Question: Fi s Homework: Homework 1 Question list D Question 37 A Question 37, P7-4 (similar to) Part 1 of 14 HW Score: 88.41%,88.41 of 100

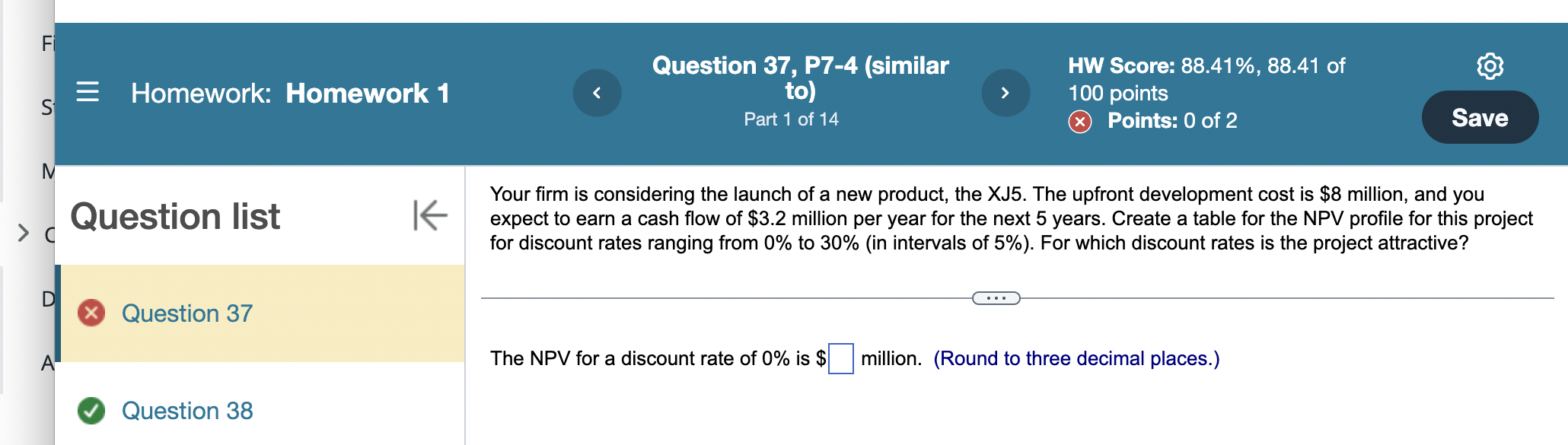

Fi s Homework: Homework 1 Question list D Question 37 A Question 37, P7-4 (similar to) Part 1 of 14 HW Score: 88.41%,88.41 of 100 points Points: 0 of 2 Save Your firm is considering the launch of a new product, the XJ5. The upfront development cost is $8 million, and you expect to earn a cash flow of $3.2 million per year for the next 5 years. Create a table for the NPV profile for this project for discount rates ranging from 0% to 30% (in intervals of 5% ). For which discount rates is the project attractive? The NPV for a discount rate of 0% is $ million. (Round to three decimal places.) Question 38

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts