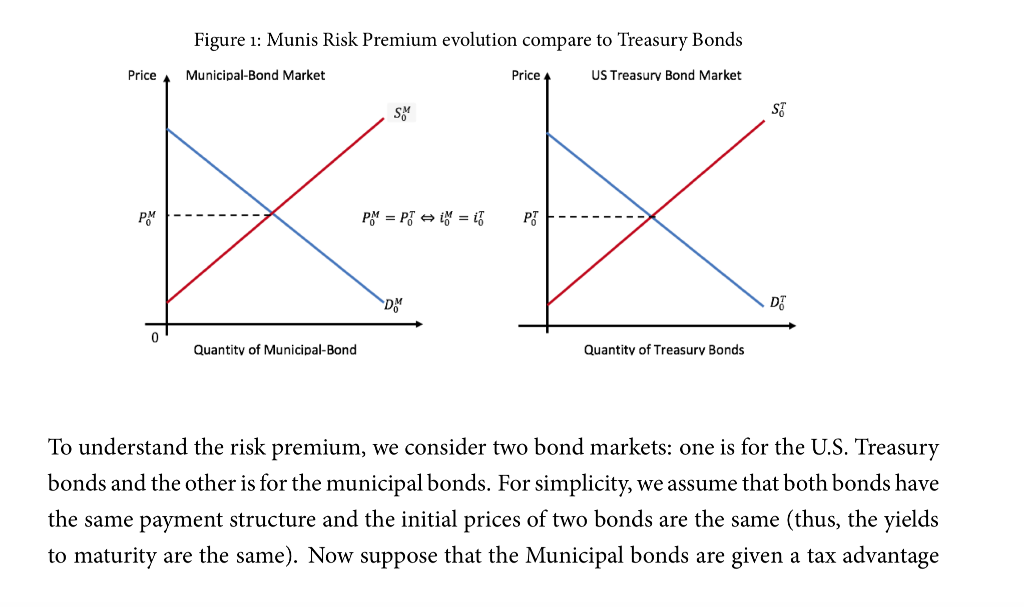

Question: Figure 1: Munis Risk Premium evolution compare to Treasury Bonds Price Municipal-Bond Market Price US Treasury Bond Market S6 DM I-_ DT Quantitv of Municipal-Bond

Figure 1: Munis Risk Premium evolution compare to Treasury Bonds Price Municipal-Bond Market Price US Treasury Bond Market S6 DM I-_ DT Quantitv of Municipal-Bond Quantitv of Treasurv Bonds To understand the risk premium, we consider two bond markets: one is for the U.S. Treasury bonds and the other is for the municipal bonds. For simplicity, we assume that both bonds have the same payment structure and the initial prices of two bonds are the same (thus, the yields to maturity are the same). Now suppose that the Municipal bonds are given a tax advantage Figure 1: Munis Risk Premium evolution compare to Treasury Bonds Price Municipal-Bond Market Price US Treasury Bond Market S6 DM I-_ DT Quantitv of Municipal-Bond Quantitv of Treasurv Bonds To understand the risk premium, we consider two bond markets: one is for the U.S. Treasury bonds and the other is for the municipal bonds. For simplicity, we assume that both bonds have the same payment structure and the initial prices of two bonds are the same (thus, the yields to maturity are the same). Now suppose that the Municipal bonds are given a tax advantage

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts