Question: FIEW tay in Protected View. Enable Editing Question 2 (15 Marks): The Managing director of Tita Co has asked you to prepare the statement of

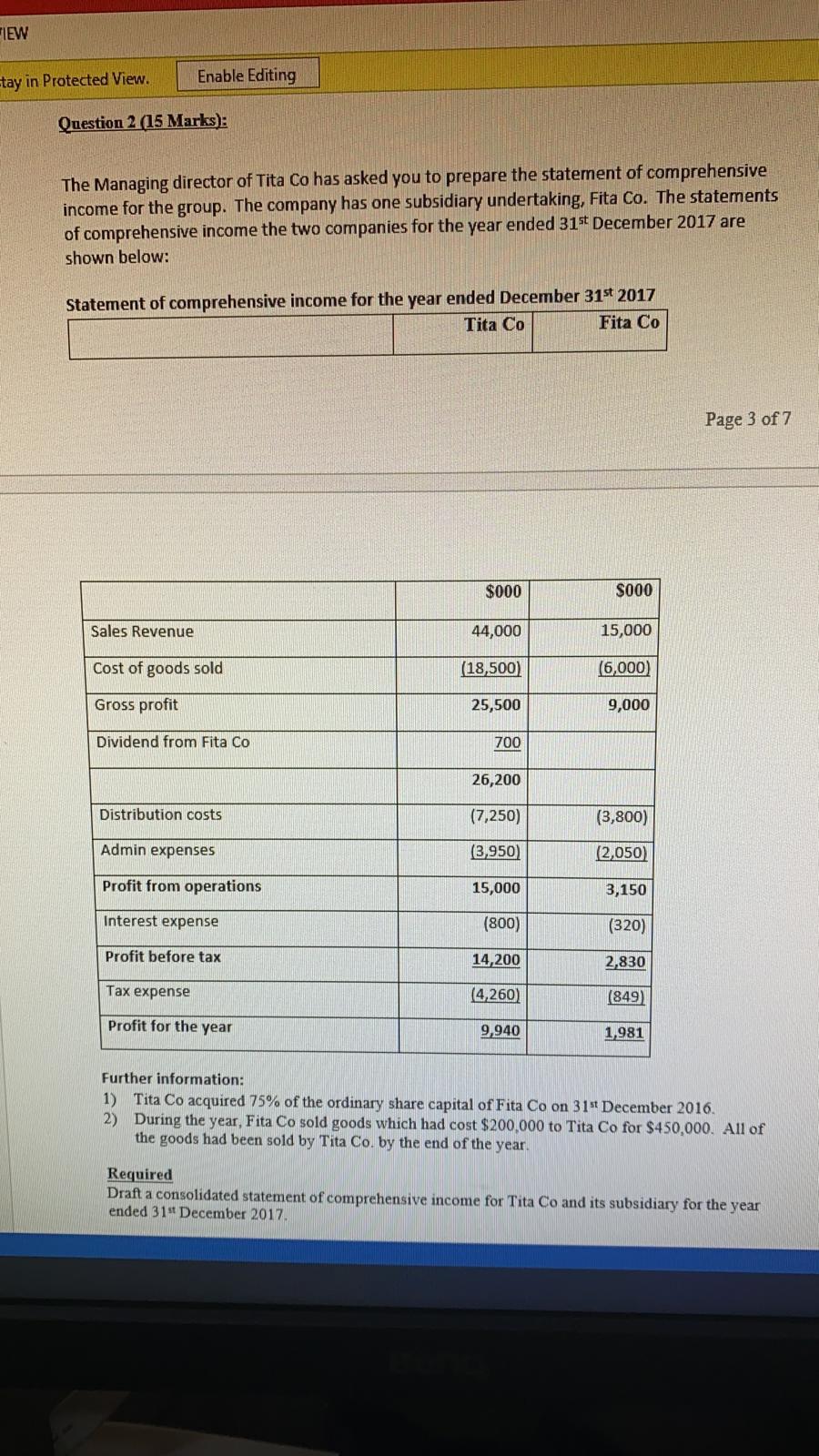

FIEW tay in Protected View. Enable Editing Question 2 (15 Marks): The Managing director of Tita Co has asked you to prepare the statement of comprehensive income for the group. The company has one subsidiary undertaking, Fita Co. The statements of comprehensive income the two companies for the year ended 31st December 2017 are shown below: Statement of comprehensive income for the year ended December 31st 2017 Tita Co Fita Co Page 3 of 7 $000 S000 Sales Revenue 44,000 15,000 Cost of goods sold (18,500) (6,000) Gross profit 25,500 9,000 Dividend from Fita Co 700 26,200 Distribution costs (7,250) (3,800) Admin expenses (3,950) (2,050) Profit from operations 15,000 3,150 Interest expense (800) (320) Profit before tax 14,200 2,830 Tax expense (4,260) (849) Profit for the year 9,940 1,981 Further information: 1) Tita Co acquired 75% of the ordinary share capital of Fita Co on 31st December 2016. 2) During the year, Fita Co sold goods which had cost $200,000 to Tita Co for $450,000. All of the goods had been sold by Tita Co. by the end of the year. Required Draft a consolidated statement of comprehensive income for Tita Co and its subsidiary for the year ended 31st December 2017

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts