Question: Figure out this simulation problems following the instructions. Include a screenshot of excel better Important notes: For full credit, answers must be based on the

Figure out this simulation problems following the instructions. Include a screenshot of excel better

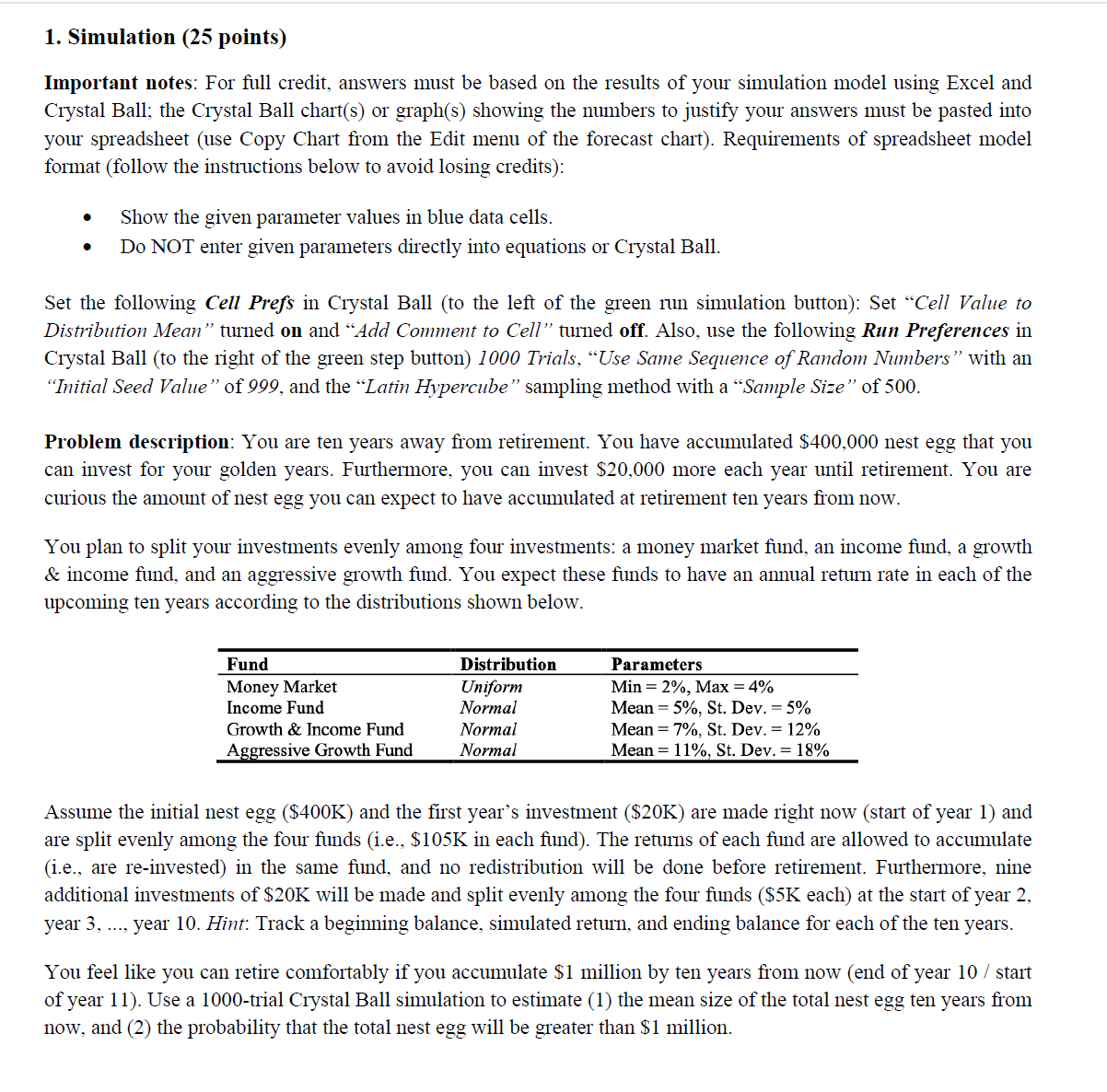

Important notes: For full credit, answers must be based on the results of your simulation model using Excel and Crystal Ball; the Crystal Ball chart(s) or graph(s) showing the numbers to justify your answers must be pasted into your spreadsheet (use Copy Chart from the Edit menu of the forecast chart). Requirements of spreadsheet model format (follow the instructions below to avoid losing credits): - Show the given parameter values in blue data cells. - Do NOT enter given parameters directly into equations or Crystal Ball. Set the following Cell Prefs in Crystal Ball (to the left of the green run simulation button): Set "Cell Value to Distribution Mean" turned on and "Add Comment to Cell" turned off. Also, use the following Run Preferences in Crystal Ball (to the right of the green step button) 1000 Trials, "Use Same Sequence of Random Numbers" with an "Initial Seed Value" of 999, and the "Latin Hypercube" sampling method with a "Sample Size" of 500. Problem description: You are ten years away from retirement. You have accumulated $400,000 nest egg that you can invest for your golden years. Furthermore, you can invest $20,000 more each year until retirement. You are curious the amount of nest egg you can expect to have accumulated at retirement ten years from now. You plan to split your investments evenly among four investments: a money market fund, an income fund, a growth \& income fund, and an aggressive growth fund. You expect these funds to have an annual return rate in each of the upcoming ten years according to the distributions shown below. Assume the initial nest egg ($400K) and the first year's investment ($20K) are made right now (start of year 1) and are split evenly among the four funds (i.e., $105K in each fund). The returns of each fund are allowed to accumulate (i.e., are re-invested) in the same fund, and no redistribution will be done before retirement. Furthermore, nine additional investments of $20K will be made and split evenly among the four funds ( $5K each) at the start of year 2 , year 3,, year 10. Hint: Track a beginning balance, simulated return, and ending balance for each of the ten years. You feel like you can retire comfortably if you accumulate \$1 million by ten years from now (end of year 10 / start of year 11). Use a 1000-trial Crystal Ball simulation to estimate (1) the mean size of the total nest egg ten years from now, and (2) the probability that the total nest egg will be greater than $1 million

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts