Question: ferences aborations ple Tutor rchase Course ABC, Inc. is a U.S. based MNC that is considering the development of a subsidiary in Ireland (whose currency

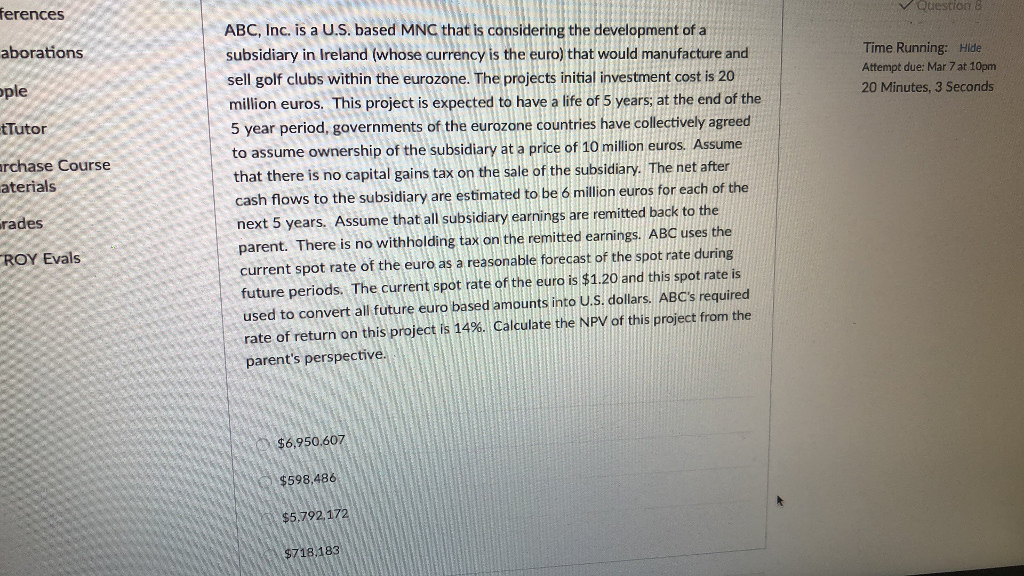

ferences aborations ple Tutor rchase Course ABC, Inc. is a U.S. based MNC that is considering the development of a subsidiary in Ireland (whose currency is the euro) that would manufacture and sell golf clubs within the eurozone. The projects initial investment cost is 20 million euros. This project is expected to have a life of 5 years; at the end of the 5 year period, governments of the eurozone countries have collectively agreed to assume ownership of the subsidiary at a price of 10 milion euros. Assume that there is no capital gains tax on the sale of the subsidiary. The net after cash flows to the subsidiary are estimated to be 6 million euros for each of the next 5 years. Assume that all subsidiary earnings are remitted back to the parent. There is no withholding tax on the remitted earnings. ABC uses the current spot rate of the euro as a reasonable forecast of the spot rate during future periods. The current spot rate of the euro is $1.20 and this spot rate is used to convert all future euro based amounts into U.S dollars. ABC's required rate of return on this project is 14%. Calculate the NPV of this project from the parent's perspective. Time Running: Hide Attempt due: Mar 7 at 10pm 20 Minutes, 3 Seconds aterials rades ROY Evals $6,950.607 $598,486 $5.792 172 9718183

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts