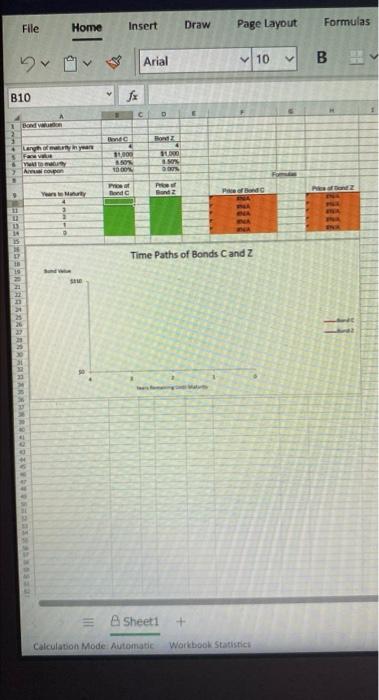

Question: File Home Insert Draw Formulas Page Layout v V Arial 10 B B10 fx C D 1 and 4 Length 4 11,000 50 HO 10

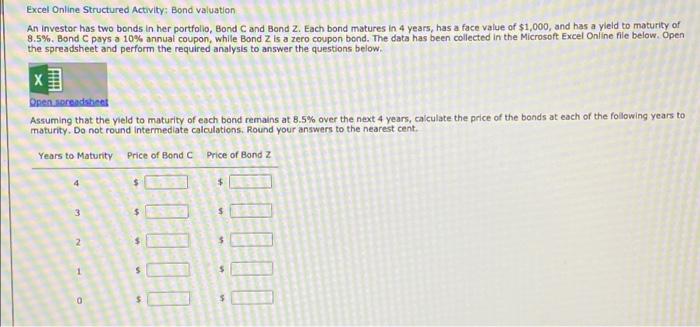

File Home Insert Draw Formulas Page Layout v V Arial 10 B B10 fx C D 1 and 4 Length 4 11,000 50 HO 10 Abon tant YM Band Bandz 11 Time Paths of Bonds Cand z w Sheet1 + Calculation Mode: Automatic Workbook Statistics Excel Online Structured Activity: Bond valuation An investor has two bonds in her portfolio, Bond C and Bond 2. Each bond matures in 4 years, has a face value of $1,000, and has a yleld to maturity of 8.5%. Bond C pays a 10% annual coupon, while Bond 2 is a zero coupon bond. The data has been collected in the Microsoft Excel Online file below. Open the spreadsheet and perform the required analysis to answer the questions below Open soreadsheet Assuming that the yield to maturity of each bond remains at 8.5% over the next 4 years, calculate the price of the bonds at each of the following years to maturity. Do not round Intermediate calculations. Round your answers to the nearest cent. Years to Maturity Price of Bond C Price of Bond z $ $ 3 $ 2 $ 1 $ 0 $ $

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts