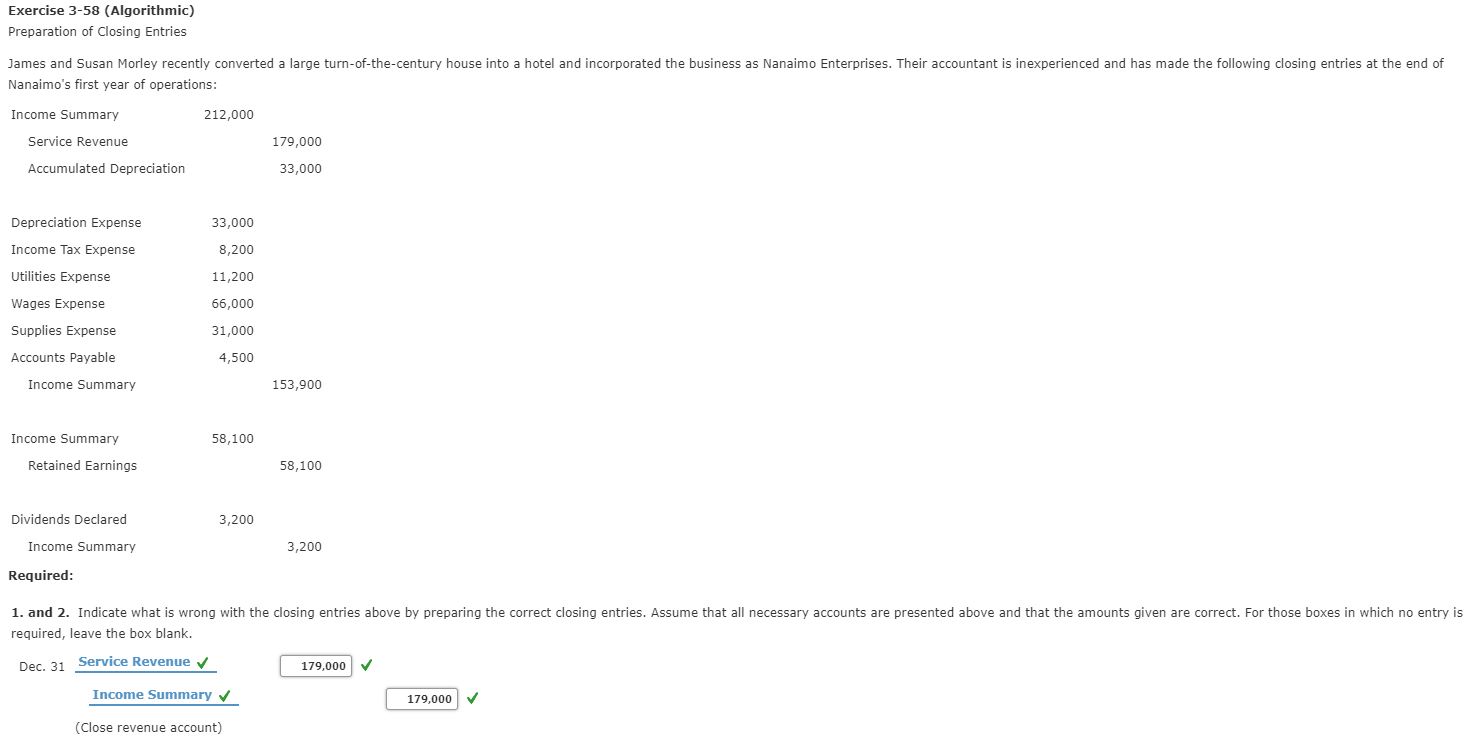

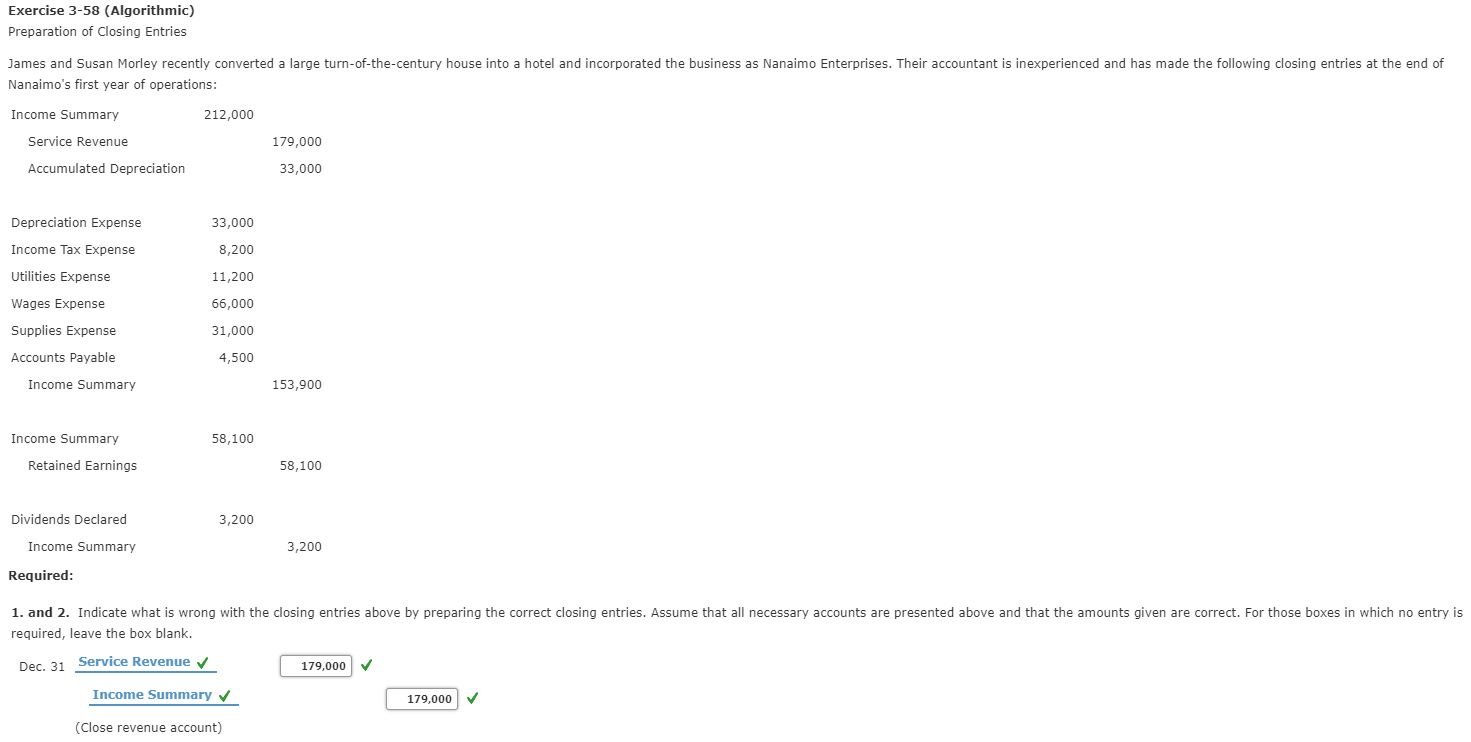

Question: Exercise 3-58 (Algorithmic) Preparation of Closing Entries James and Susan Morley recently converted a large tum-of-the-century house into a hotel and incorporated the business

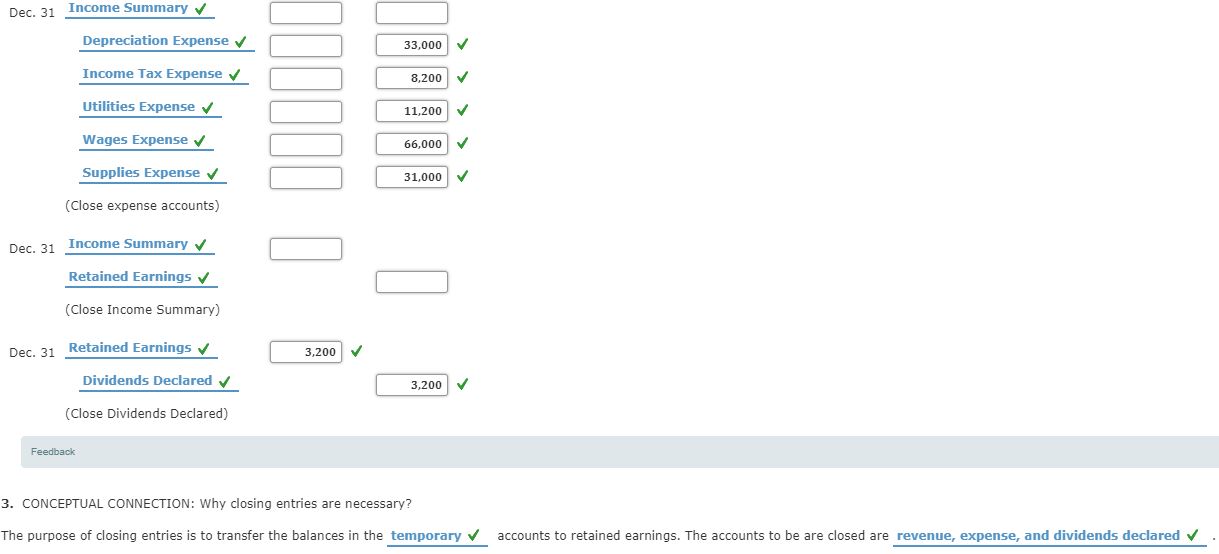

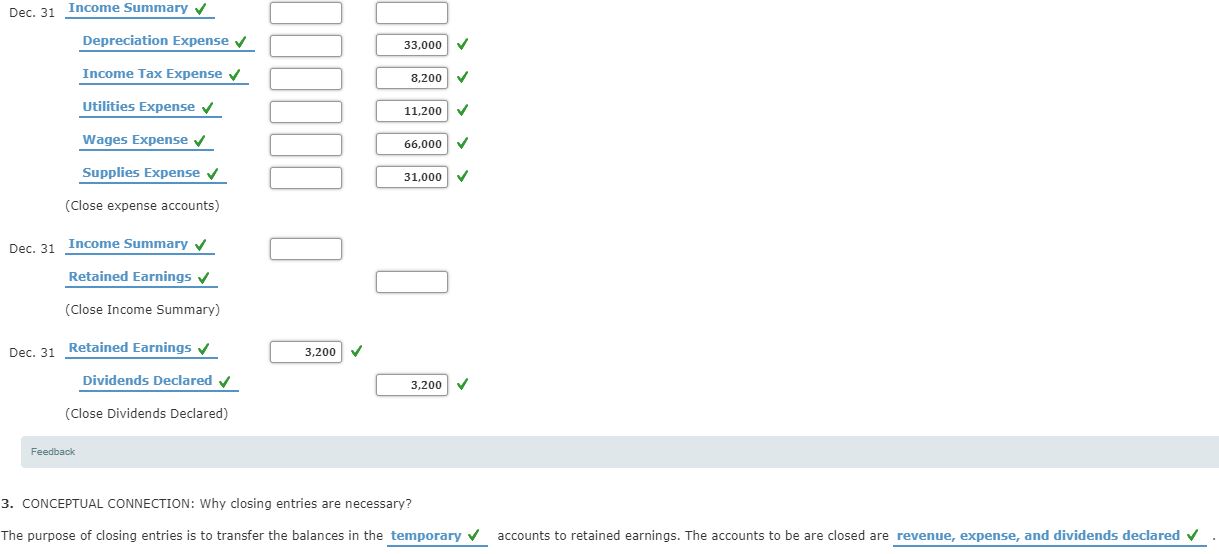

Exercise 3-58 (Algorithmic) Preparation of Closing Entries James and Susan Morley recently converted a large tum-of-the-century house into a hotel and incorporated the business as Nanaimo Enterprises. Their accountant is inexperienced and has made the following closing entries at the end of Nanaimo's first year of operations: 212,000 Income Summary Service Revenue Accumulated Depreciation Depreciation Expense Income Tax Expense utilities Expense Wages Expense Supplies Expense Accounts Payable Income Summary Income Summary Retained Earnings Dividends Declared Income Summary Required: 179,000 33,000 33,000 8,200 11,200 66,000 31,000 4,500 153,goo 58,100 58,100 3,200 3,200 1. and 2. Indicate what is wrong with the closing entries above by preparing the correct closing entries. Assume that all necessary accounts are presented above and that the amounts given are correct. For those boxes in which no entry is required, leave the box blank. Service Revenue Dec. 31 Income Summary (Close revenue account) 179,000 v' 179,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts