Question: (FIFO: Process cost summary; equivalent units; cost estimates) Tamar Co. manufactures a single product in one department. All direct materials are added at the beginning

(FIFO: Process cost summary; equivalent units; cost estimates)

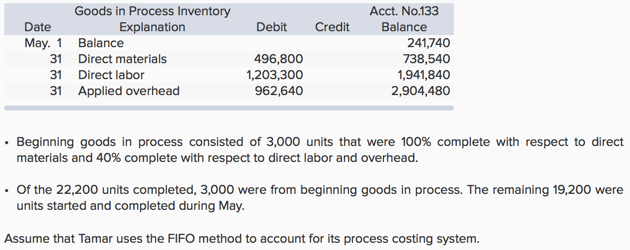

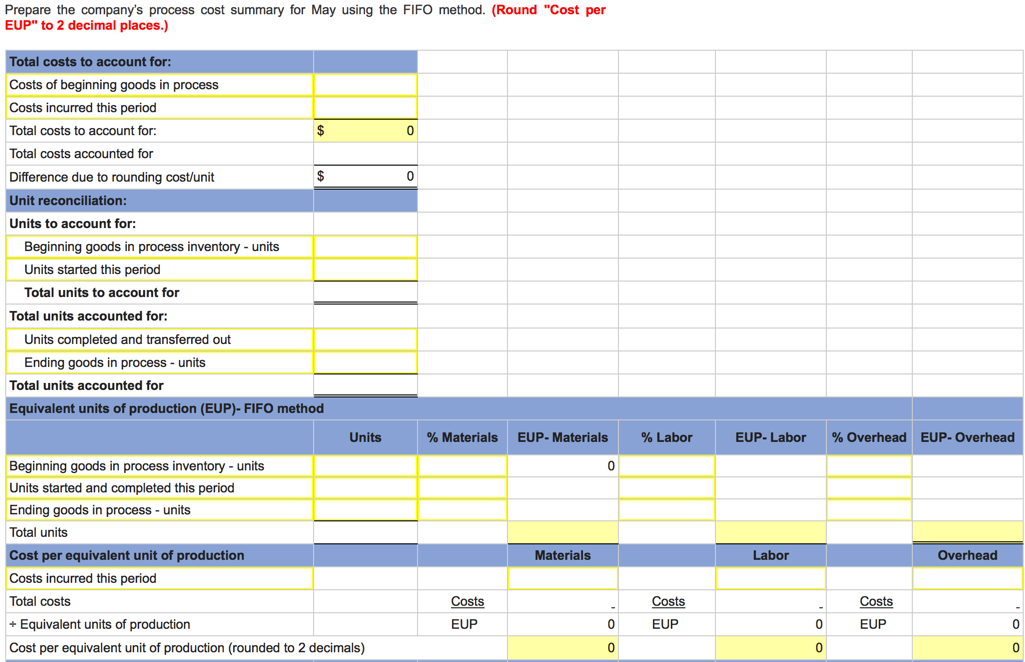

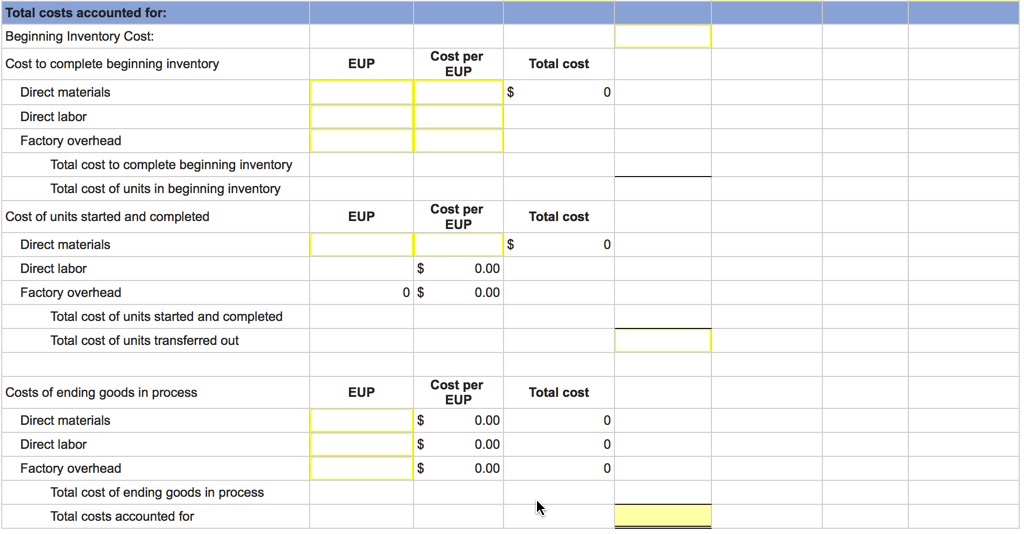

Tamar Co. manufactures a single product in one department. All direct materials are added at the beginning of the manufacturing process. Direct labor and overhead are added evenly throughout the process. The company uses monthly reporting periods for its weighted-average process cost accounting. During May, the company completed and transferred 22,200 units of product to finished goods inventory. Its 3,000 units of beginning goods in process consisted of $19,800 of direct materials, $123,300 of direct labor, and $98,640 of factory overhead. It has 2,400 units (100% complete with respect to direct materials and 80% complete with respect to direct labor and overhead) in process at month-end. After entries to record direct materials, direct labor, and overhead for May, the companys Goods in Process Inventory account follows.

Goods in Process Inventory Explanation Acct. No.133 Balance Debit Credit 496,800 962,640 May. 1 Balance 31 Direct materials 31 Direct labor 1 Applied overhead 241,740 738,540 1,941,840 2,904,480 1,203,300 Beginning goods in process consisted of 3,000 units that were 100% complete with respect to direct materials and 40% complete with respect to direct labor and overhead. Of the 22,200 units completed, 3,000 were from beginning goods in process. The remaining 19,200 were units started and completed during May Assume that Tamar uses the FIFO method to account for its process costing system

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts