Question: fffd] Create a 95% oondenoe interval around this prediction using the formula below for the variance of the prediction. The sample mean of Market risk

![\f\f\fd] Create a 95% oondenoe interval around this prediction using the](https://dsd5zvtm8ll6.cloudfront.net/si.experts.images/questions/2024/09/66f6b4b6f3165_15066f6b4b6d5a1e.jpg)

![Market risk premium is 1.5% {1: 0.015] and the sample variance is](https://dsd5zvtm8ll6.cloudfront.net/si.experts.images/questions/2024/09/66f6b4b7be75b_15166f6b4b7ac292.jpg)

![[1.25% {Si = II].DD25). \f\fYou are an investor in JP Morgan stock](https://dsd5zvtm8ll6.cloudfront.net/si.experts.images/questions/2024/09/66f6b4b807d23_15166f6b4b7e8388.jpg)

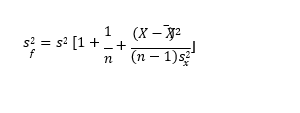

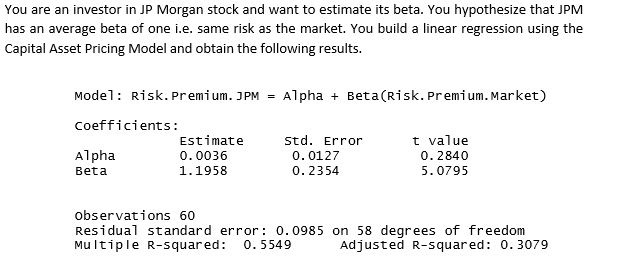

\f\f\fd] Create a 95% oondenoe interval around this prediction using the formula below for the variance of the prediction. The sample mean of Market risk premium is 1.5% {1: 0.015] and the sample variance is [1.25% {Si = II].DD25). \f\fYou are an investor in JP Morgan stock and want to estimate its beta. You hvpothesize that JPl'vl has an average beta of one i.e. same risk as the market. You build a linear regression using the Capital Asset Pricing Model and obtain the following resulis. Model: Risk.Premiun.]PH = Alpha + Beta(Risk.Premium.Harket} Coefficients: Estimate Std. Error t value Alpha 0.0035 0.012? 0.2340 Beta 1.1958 0.2354 5.0?95 observations 60 Residual standard error: 0.0035 on 53 degrees of freedom Multiple Rsquared: 0.5549 Adjusted Rsquared: 0.30?9

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts