Question: Required inform etion IThe fm'.'owlng app'/es to the questions displayed be,'owl Tiny and Tim each cwn half of the 100 outstanding shares of Flcwer

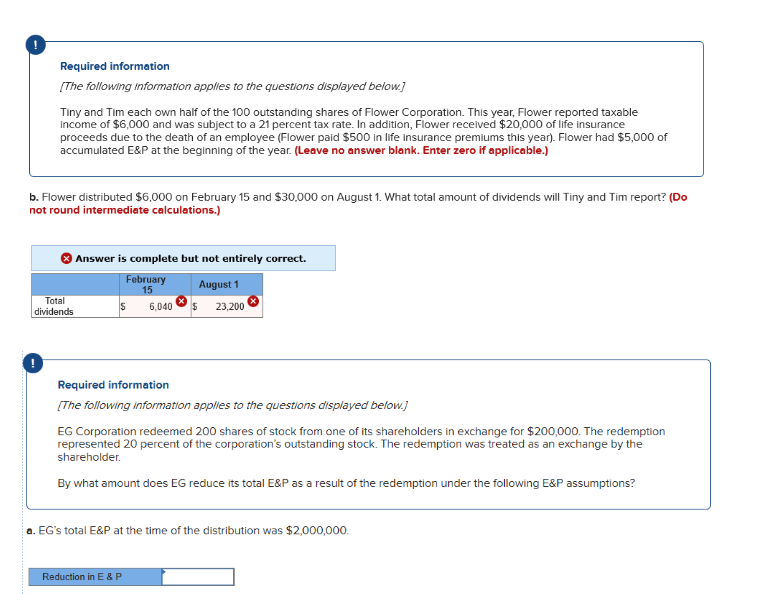

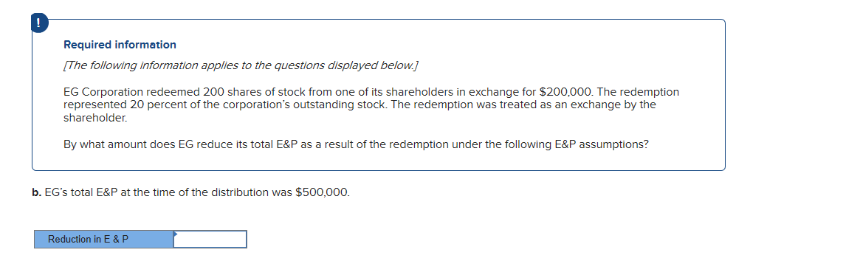

Required inform etion IThe fm'.'owlng app'/es to the questions displayed be,'owl Tiny and Tim each cwn half of the 100 outstanding shares of Flcwer Corporatlon_ This year. Flower reported taxable income of 36,000 and was subject to a 21 percent tax rate. In addition, Flower received $20000 of life insurance proceeds due to the death of an employee (Flcnner paid SSOO in life Insurance premiums this year). Flcnver had $5,000 of accumulated ESP at the beginning of the year. (Leave no answer blank. Enter zero if applicable.) b. Flower distributed $6,000 on February 15 and S30.OOO on August I. What total amount of dividends will Tiny and Tim report? (Do not round intermediete calculations.) Answer is complete but not entirely Correct. ebruary 6.010 Required information August I 23,200 t'The following information applies to the questions displayed below,' EG Corporation redeemed 200 shares of stock from one of its shareholders in exchange for $200,000 The redemption represented 20 percent of the corporation's outstanding stock. The redemption was treated as an exchange by the shareholder. By what amount does EG reduce its total ESP as a result of the redemption under the following E&P assumptions? a. EC's total EEP at the time ofthe distribution was

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts