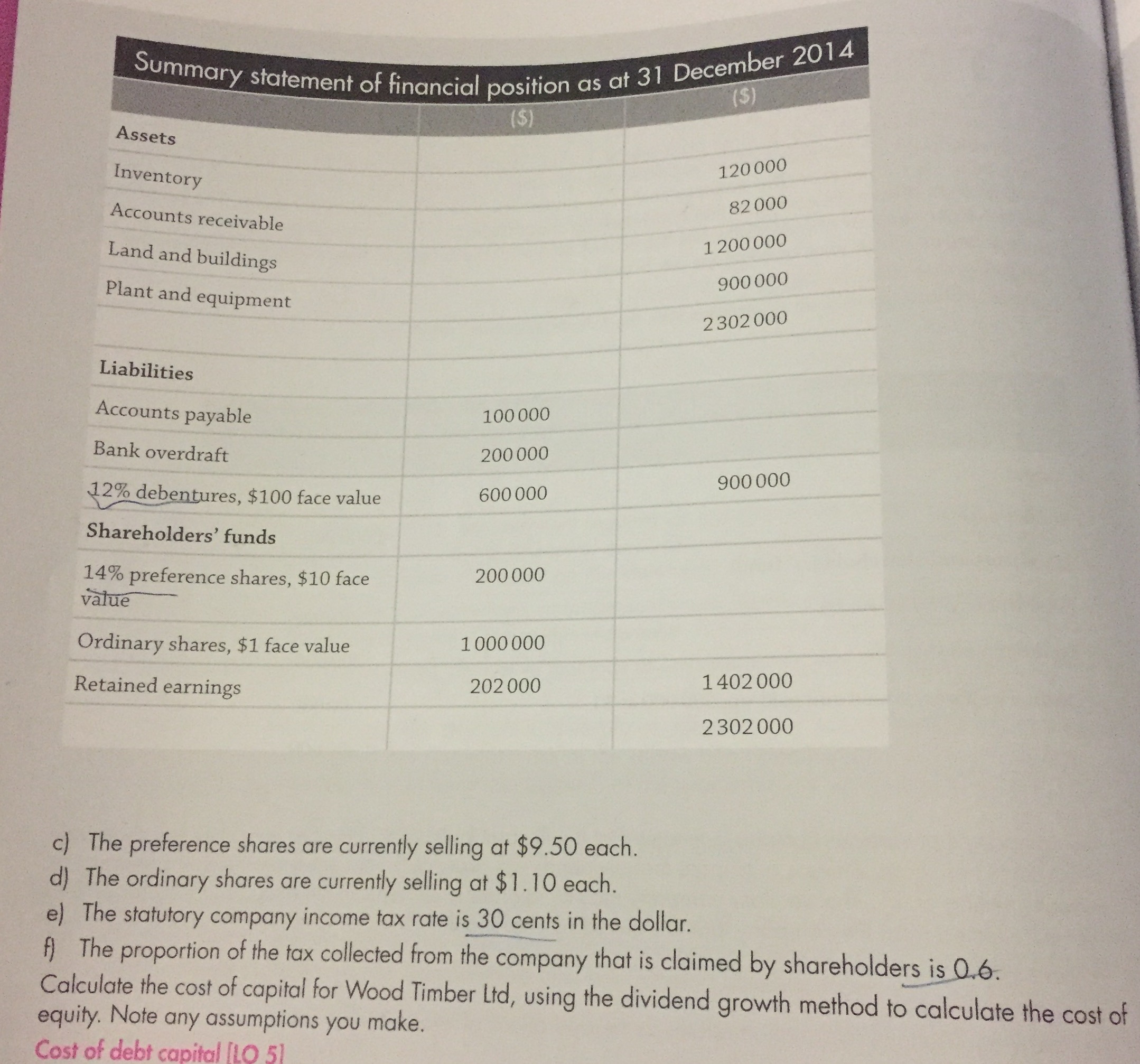

Question: Summary statement of financial position as at 31 December 2014 Assets Inventory Accounts receivable Land and buildings Plant and equipment Liabilities Accounts payable Bank

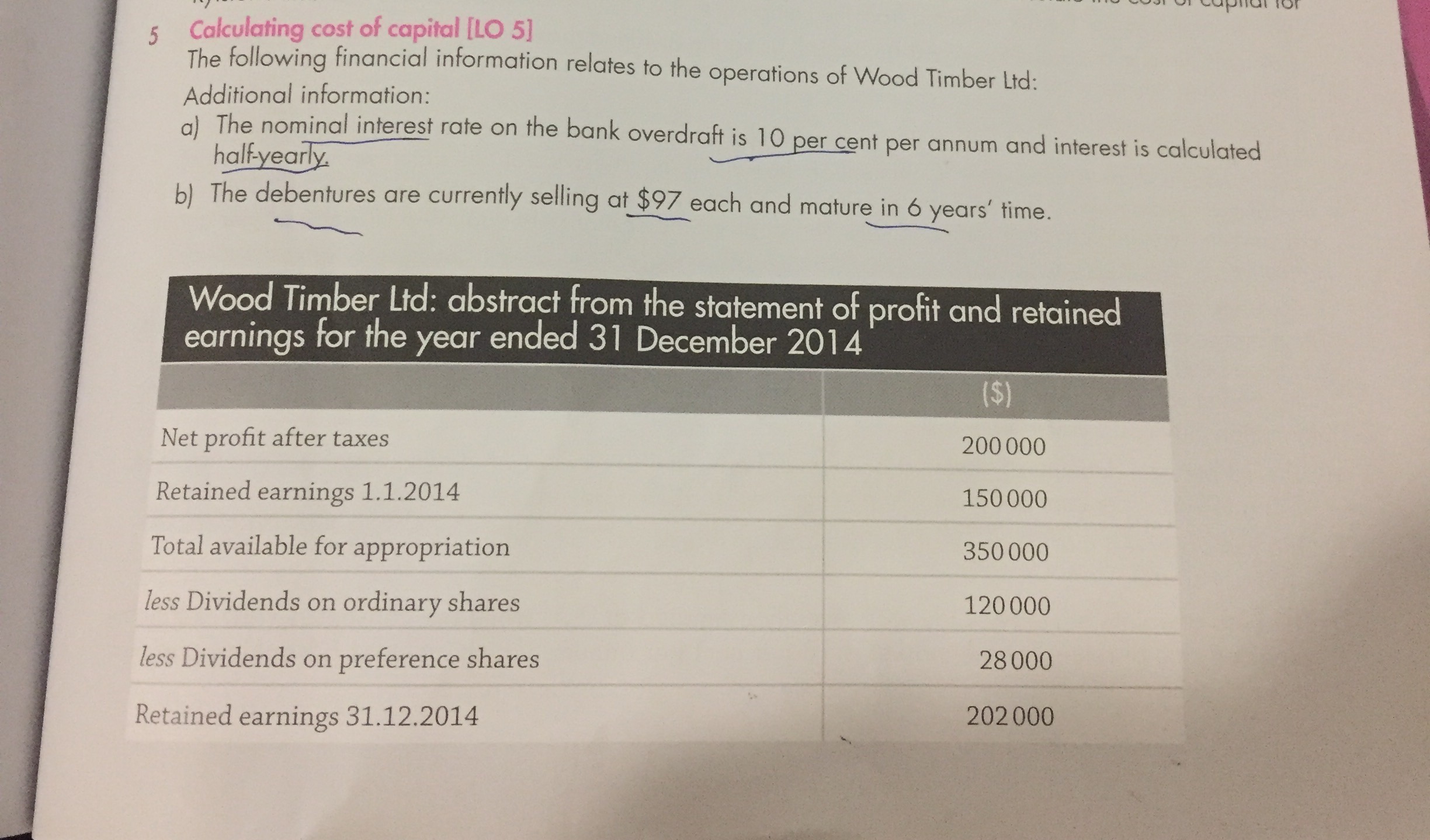

Summary statement of financial position as at 31 December 2014 Assets Inventory Accounts receivable Land and buildings Plant and equipment Liabilities Accounts payable Bank overdraft $100 face value Shareholders' funds 14% preference shares, $10 face v ue Ordinary shares, $1 face value Retained earnings 120000 82 ooo 1200 ooo 900 ooo 2302 ooo 100 ooo 200 900 ooo 600 ooo 200 ooo 1 ooo 1402 ooo 202 ooo 2302 ooo c) The preference shares are currently selling at $9.50 each. d) The ordinary shares are currently selling at $1 .10 each. e) The statutory company income tax rate is 30 cents in the dollar. f) The proportion of the tax collected from the company that is claimed by shareholdersj_06. Calculate the cost of capital for Wood Timber Ltd, using the dividend growth method to calculate the cost of equity. Note any assumptions YOU make.

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts