Question: File Home Insert Cur Pose Copy - General wap Text Merge Center D E Autosum- Page Layout Formulas Data Review View Help Calitri 11 AA

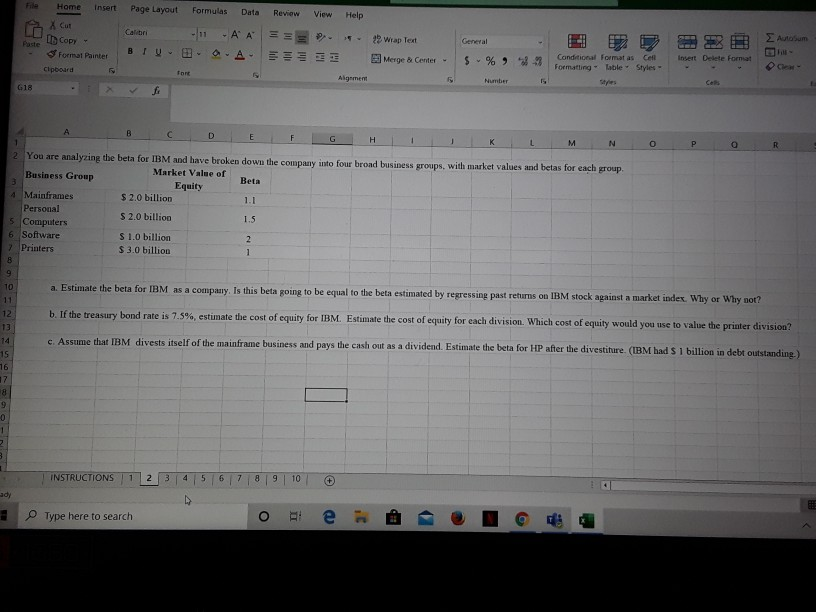

File Home Insert Cur Pose Copy - General wap Text Merge Center D E Autosum- Page Layout Formulas Data Review View Help Calitri 11 AA == . A EEEE fort Algement fo Format Painter B Cipboard . A Conditional Formats Formatting - Lable - Styles - 3 Insert Delete Format - O- 618 B C D E F G H I K L M N O P o R 2 You are analyzing the beta for IBM and have broken down the company into four broad business groups, with market values and betas for each group Business Group Market Value of Beta Equity Mainframes $ 2.0 billion Personal S 2.0 billion 1.5 Computers 6 Software $ 1.0 billion 7 Printers $ 3.0 billion 10 a. Estimate the beta for IBM as a company. Is this beta going to be equal to the beta estimated by regressing past returns on IBM stock against a market index. Why or Why not? b. If the treasury bond rate is 7.5%, estimate the cost of equity for IBM. Estimate the cost of equity for each division. Which cost of equity would you use to value the printer division? E- c. Assume that IBM divests itself of the mainframe business and pays the cash out as a dividend. Estimate the beta for HP after the divestiture. (IBM had s 1 billion in debt outstandine INSTRUCTIONS 1 2 3 4 5 6 7 8 9 10 ady Type here to search e . File Home Insert Cur Pose Copy - General wap Text Merge Center D E Autosum- Page Layout Formulas Data Review View Help Calitri 11 AA == . A EEEE fort Algement fo Format Painter B Cipboard . A Conditional Formats Formatting - Lable - Styles - 3 Insert Delete Format - O- 618 B C D E F G H I K L M N O P o R 2 You are analyzing the beta for IBM and have broken down the company into four broad business groups, with market values and betas for each group Business Group Market Value of Beta Equity Mainframes $ 2.0 billion Personal S 2.0 billion 1.5 Computers 6 Software $ 1.0 billion 7 Printers $ 3.0 billion 10 a. Estimate the beta for IBM as a company. Is this beta going to be equal to the beta estimated by regressing past returns on IBM stock against a market index. Why or Why not? b. If the treasury bond rate is 7.5%, estimate the cost of equity for IBM. Estimate the cost of equity for each division. Which cost of equity would you use to value the printer division? E- c. Assume that IBM divests itself of the mainframe business and pays the cash out as a dividend. Estimate the beta for HP after the divestiture. (IBM had s 1 billion in debt outstandine INSTRUCTIONS 1 2 3 4 5 6 7 8 9 10 ady Type here to search e

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts