Question: Consolidation subsequent to date of acquisitionEquity method with noncontrolling interest , AAP and gain on upstream intercompany equipment sale A parent company acquired its

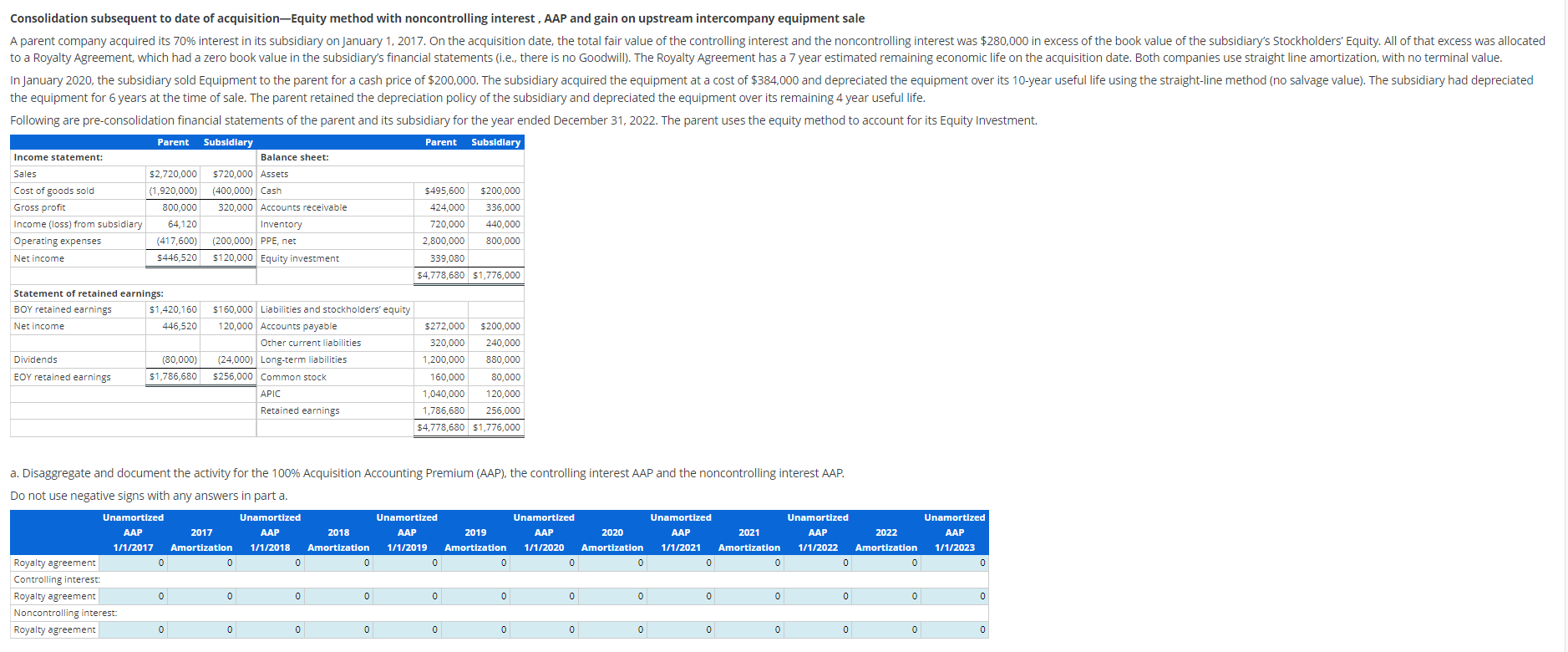

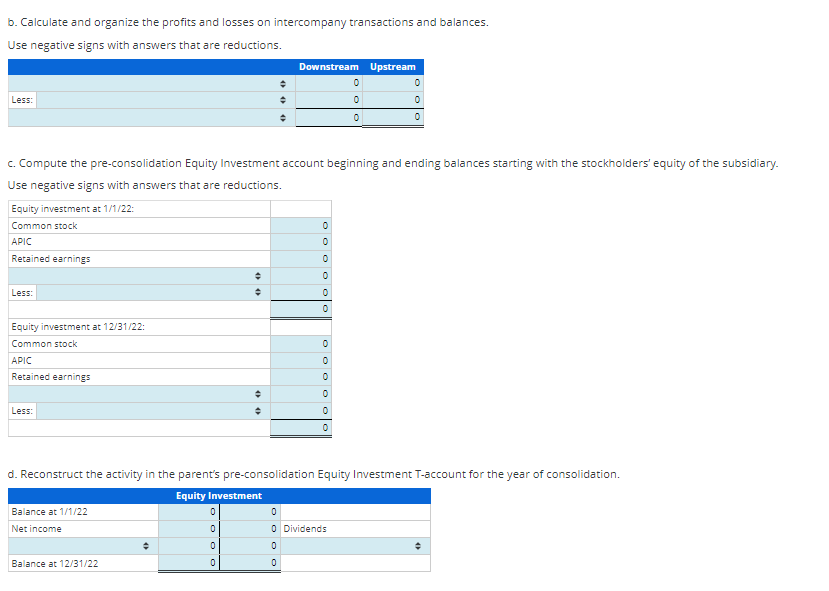

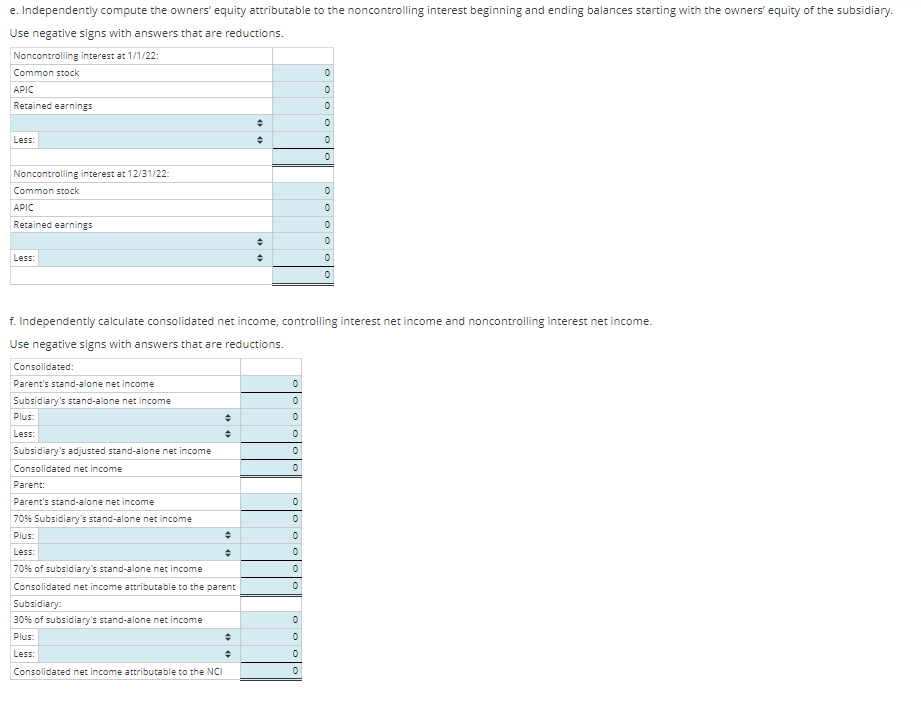

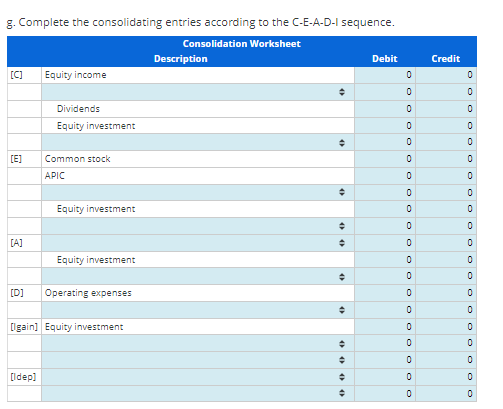

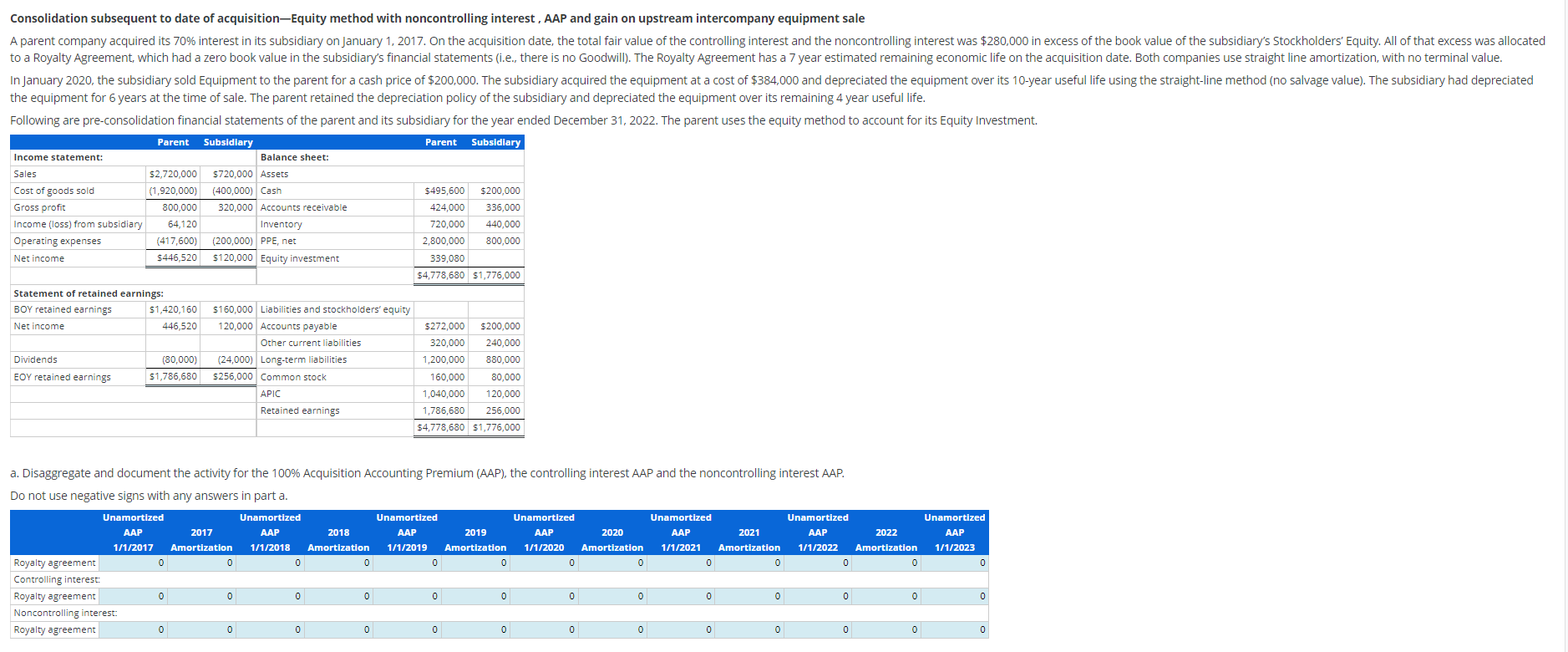

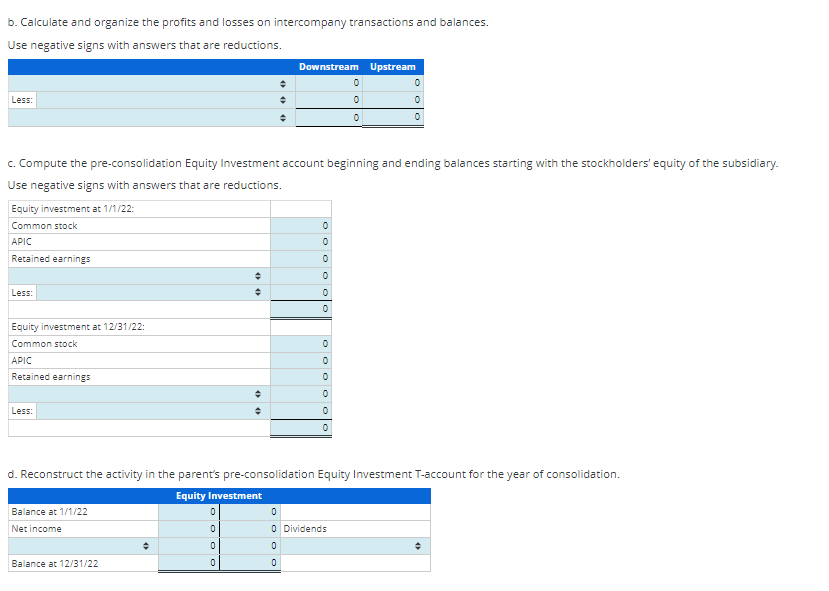

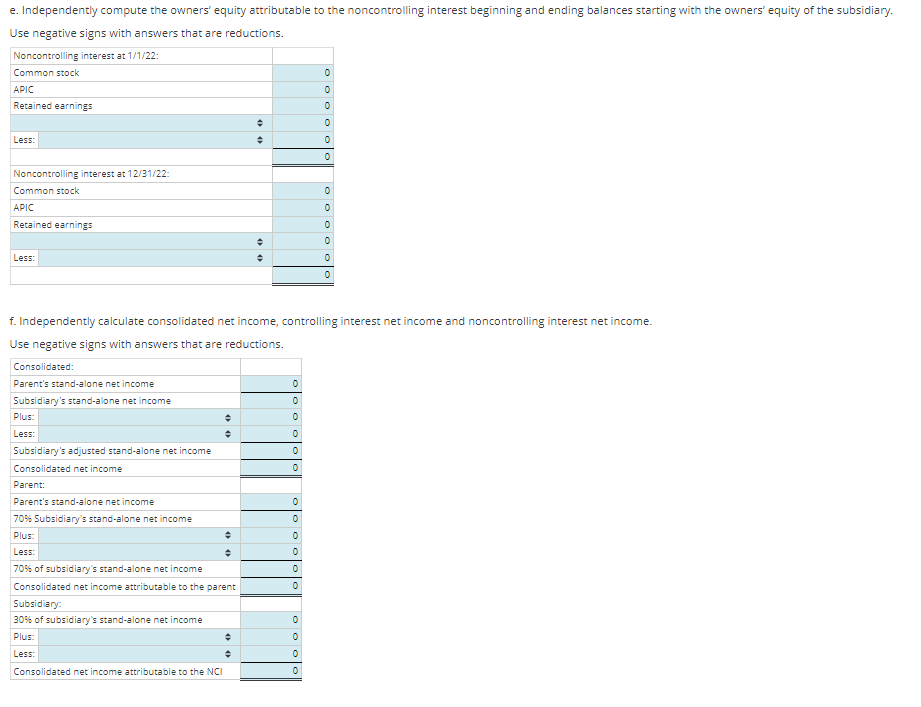

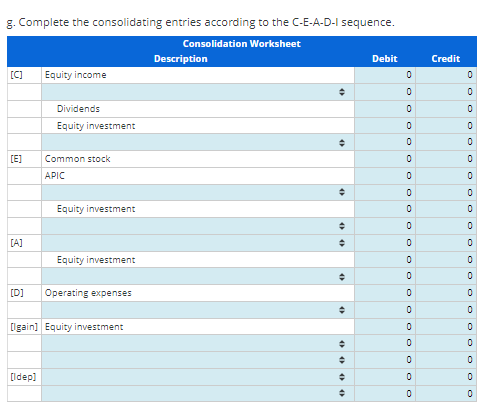

Consolidation subsequent to date of acquisitionEquity method with noncontrolling interest , AAP and gain on upstream intercompany equipment sale A parent company acquired its 70% interest in its subsidiary on January 1, 2017. On the acquisition date, the total fair value ofthe controlling interest and the noncontrolling interest was $280,000 in excess of the book value of the subsidiarys Stockholders' Equity. All of that excess was allocated to a Royalty Agreement, which had a zero book value in the subsidiary's financial statements (i.e., there is no Goodwill). The Royalty Agreement has a 7 year estimated remaining economic life on the acquisition date. 80th companies use straight line amortization, with no terminal value. In January 2020, the subsidiary sold Equipment to the parent for a cash price of $200,000. The subsidiary acquired the equipment at a cost of $384,000 and depreciated the equipment over its 10-year useful life using the straight-line method (no salvage value). The subsidiary had depreciated the equipment for 6 years at the time of sale. The parent retained the depreciation policy of the subsidiary and depreciated the equipment over its remaining 4 year useful life. Following are pre-consolidation financial statements of the parent and its subsidiary for the year ended December 31 , 2022. The parent uses the equity method to account for its Equity Investment. Parent Subsidiary Pa rent Subsidiary Income statement: Sales Cost of goods sold Gross profit Income (loss) from subsidizry Opereting expenses Net income 800,000 64,120 (417,600) Statement of retained earnings: SOY retained earnings Net income Dividends EOY retained earnings 446,520 (80,000) S720,ooo (400,000) 320,000 (200,000) Sl 20,000 Sl SO,OOO 120,000 (24,000) szss,ooo Balance sheet: Assets Accounts receiveble Inventory ppE, Equity investment Liebi'ities end stockholders' Accounts payed',e Other current liebilities Long-term liebilities Common stock AplC Retzined earnings S4gs,soo 424,000 720,000 339,080 equity 3272.000 320,000 1 60,000 $200,000 336,000 440,000 800,000 $200,000 240,000 880,000 80,000 1 20,000 256,000 a. Disaggregate and document the activity for the 100% Acquisition Accounting Premium (AAP), the controlling interest AAP and the noncontrolling interest AAR Do not use negative signs with any answers in part a. Unamortized I II 12017 Royalty agreemen: Controlling interest Royalty agreement No ncontrollins interest: Royalty agreement Unamortized 2018 I II 12018 Amortization Unamortized 2019 I II 12019 Amortization Unamortized 1/1/2020 Amortization Unamortized 1 /1/2021 Unamor d 1,'1/2022 Amortization Unamortized Amortization

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts