Question: Figure out the implied share price based on the DCF valuation. Use the WACC of 10% and long-term growth rate of 4%. Please show a

Figure out the implied share price based on the DCF valuation. Use the WACC of 10% and long-term growth rate of 4%. Please show a step by step process.

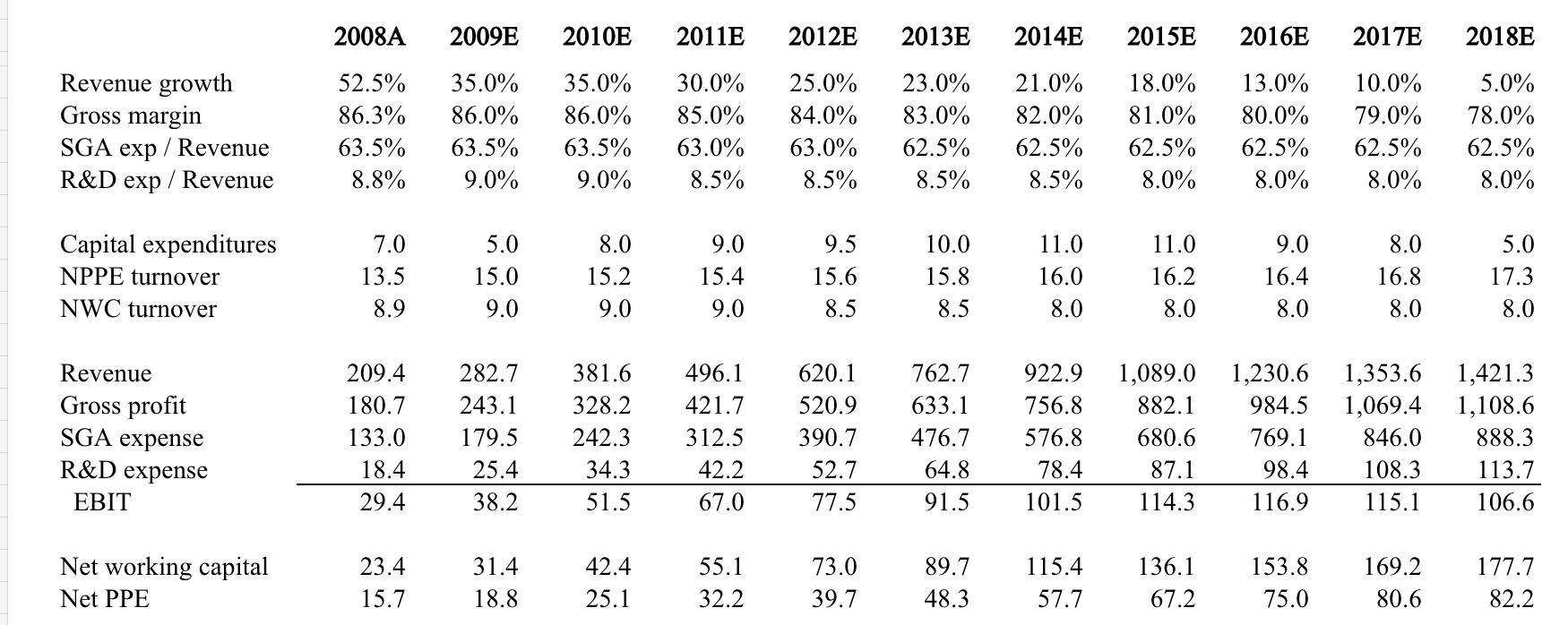

Revenue growth Gross margin SGA exp/ Revenue R&D exp / Revenue Capital expenditures NPPE turnover NWC turnover Revenue Gross profit SGA expense R&D expense EBIT Net working capital Net PPE 2008A 2009E 2010E 2011E 52.5% 35.0% 35.0% 30.0% 25.0% 23.0% 21.0% 86.3% 86.0% 86.0% 85.0% 84.0% 83.0% 82.0% 63.5% 63.5% 63.5% 63.0% 63.0% 62.5% 62.5% 9.0% 9.0% 8.5% 8.5% 8.8% 8.5% 8.5% 7.0 13.5 8.9 209.4 180.7 133.0 18.4 29.4 23.4 15.7 5.0 15.0 9.0 282.7 243.1 179.5 25.4 38.2 31.4 18.8 8.0 15.2 9.0 381.6 328.2 242.3 34.3 51.5 42.4 25.1 9.0 15.4 9.0 496.1 421.7 312.5 42.2 67.0 55.1 32.2 2012E 2013E 2014E 2015E 2016E 2017E 2018E 10.0% 5.0% 18.0% 13.0% 81.0% 80.0% 79.0% 78.0% 62.5% 62.5% 62.5% 62.5% 8.0% 8.0% 8.0% 8.0% 9.5 15.6 8.5 620.1 762.7 520.9 633.1 390.7 476.7 64.8 91.5 52.7 77.5 10.0 15.8 8.5 73.0 39.7 89.7 48.3 11.0 16.0 8.0 11.0 16.2 8.0 922.9 756.8 882.1 576.8 680.6 78.4 87.1 101.5 114.3 9.0 16.4 8.0 1,089.0 1,230.6 1,353.6 984.5 1,069.4 769.1 846.0 98.4 108.3 116.9 115.1 115.4 136.1 57.7 67.2 8.0 16.8 8.0 153.8 75.0 169.2 80.6 5.0 17.3 8.0 1,421.3 1,108.6 888.3 113.7 106.6 177.7 82.2

Step by Step Solution

There are 3 Steps involved in it

Answer To calculate the implied share price based on the DCF valuation using the WACC of 10 and longterm growth rate of 4 we need to follow these steps Step 1 Calculate the terminal value using the Go... View full answer

Get step-by-step solutions from verified subject matter experts