage stability. These will help you understand what model you should be using. I am not requiring a pefect writing to this step. But would like to point out the direction so that you know what you should be working on. This could of course be included in the final version rather than this preliminary version. But if you do provide these. I will be able to comment and give more detaield feedbacks. 3. An even extended part that you could included in you preliminary report are the input" numbers. Three groups of information will eventually be needed and you will follow the discussion dutring class to come up with calculation of each group of measures based on the model you choose. A. Discout rate B. Cash flows C. Growth and terminal value Microsoft acel FeEdit Format View Help The following is what I need for Walt Disney Co (DIS) 1. The story part of the valuation, including the summary of the company, the past and outlook, chalenges and opportunity. And your understanding of the potential growth, risk, and projects statas. 2. Think about what model you should be using when valuing the company. This needs you to look back some years' of financial reports. Look for information of dividend payment, reinvestment (Capex and change in working capital) amount and percentage stability, financial leverage stability. These will help you understand what model you should be using. I am not requiring a pefect writing to this step. But would like to point out the direction so that you know what you should be working on. This could of course be included in the final version rather than this preliminary version. But if you do provide these. I will be able to comment and give more detaield feedbacks. 3. An even extended part that you could included in you preliminary report are the input" numbers. Three groups of information will eventually be needed and you will follow the discussion dutring class to come up with calculation of each group of measures based on the model you choose. A. Discout rate B. Cash flows C. Growth and terminal value Microsoft acel

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts