Question: FIFO Method, Single Department Analysis, One Cost Category Hatch Company produces a product that passes through three processes: Fabrication, Assembly, and Finishing. All manufacturing costs

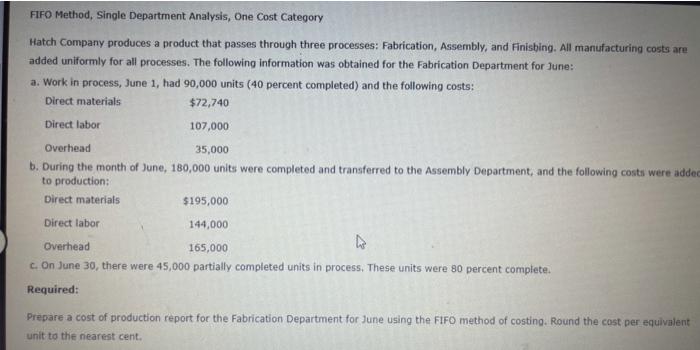

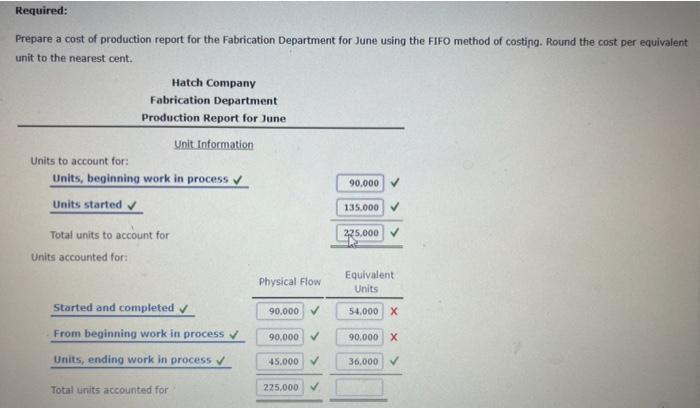

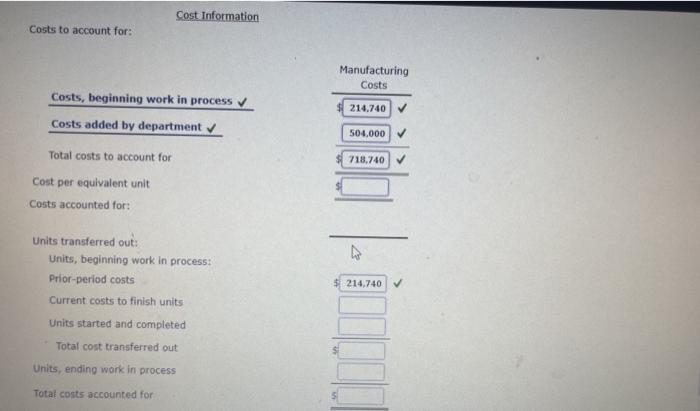

FIFO Method, Single Department Analysis, One Cost Category Hatch Company produces a product that passes through three processes: Fabrication, Assembly, and Finishing. All manufacturing costs are added uniformly for all processes. The following information was obtained for the Fabrication Department for June: a. Work in process, June 1, had 90,000 units (40 percent completed) and the following costs: Direct materials $72,740 Direct labor 107,000 Overhead 35,000 b. During the month of June, 180,000 units were completed and transferred to the Assembly Department, and the following costs were added to production: Direct materials $195,000 Direct labor 144,000 Overhead 165,000 c. On June 30, there were 45,000 partially completed units in process. These units were 80 percent complete. Required: Prepare a cost of production report for the Fabrication Department for June using the FIFO method of costing. Round the cost per equivalent unit to the nearest cent. Required: Prepare a cost of production report for the Fabrication Department for June using the FIFO method of costing. Round the cost per equivalent unit to the nearest cent Hatch Company Fabrication Department Production Report for June Unit Information Units to account for: Units, beginning work in process 90,000 , Units started 135.000 Total units to account for 225,000 Units accounted for Physical Flow Equivalent Units Started and completed 90.000 54,000 X From beginning work in process 90 000 90.000 X Units, ending work in process 45.000 36.000 Total units accounted for 225.000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts