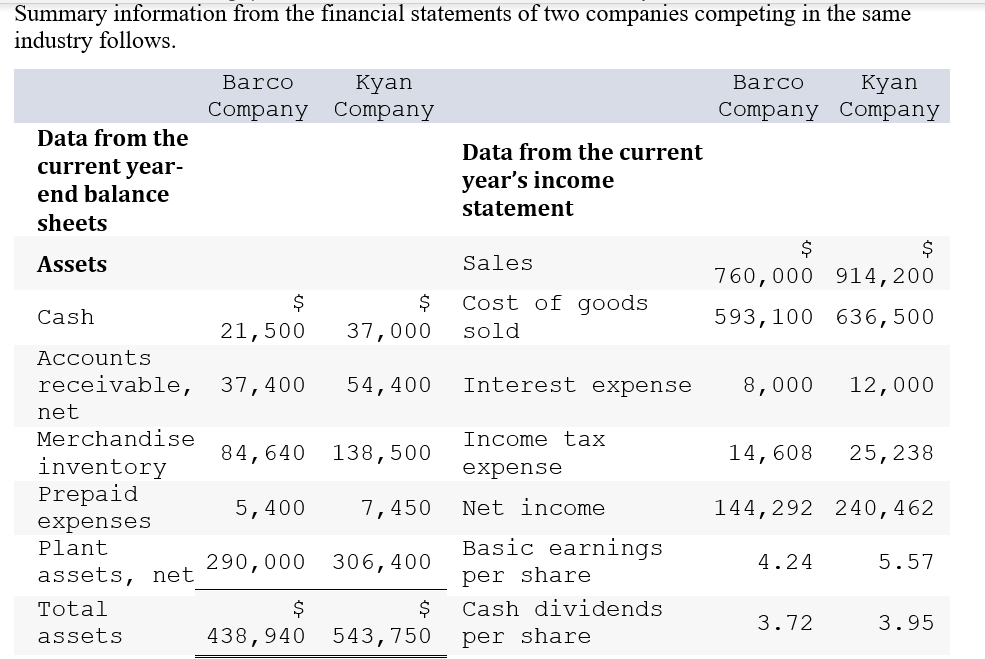

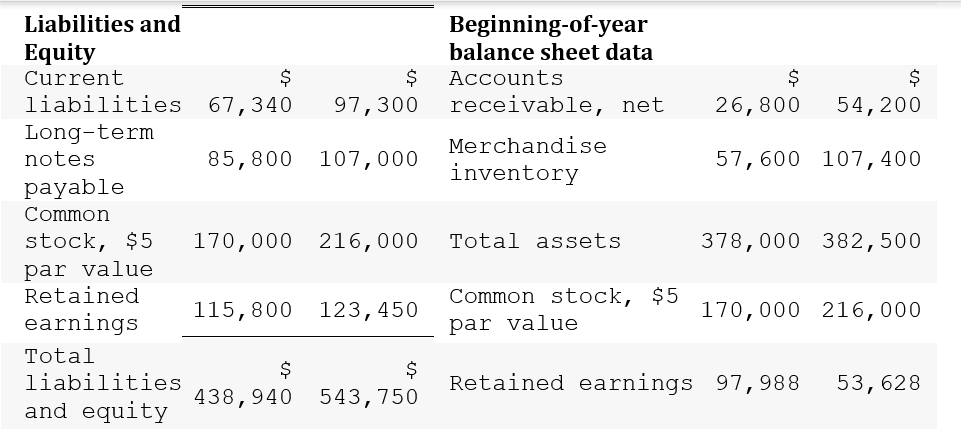

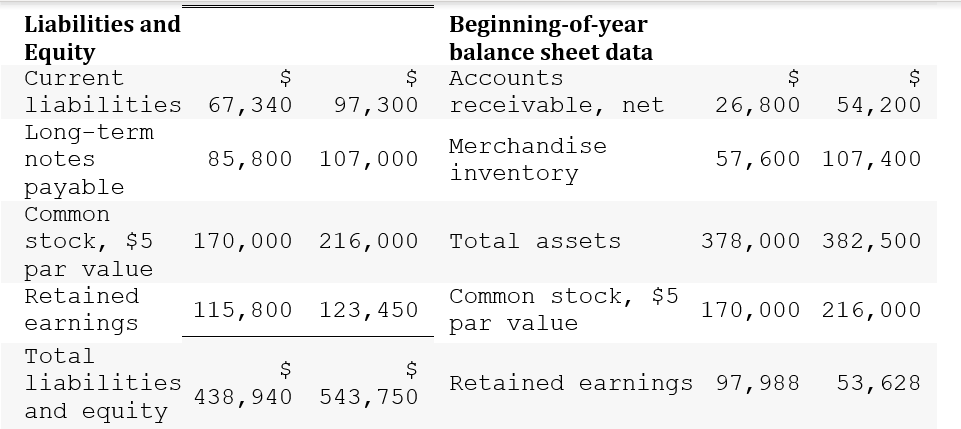

Question: fEquy Current 8 $ liabilities 67,340 97,300 Longterm notes 85,800 107,000 payable Common stock, $5 170,000 216,000 par value R9t819d 115,800 123,450 earnings Total $

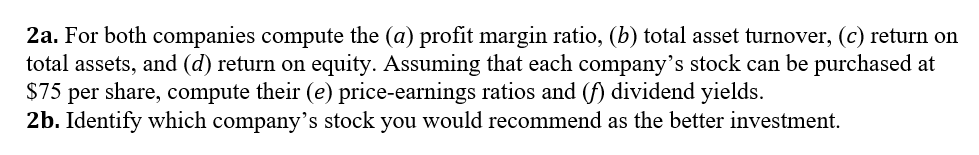

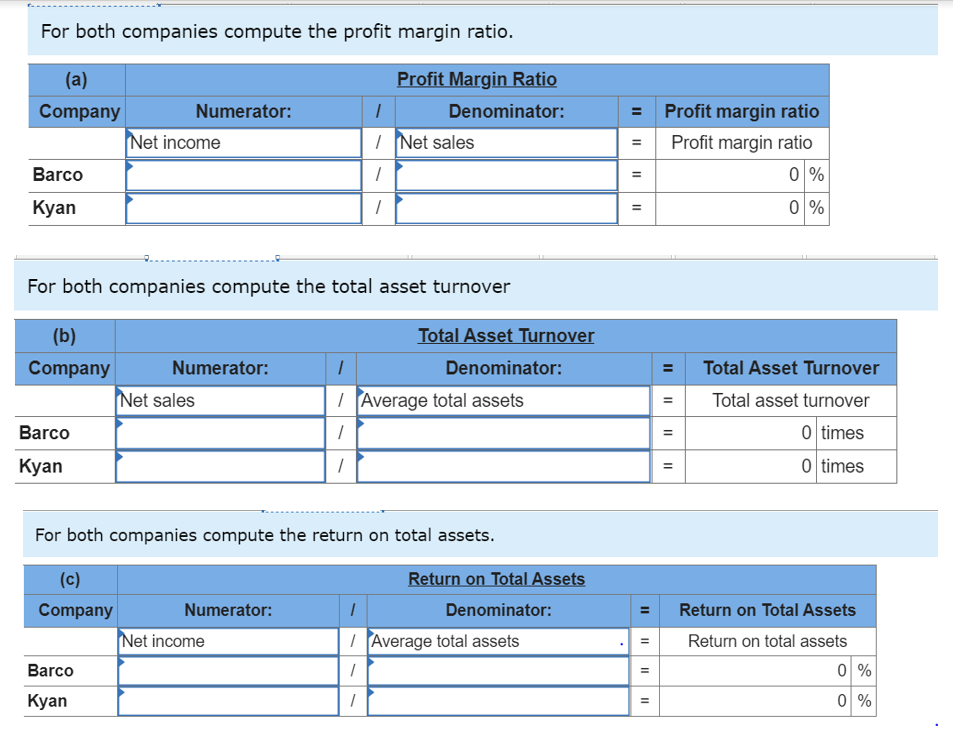

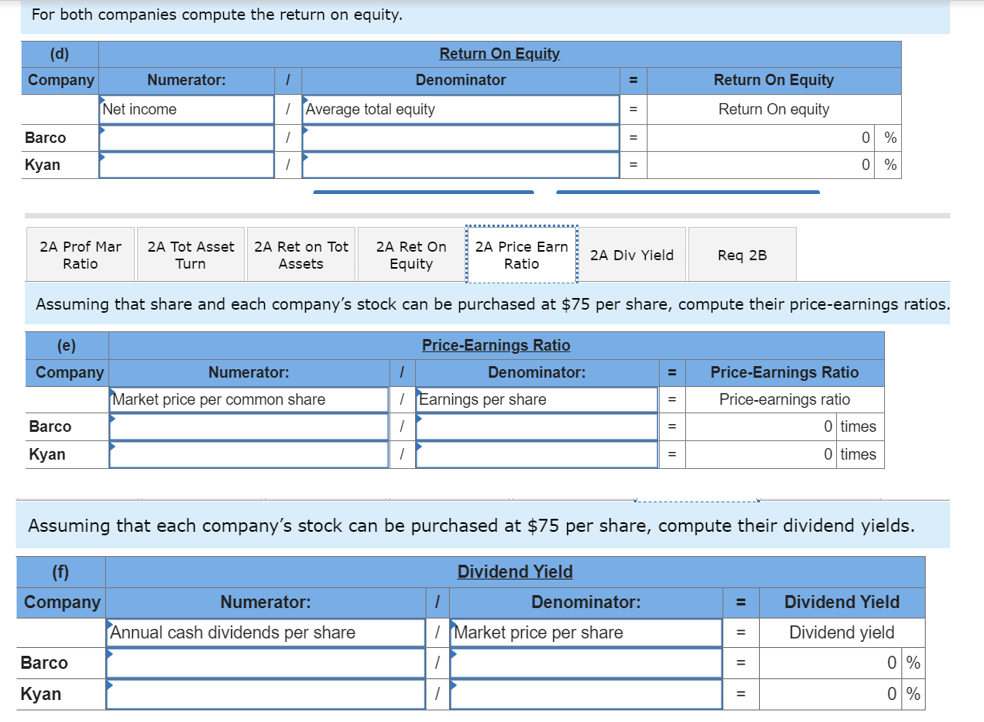

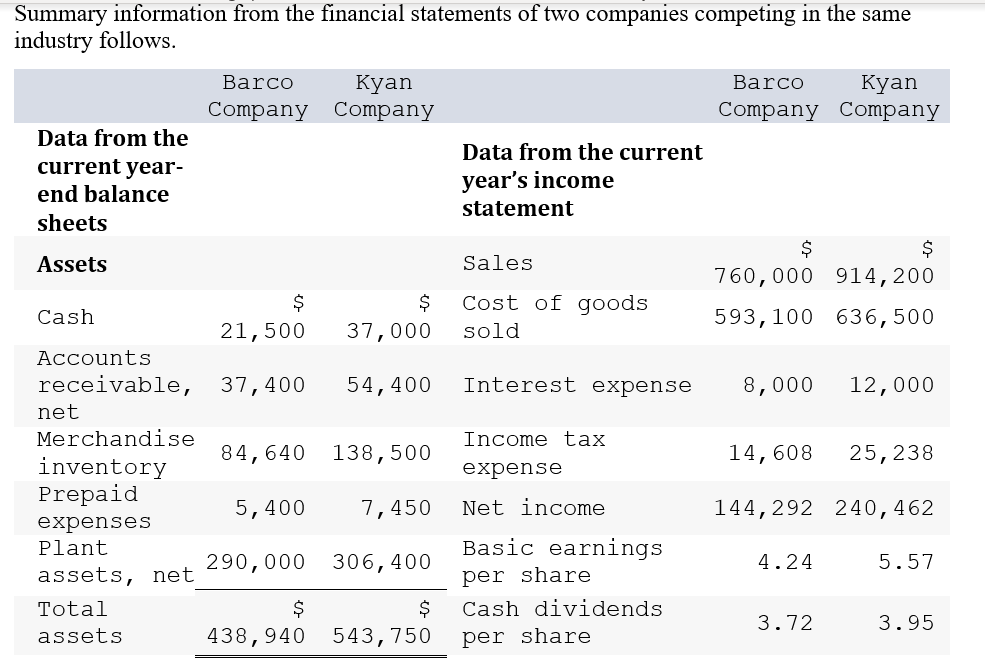

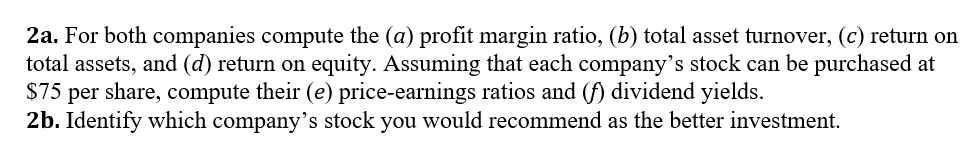

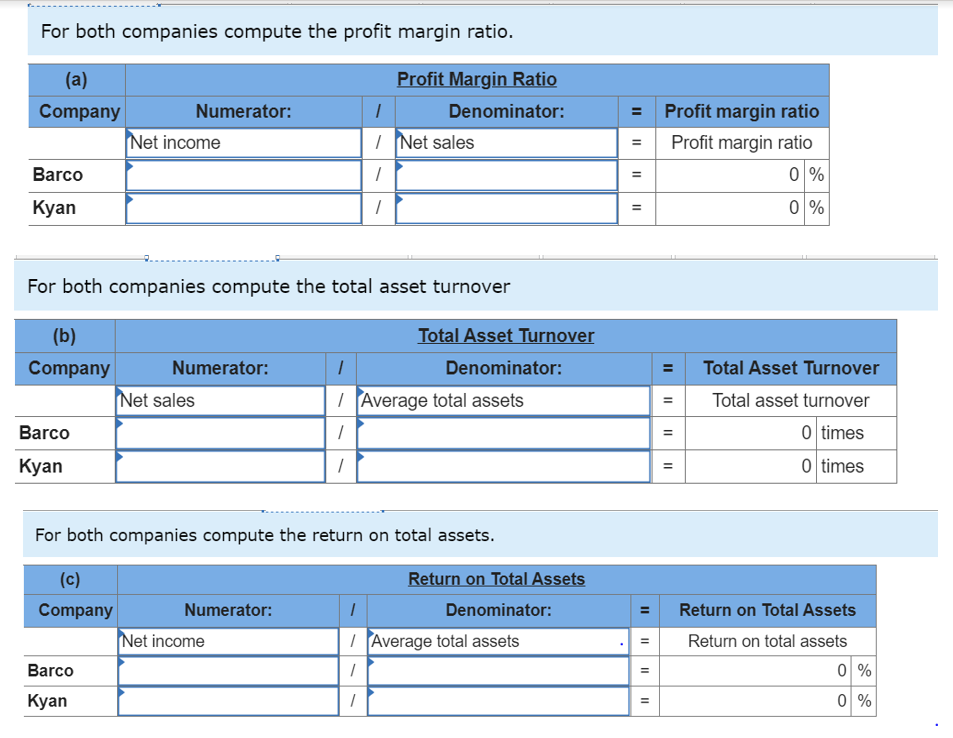

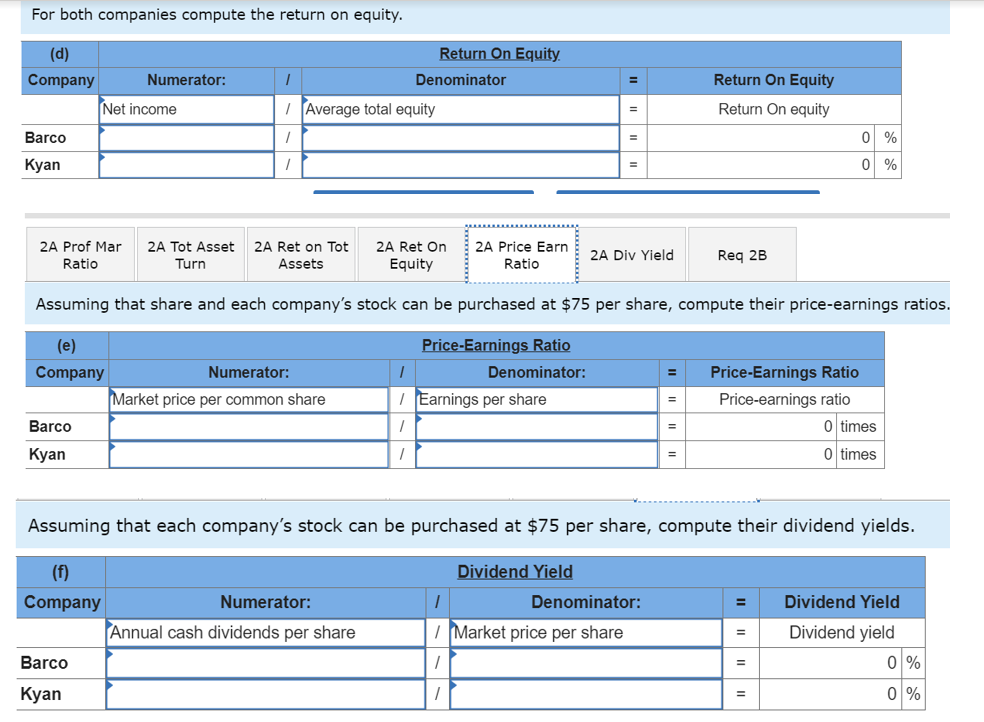

\fEquy Current 8 $ liabilities 67,340 97,300 Longterm notes 85,800 107,000 payable Common stock, $5 170,000 216,000 par value R9t81\"9d 115,800 123,450 earnings Total $ $ llabllltles 438,940 543,150 and equity Beginning-of-year balance sheet data Accounts $ receivable, net 26,800 Merchandise 57,600 inventory Total assets 378,000 Common stock, $5 par value i70'000 Retained earnings 97,988 $ 54,200 107,400 382,500 216,000 53,628 Za. For both companies compute the (a) prot margin ratio, (b) total asset turnover, (6) return on total assets, and (0') return on equity. Assuming that each company's stock can be purchased at $75 per share, compute their (9) price-earnings ratios and (f) dividend yields. 2b. Identify which company' s stock you would recommend as the better investment. :_______________________u For both companies compute the prot margin ratio. et inoome - et sales Prot margin ratio For both companies compute the total asset tu mover Average total assets I Total asset turnover I. 0 times I' 0 times For both companies compute the return on total assets. a_lasseAveragewrals . Return on total assets I 0%i I 0% For both companies compute the return on equity. (d) Return On Equity Company Numerator: 1 Denominator Return On Equity Net income Average total equity = Return On equity Barco 0 % Kyan 0 % 2A Prof Mar 2A Tot Asset 2A Ret on Tot 2A Ret On 2A Price Earn Ratio Turn Assets Equity Ratio 2A Div Yield Req 2B Assuming that share and each company's stock can be purchased at $75 per share, compute their price-earnings ratios. (e) Price-Earnings Ratio Company Numerator: I Denominator: Price-Earnings Ratio Market price per common share Earnings per share Price-earnings ratio Barco 0 times Kyan 0 times Assuming that each company's stock can be purchased at $75 per share, compute their dividend yields. (f) Dividend Yield Company Numerator: 1 Denominator: Dividend Yield Annual cash dividends per share Market price per share = Dividend yield Barco 0 % Kyan 0%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts