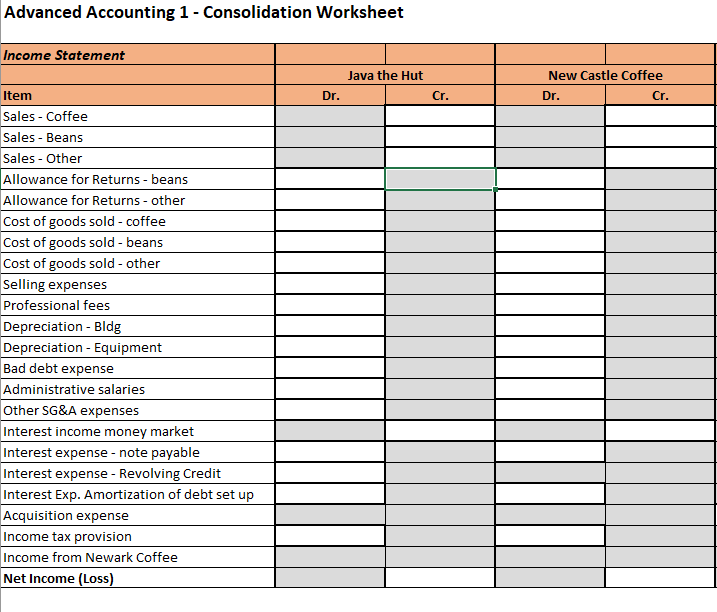

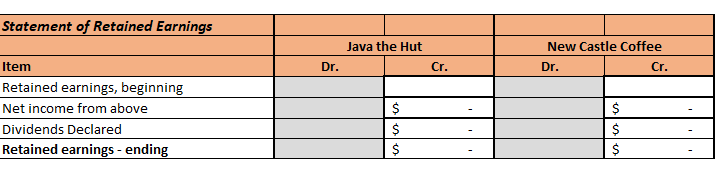

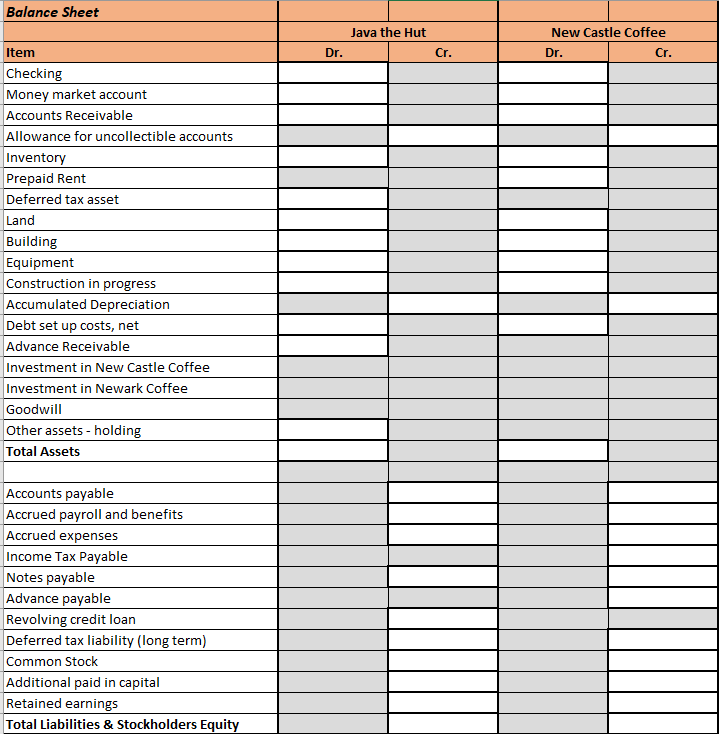

Question: ffffBalance Sheet Java the Hut New Castle Coffee Item Dr. Cr. Dr. Cr. Checking Money market account Accounts Receivable Allowance for uncollectible accounts Inventory Rent

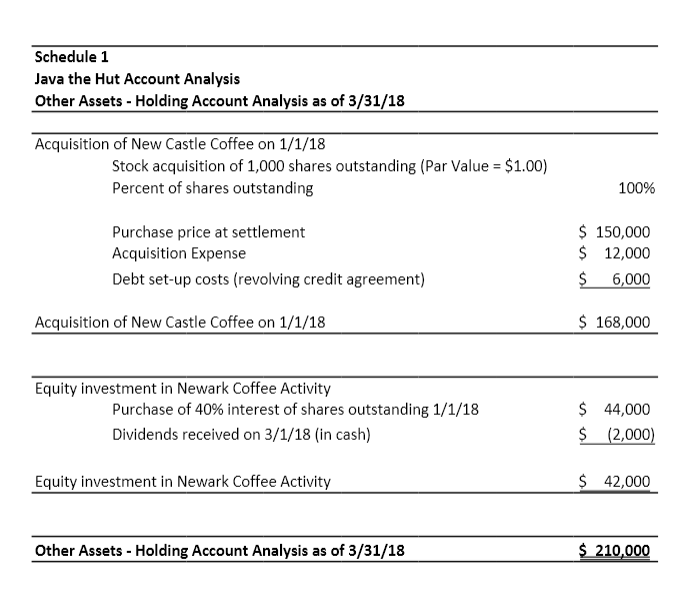

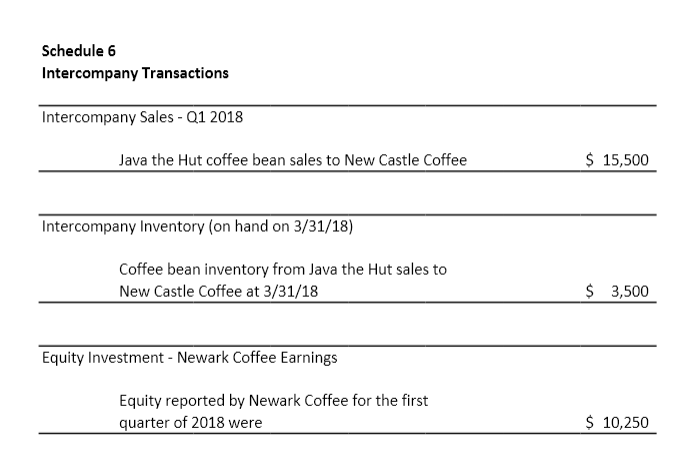

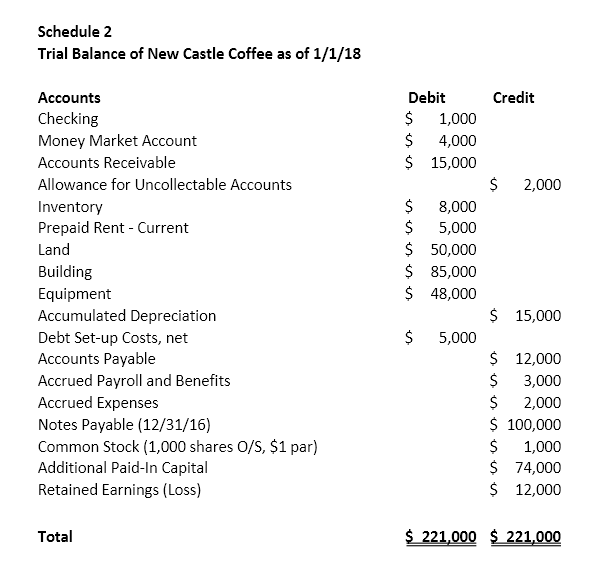

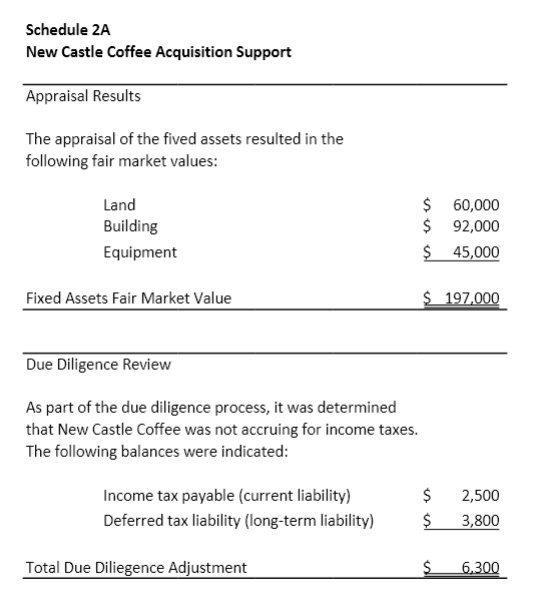

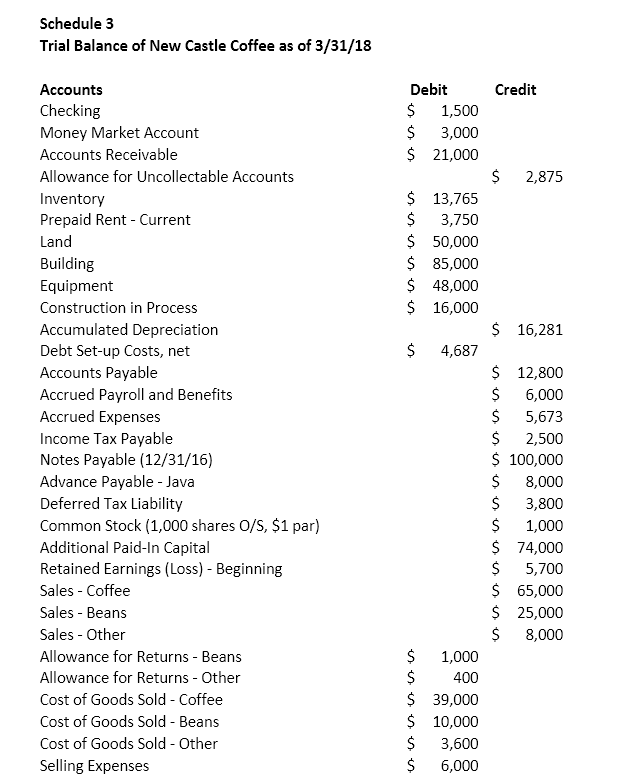

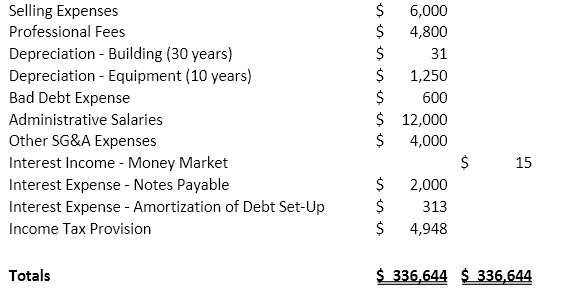

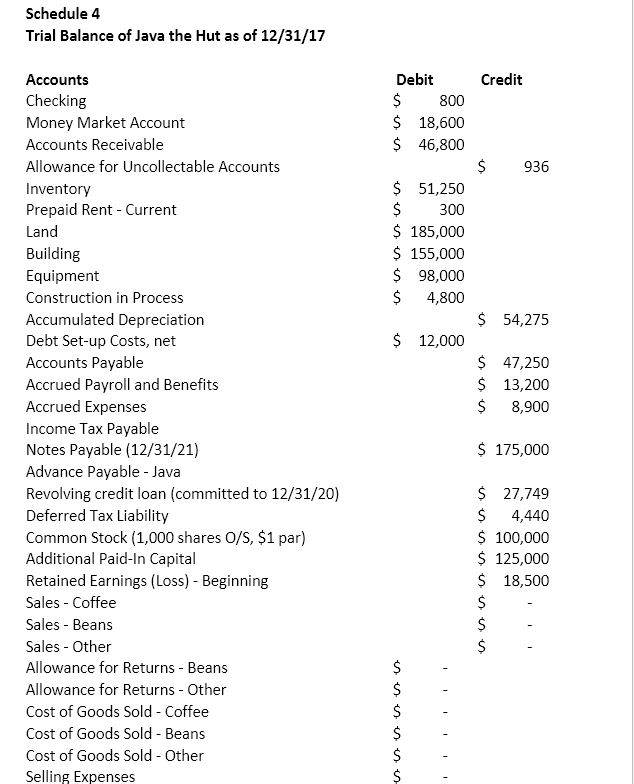

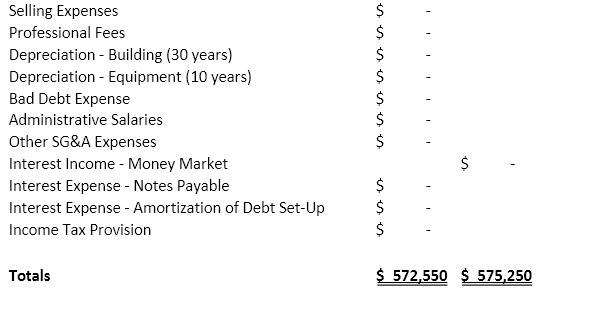

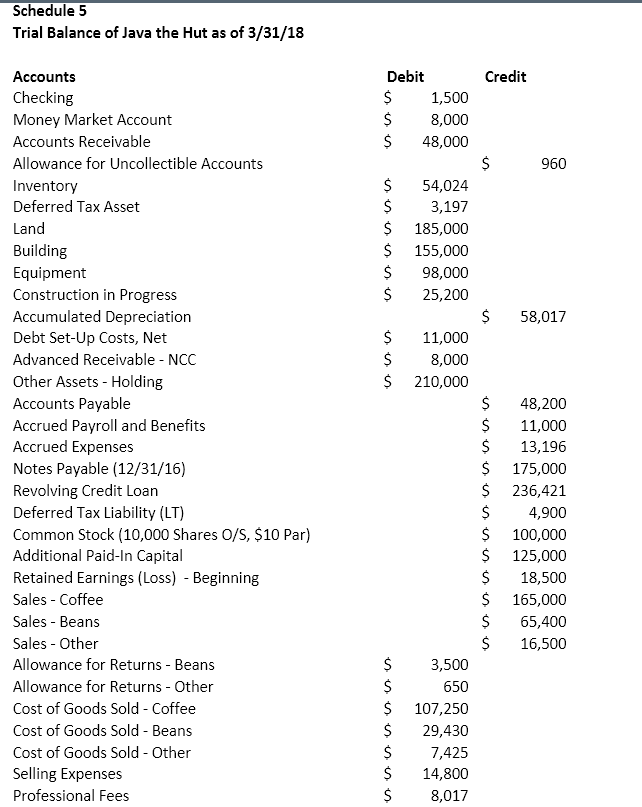

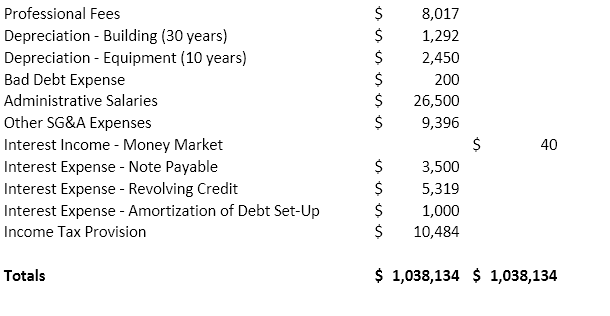

\f\f\f\fBalance Sheet Java the Hut New Castle Coffee Item Dr. Cr. Dr. Cr. Checking Money market account Accounts Receivable Allowance for uncollectible accounts Inventory Rent Deferred tax asset Land Building Equipment Construction in progress Accumulated Depreciation Debt set up costs, net Advance Receivable Investment in New Castle Coffee Investment in Newark Coffee Goodwill Other assets - holding Total Assets Accounts payable Accrued payroll and benefits Accrued expenses Income Tax Payable Notes payable Advance payable Revolving credit loan Deferred tax liability (long term) Common Stock Additional paid in capital Retained earnings Total Liabilities & Stockholders EquitySchedule 2 Trial Balance of New Castle Coffee as of 1/1/18 Accounts Debit Credit Checking S 1,000 Money Market Account 4,000 Accounts Receivable $ 15,000 Allowance for Uncollectable Accounts $ 2,000 Inventory 8,000 Prepaid Rent - Current S 5,000 Land 50,000 Building 85,000 Equipment 48,000 Accumulated Depreciation $ 15,000 Debt Set-up Costs, net $ 5,000 Accounts Payable $ 12,000 Accrued Payroll and Benefits S 3,000 Accrued Expenses S 2,000 Notes Payable (12/31/16) $ 100,000 Common Stock (1,000 shares O/S, $1 par) 5 1,000 Additional Paid-In Capital 74,000 Retained Earnings (Loss) 5 12,000 Total $ 221,000 $ 221,000Schedule ZA New Castle Coffee Acquisition Support Appraisal Results The appraisal of the fiued assets resulted in the following fair market values: Land 5 50.000 Building 5 02.000 Equipment 45.000 Fixed Assets Fair Market Value S_19_Z._0_&Q Due Diligence Review As part of the due diligence process, it was determined that New Castle Coffee was not accruing for income taxes. The following balances were indicated: Income tax payable {current liability] 29 2.5DD Deferred tax liabilityr {longterm liability] S 3,3DD Total Due Diliegence Adjustment 5 @3051 Schedule 3 Trial Balance of New Castle Coffee as of 3331,.if 18 Accounts Debit Credit Checking S 1,500 Money Market Account S 8,000 Accounts Receiyable S 21,000 Allowance for Uncollectable Accounts S 2,8?5 lnyentory S 18,?65 Prepaid Rent - Current S 8,?50 Land 3 50,000 Building S 85,000 Equipment S 48,000 Construction in Process S 16,000 Accumulated Depreciation S 16,281 Debt Setup Costs, net S 4,68? Accounts Payable S 12,800 Accrued Payroll and Benefits S 6,000 Accrued Expenses S 5,6?8 Income Tax Payable S 2,500 Notes Payable [12X31g'16l S 100,000 Adyance Payable - Jaya S 8,000 Deferred Tax Liability S 3,800 Common Stock {1,000 shares DIS, S1 par} S 1,000 Additional PaidIn Capital S 14,000 Retained Earnings [Loss] Beginning S 5,?00 Sales Coffee S 65,000 Sales Beans S 25,000 Sales lDther S 8,000 Allowance for Returns Beans S 1,000 Allowance for Returns Dther S 400 Cost of Goods Sold - Coffee S 88,000 Cost of Goods Sold - Beans S 10,000 Cost of Goods Sold Other S 8,600 Selling Expenses S 6,000 Selling Expenses 6,000 Professional Fees 4,800 Depreciation - Building (30 years) 31 Depreciation - Equipment (10 years) 1,250 Bad Debt Expense 600 Administrative Salaries 12,000 Other SG&A Expenses 4,000 Interest Income - Money Market 15 Interest Expense - Notes Payable 2,000 Interest Expense - Amortization of Debt Set-Up 313 Income Tax Provision S 4,948 Totals $ 336.644 $ 336.644\fSelling Expenses - Professional Fees 1 Depreciation - Building (30 years) - Depreciation - Equipment (10 years) Bad Debt Expense Administrative Salaries I Other SG&A Expenses - Interest Income - Money Market 5 Interest Expense - Notes Payable - Interest Expense - Amortization of Debt Set-Up 1 Income Tax Provision Totals $ 572 550 $ 575,250Schedule 5 Trial Balance of Java the Hut as of 3331313 Accounts Checking ivlonevr Market Account Accounts Receivable Allowance for Uncollectible Accounts Inve ntorv Deferred Tax Asset Land Building Equipment Construction in Progress Accumulated Depreciation Debt SetUp Costs, Net Advanced Receivable - NCC OtherAssets - Holding Accounts Pavable Accrued Pavroll and Benefits Accrued Expenses Notes Pavable [12,f31f16} Revolving Credit Loan Deferred Tax Liability {LT} Common Stock {10,000 Shares DIS, $10 Par} Additional Paid-In Capital Retained Earnings [Loss] Beginning Sales Coffee Sales Beans Sales - Citber Allowance for Returns Beans Allowance for Returns |Either Cost of Goods Sold - Coffee Cost of Goods Sold Beans Cost of Goods Sold Other Selling Expenses Professional Fees Debit 5 1,500 5 8,000 5 43,000 5 54,024 5 3,19}r S 185,000 5 155,000 5 93,000 5 25,200 5 11,000 5 8,000 5 210,000 5 3,500 5 650 S 102,250 5 29,430 5 2,425 5 14,800 5 6,01}r Credit 960 59,01}r 43,200 11,000 13,196 125,000 236,421 4,900 100,000 125,000 16,500 165,000 65,400 16,500 Professional Fees 8,017 Depreciation - Building (30 years) 1,292 Depreciation - Equipment (10 years) 2,450 Bad Debt Expense 200 Administrative Salaries 26,500 Other SG&A Expenses 9,396 Interest Income - Money Market 40 Interest Expense - Note Payable 3,500 Interest Expense - Revolving Credit 5,319 Interest Expense - Amortization of Debt Set-Up 1,000 Income Tax Provision 10,484 Totals $ 1,038,134 $ 1,038,134

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts