Question: fiance problem solving and answer please Copy Format Painter 8 Merge & Center-5 . % , .g Condit Formatt | u,. 5-A- Number Font Clipboard

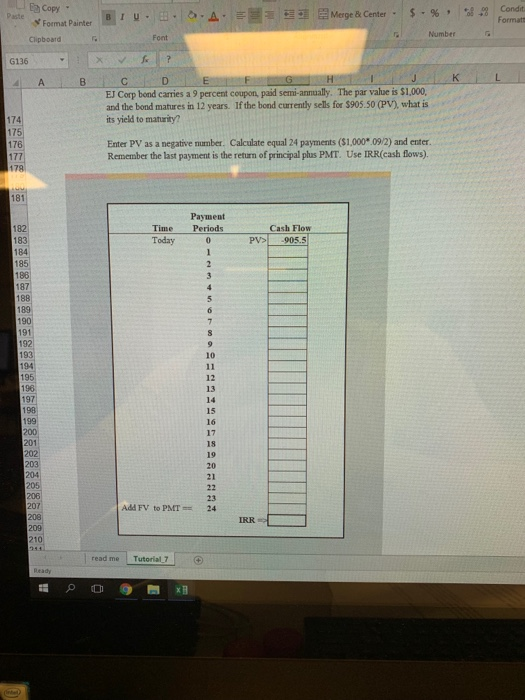

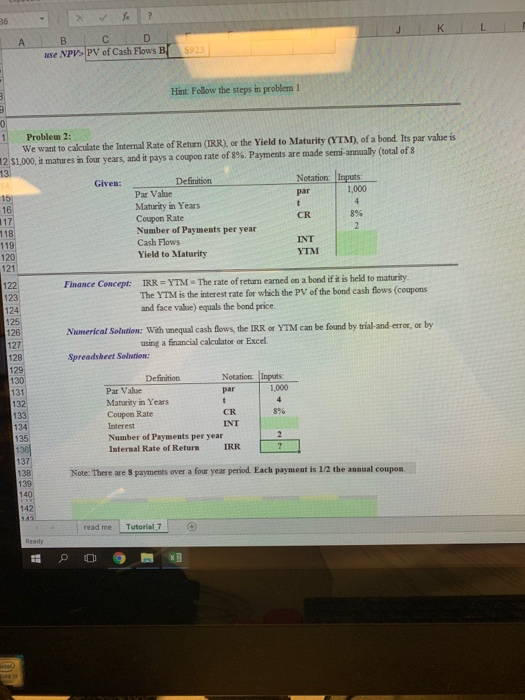

Copy Format Painter 8 Merge & Center-5 . % , .g Condit Formatt | u,. 5-A- Number Font Clipboard G136 4 A EJ Corp bond carries a 9 percent coupon, paid semi-annually. The par value is $1,000, and the bond matures in 12 years. If the bond currently sells for $905.50 (PV), what is its yield to maturity? Enter PV as a negative number. Calculate equal 24 payments ($1,000* 09/2) and enter Remember the last payment is the return of principal plus PMT. Use IRR(cash flows). Payment TimePeriods Today Cash Flow PV -905.5 16 Add FV to PMT24 IRR read me Tutorial 7 36 nse NPV> PV of Cash Flows Hint: Follow the steps in problem 1 1Problem 2: We want to calculate the Internal Rate of Return (IRR) or the Yield to Maturity (YTMD, of a bond. Its par value is 2S 1,000, it matures n four years, and it pays a coupon rate of 8%. Payments are made semi-annualy (total of 8 Notation inputs. 1,000 Given: Definition Par Value Maturity in Years Coupon Rate Number of Payments per year Cash Flows Yield to Maturity 16 CR 8% 118 INT YTM 121 Finance Concep: IRR-YTM The rate of return eaned on a bond if i is held to maturity The YTMM is the interest rate for which the PV of the bond cash flows (coupons and face value) equals the bond price. Numerical Solution: With unequal cash Bows, the IRR or YTM can be found by trial-and error, or by 127 128 using a financial calculator or Excel Spreadsheet Solntion: Definition Notation Inputs par Par Value Maturity in Years Coupon Rate Interest Number of Payments per year Internal Rate of Returs IRR CR INT 2 37 Note: There are 8 payments over a four year period. Each payment is 1/2 the annual coupon. 142 read me Tutorial 7

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts