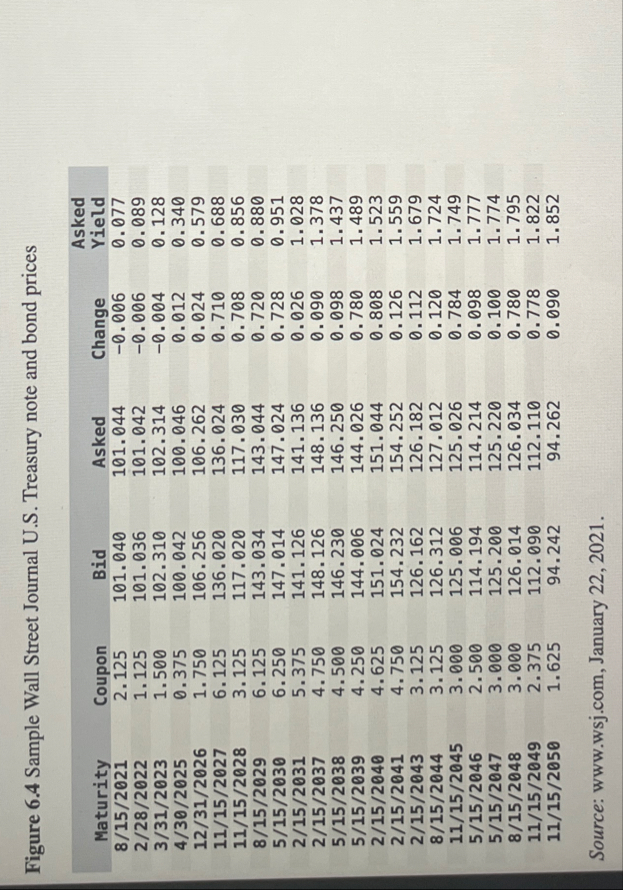

Question: Figure 6 . 4 Sample Wall Street Journal U . S . Treasury note and bond prices table [ [ Maturity , Coupon,Bid,Asked,Change,Asked Yield

Figure Sample Wall Street Journal US Treasury note and bond prices

tableMaturityCoupon,Bid,Asked,Change,Asked Yield

Source:

wwwwsjcom, January

Locate the Treasury bond in:Figure : maturing in February Assume a $ par value.

a Is this a premium or discount bond?

b What is its current yield?

Note: Do not round intermediate calculations and enter your answer as a percent rounded to decimal places, eg

c What is its yield to maturity?

Note: Do not round intermediate calculations and enter your answer as a percent rounded to decimal places, eg

d What is the bidask spread in dollars?

Note: Do not round intermediate calculations and round your answer to decimal places, eg

tablea PremiumDiscountb Current yield,,

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock