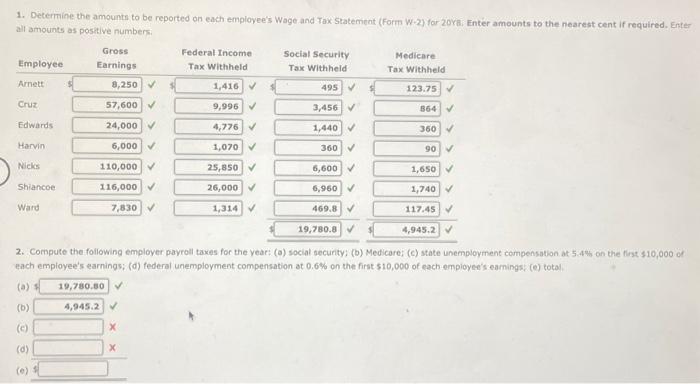

Question: figure out (c) , (d) , and (e) 1. Determine the amounts to be reported on each employee's Wage and Tax Statement (Form W-2) for

1. Determine the amounts to be reported on each employee's Wage and Tax Statement (Form W-2) for 20 kai Enter amounts to the nearest cent if required. Enter all amounts as positive numbers. 2. Compute the following employer payroll taxes for the vear: (o) social security; (b) Medicare; (c) state unemployment compensation at 5.4% - on the first $10,000 of each empioyee's earnings; (d) federal unemployment compensation at 0.6% on the first $10,000 of each empioyee's earnings; (e) total, (a) 1 (b) (c) (d) x x x x (e)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts