Question: Fields & Company expects its EBIT to be $95,000 every year forever. The company can borrow at 8 percent. The company currently has no debt

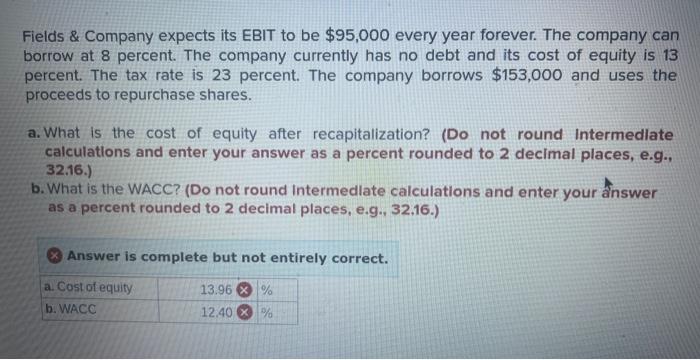

Fields \& Company expects its EBIT to be $95,000 every year forever. The company can borrow at 8 percent. The company currently has no debt and its cost of equity is 13 percent. The tax rate is 23 percent. The company borrows $153,000 and uses the proceeds to repurchase shares. a. What is the cost of equity after recapitalization? (Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.) b. What is the WACC? (Do not round Intermedlate calculations and enter your nswer as a percent rounded to 2 decimal places, e.g., 32.16.) Answer is complete but not entirely correct

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts