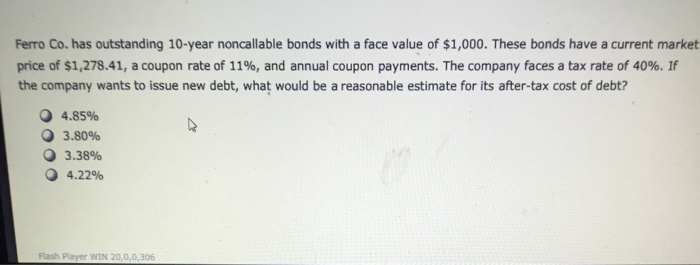

Question: Ferro Co. has outstanding 10-year noncallable bonds with a face value of $1,000. These bonds have a current market price of $1,278.41, a coupon rate

Ferro Co. has outstanding 10-year noncallable bonds with a face value of $1,000. These bonds have a current market price of $1,278.41, a coupon rate of 11%, and annual coupon payments. The company faces a tax rate of 40%. If the company wants to issue new debt, what would be a reasonable estimate for its after-tax cost of debt? 4.85% 3.80% 3.38% 4.22% Flash Player WIN 20,0,0,306

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts