Question: Figure 3 . 8 1 1 c Reserved for future use You MUST complete all three pages of Form 9 4 1 and SIGN it

Figure c Reserved for future use

You MUST complete all three pages of Form and SIGN it

For Privacy Act and Paperwork Reduction Act Notice, see the back of the Payment Voucher. c Reserved for future use

You MUST complete all three pages of Form and SIGN it

For Privacy Act and Paperwork Reduction Act Notice, see the back of the Payment Voucher. Read the separate instructions before you complete Form Type or print within the boxes.

Part : Answer these questions for this quarter.

Number of employees who received wages, tips, or other compensation for the pay period including:

Mar. Quarter June Quarter Sept. Quarter or Dec. Quarter

Wages, tips, and other compensation

Federal income tax withheld from wages, tips, and other compensation

If no wages, tips, and other compensation are subject to social security or Medicare tax

Check and go to line

Column

a Taxable social security wages

Column

Sa i Qualified sick leave wages

a ii Qualified family leave wages

b Taxable social security tips.

c Taxable Medicare wages & tips

d Taxable wages & tips subject to

Additional Medicare Tax withholding

e Total social security and Medicare taxes. Add Column from lines aa and ddotsdots.

Section q Notice and DemandTax due on unreported tips see instructions

Total taxes before adjustments. Add lines e and

Current quarter's adjustment for fractions of cents

current quarter's adjustment for sick pay

Current quarter's adjustments for tips and groupterm life insurance dotsdotsdotsdotsdotsdotsdotsdotsdots.

a qualified small business payroll tax credit for increasing research activities. Attach Form a

b Nonrefundable portion of credit for qualified sick and family leave wages for leave taken before

April b c Reserved for future use

You MUST complete all three pages of Form and SIGN it

For Privacy Act and Paperwork Reduction Act Notice, see the back of the Payment Voucher. Balance due. If line is more than line g enter the difference and see instructions

Overpayment. If line g is more than line enter the difference

Check one: Apply to next return. Send a refund.

Page

Form Rev

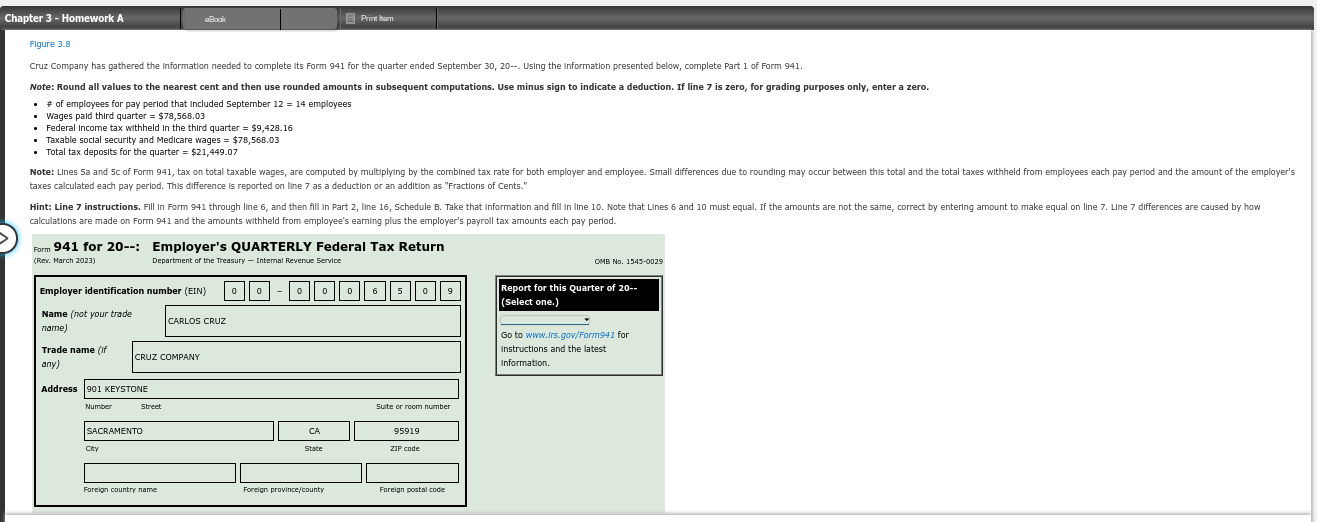

Cruz Company has gathered the information needed to complete its Form for the quarter ended September Using the information presented below, complete Part of Form

# of employees for pay perlod that Included September employees

Wages pald third quarter $

Federal income tax withheld in the third quarter $

Taxable soclal security and Medicare wages $

Total tax deposits for the quarter $

taxes calculated each pay period. This difference is reported on line as a deduction or an addition as "Fractions of Cents."

calculations are made on Form and the amounts withheld from employee's earning plus the employer's payroll tax amounts each pay perlod.

Form for : Employer's QUARTERLY Federal Tax Return

Rev March

OMB No

Report for this Quarter of

Select one.

Go to

wwwirs.govForm for

Instructions and the latest

information.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock