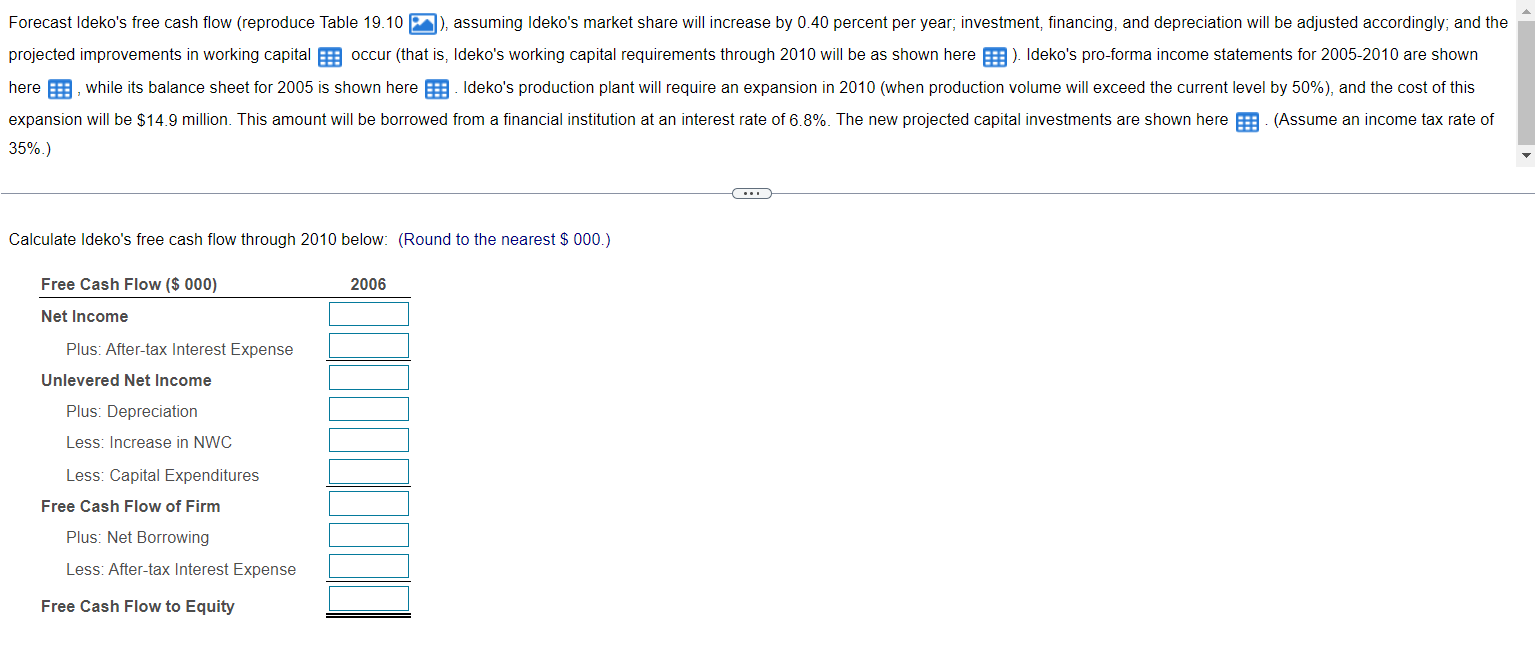

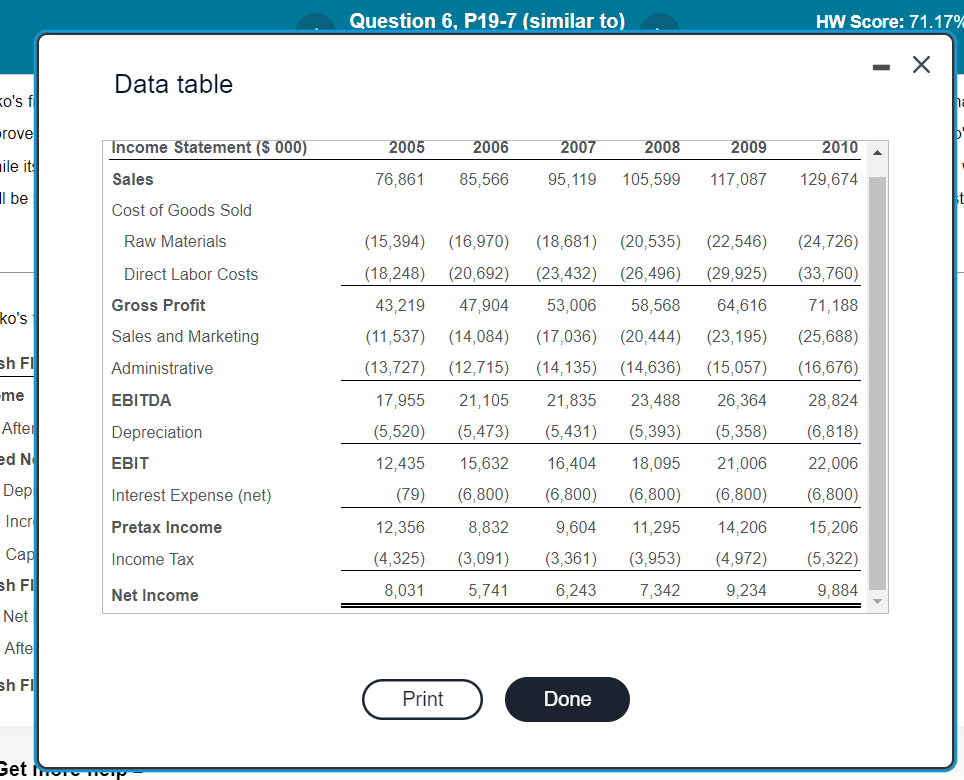

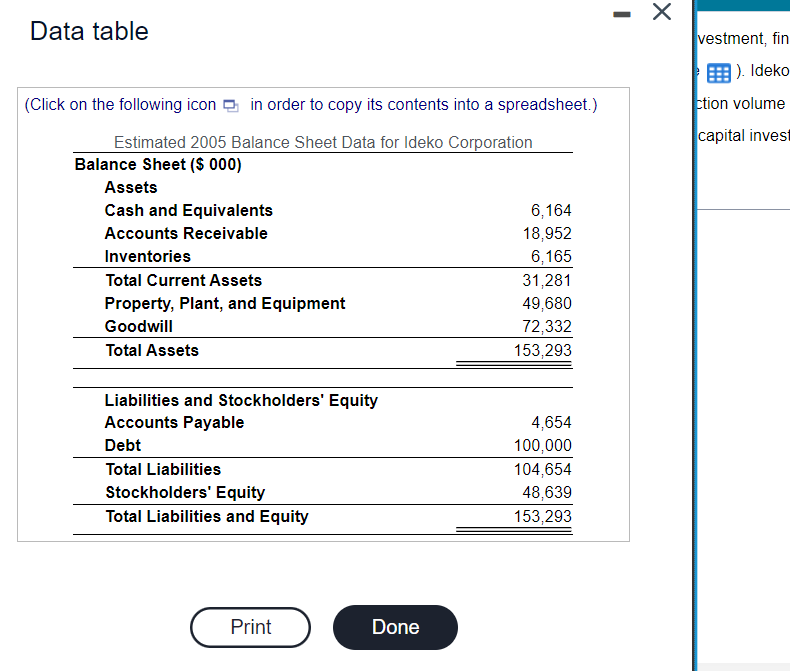

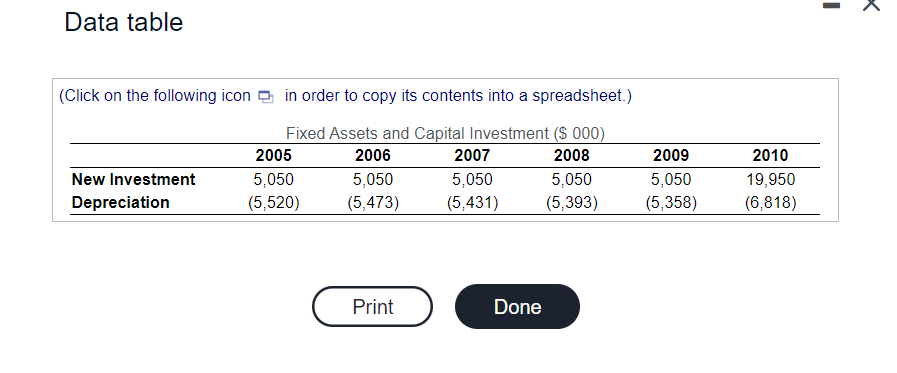

Question: Figure ). Ideko's pr TABLE 19.10 Ideko's Free Cash Flow Forecast SPREADSHEET Data table vestment, fin ). Ideko (Click on the following icon in order

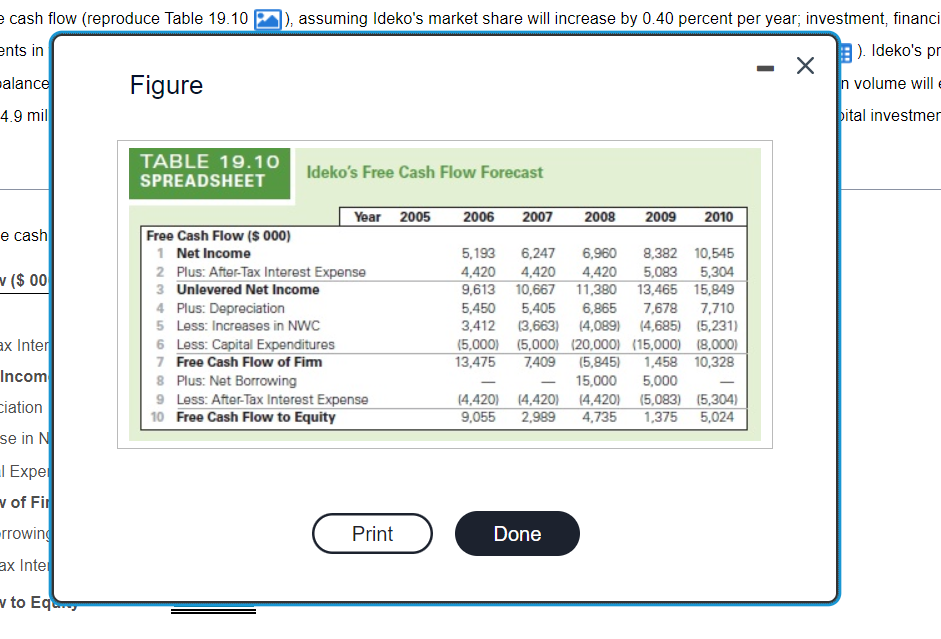

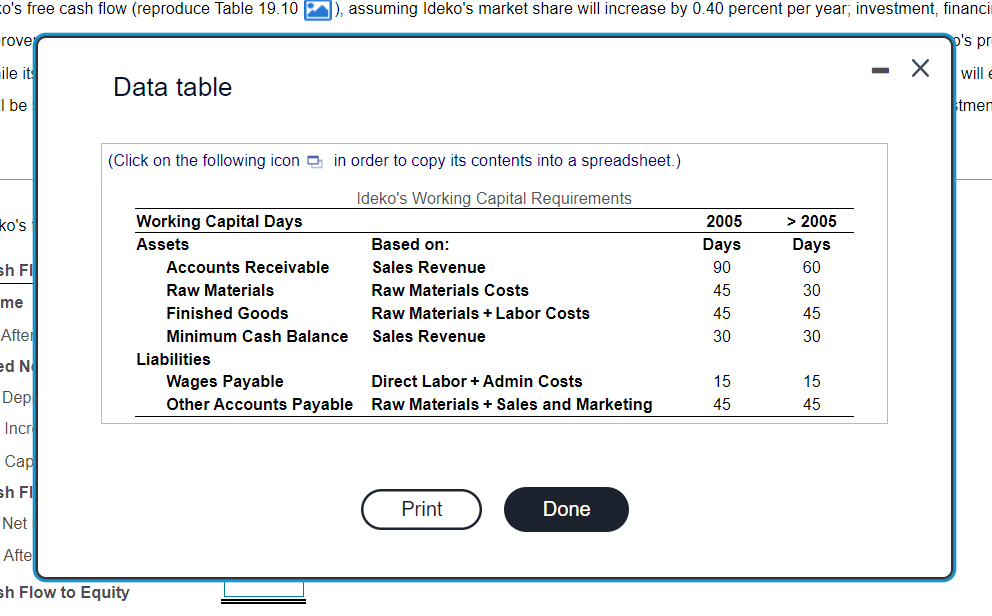

Figure ). Ideko's pr TABLE 19.10 Ideko's Free Cash Flow Forecast SPREADSHEET Data table vestment, fin ). Ideko (Click on the following icon in order to copy its contents into a spreadsheet.) ction volume capital inves Forecast Ideko's free cash flow (reproduce Table 19.10 ), assuming Ideko's market share will increase by 0.40 percent per year; investment, financing, and depreciation will be adjusted accordingly; and the projected improvements in working capital occur (that is, Ideko's working capital requirements through 2010 will be as shown here ). Ideko's pro-forma income statements for 2005-2010 are shown here while its balance sheet for 2005 is shown here . Ideko's production plant will require an expansion in 2010 (when production volume will exceed the current level by 50% ), and the cost of this expansion will be $14.9 million. This amount will be borrowed from a financial institution at an interest rate of 6.8%. The new projected capital investments are shown here (Assume an income tax rate of 35%.) Calculate Ideko's free cash flow through 2010 below: (Round to the nearest $000.) Data table (Click on the following icon in order to copy its contents into a spreadsheet.) Data table (Click on the following icon in order to copy its contents into a spreadsheet.) Data table Data table Figure ). Ideko's pr TABLE 19.10 Ideko's Free Cash Flow Forecast SPREADSHEET Data table vestment, fin ). Ideko (Click on the following icon in order to copy its contents into a spreadsheet.) ction volume capital inves Forecast Ideko's free cash flow (reproduce Table 19.10 ), assuming Ideko's market share will increase by 0.40 percent per year; investment, financing, and depreciation will be adjusted accordingly; and the projected improvements in working capital occur (that is, Ideko's working capital requirements through 2010 will be as shown here ). Ideko's pro-forma income statements for 2005-2010 are shown here while its balance sheet for 2005 is shown here . Ideko's production plant will require an expansion in 2010 (when production volume will exceed the current level by 50% ), and the cost of this expansion will be $14.9 million. This amount will be borrowed from a financial institution at an interest rate of 6.8%. The new projected capital investments are shown here (Assume an income tax rate of 35%.) Calculate Ideko's free cash flow through 2010 below: (Round to the nearest $000.) Data table (Click on the following icon in order to copy its contents into a spreadsheet.) Data table (Click on the following icon in order to copy its contents into a spreadsheet.) Data table Data table

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts