Question: File Home Insert Draw Page Layout Formulas Data Review View Help Acrobat K17 D 1 Challenge 2 As International Cash Manager of US multinational firm

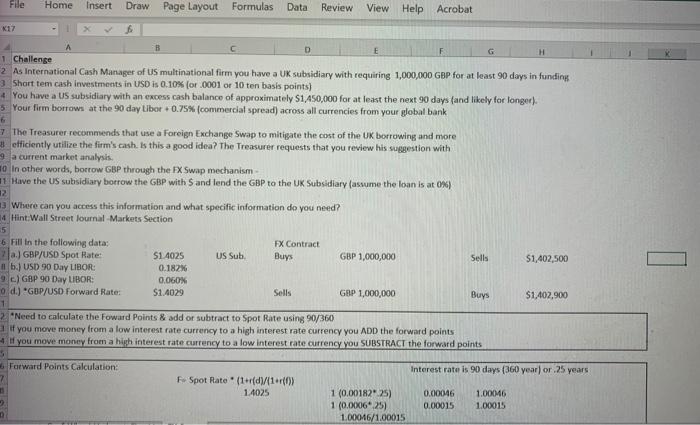

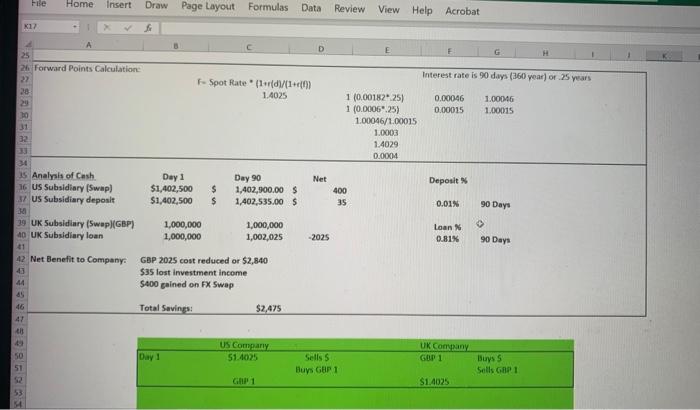

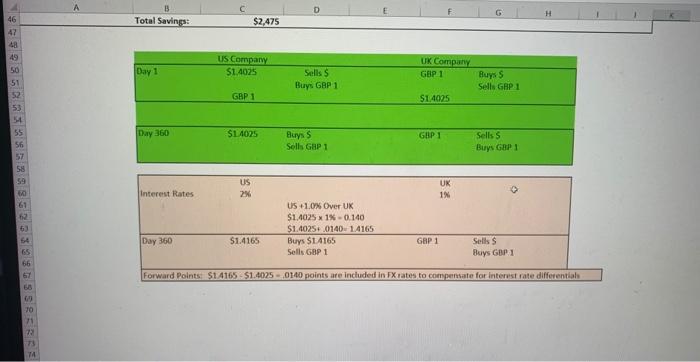

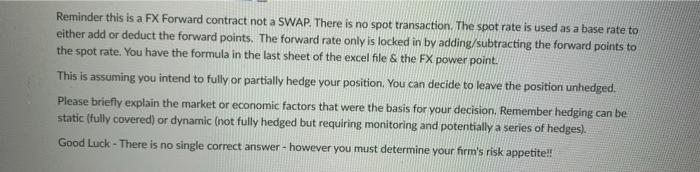

File Home Insert Draw Page Layout Formulas Data Review View Help Acrobat K17 D 1 Challenge 2 As International Cash Manager of US multinational firm you have a UK subsidiary with requiring 1,000,000 GBP for at least 90 days in funding 3 Short tem cash investments in USD is 0.10% (or .0001 or 10 ten basis points) 4 You have a US subsidiary with an excess cash balance of approximately $1,450,000 for at least the next 90 days (and likely for longer). 5 Your firm borrows at the 90 day Libor +0.75% (commercial spread) across all currencies from your global bank 6 7 The Treasurer recommends that use a Foreign Exchange Swap to mitigate the cost of the UK borrowing and more efficiently utilize the firm's cash. Is this a good idea? The Treasurer requests that you review his suggestion with 9 a current market analysis In other words, borrow GBP through the FX Swap mechanism 1 Have the US subsidiary borrow the GBP with Sand lend the GBP to the UK Subsidiary (assume the loan is at 0%) 12 13 Where can you access this information and what specific information do you need? 14 Hint Wall Street lournal Markets Section 5 6 Fill in the following data: FX Contract 2 a.) GBP/USD Spot Rate: 51.4025 US Sub Buys GBP 1,000,000 Sells $1,402, 500 b) USD 90 Day LIBOR: 0.1823 9. c) GBP 90 Day LIBOR: 0.060% d.) GOP/USD Forward Rate: $1.4029 Sells GBP 1,000,000 Buys $1,402,900 1 2. Need to calculate the Foward Points & add or subtract to Spot Rate using 90/360 if you move money from a low interest rate currency to a high interest rate currency you ADD the forward points 4. If you move money from a high interest rate currency to a low interest rate currency you SUBSTRACT the forward points Forward Points Calculation: Interest rate is 90 days (360 year) or 25 years F. Spot Rate (1r(d)/(1+r(0) 1.4025 1 (0.0018225) 1 (0.000625) 1.00046/1.00015 0.00046 0.00015 1.00046 1.00015 File Home Insert Draw Page Layout Formulas Data Review View Help Acrobat K17 Interest rate is 90 days (360 year) or 25 years 25 26 Forward Points Calculatione 22 28 20 20 31 32 - Spot Rate ( 11/11 1.4025 0.00046 0.00015 1.0006 1.00015 1 (0.0018225) 1 (0.0006".25) 1.00046/1.00015 1.0003 1.4029 0.0004 Net 34 35 Analysis of Cash 16 US Subsidiary (Swap) J/ US Subsidiary deposit Deposit Day 1 $1,402.500 $1,402.500 $ $ Day 90 1,402,900.00 $ 1,407,535.00 $ 400 35 0.01N 90 Days 39 UK Subsidiary (Swap (GBP) 40 UK Subsidiary loan 1,000,000 1,000,000 1,000,000 1,002,025 -2025 Loan 0.81% 90 Days 42 Net Benefit to Company GBP 2025 cost reduced or $2.840 $35 lost investment income $400 gained on FX Swap 44 Total Savings: $2,475 46 47 th US Company 51.4025 Day! UK Company GBP 1 50 51 Sells s Buys GOP 1 Bus 5 Sells GOP 1 $1.4025 53 D 46 Total Savings $2,475 US Company $1.4025 Day 1 Sells $ UK Company GBP 1 Ruyss Buys GBP 1 Sells GRP 1 GBP 1 $14025 48 49 50 51 32 53 5 55 56 57 58 Day 360 SL4025 GEP 1 Buys Sells GAP 1 Sells $ Buys GBP 1 US 23 UK IN Interest Rates 2 US +1.0% Over UK $1,4025 x 1% - 0.140 $1.402S+.0140. 14165 Buys $1.4165 Sells GBP 1 Day 360 $1.4165 GBP 1 Sells $ Buys GAP 1 65 66 67 Forward Points $14165 - $1.4025-0140 points are included in FXtates to compensate for Interest rate differential TO 71 72 75 74 Reminder this is a FX Forward contract not a SWAP.There is no spot transaction. The spot rate is used as a base rate to either add or deduct the forward points. The forward rate only is locked in by adding/subtracting the forward points to the spot rate. You have the formula in the last sheet of the excel file & the FX power point. This is assuming you intend to fully or partially hedge your position. You can decide to leave the position unhedged. Please briefly explain the market or economic factors that were the basis for your decision. Remember hedging can be static (fully covered) or dynamic (not fully hedged but requiring monitoring and potentially a series of hedges). Good Luck - There is no single correct answer - however you must determine your firm's risk appetite!! File Home Insert Draw Page Layout Formulas Data Review View Help Acrobat K17 D 1 Challenge 2 As International Cash Manager of US multinational firm you have a UK subsidiary with requiring 1,000,000 GBP for at least 90 days in funding 3 Short tem cash investments in USD is 0.10% (or .0001 or 10 ten basis points) 4 You have a US subsidiary with an excess cash balance of approximately $1,450,000 for at least the next 90 days (and likely for longer). 5 Your firm borrows at the 90 day Libor +0.75% (commercial spread) across all currencies from your global bank 6 7 The Treasurer recommends that use a Foreign Exchange Swap to mitigate the cost of the UK borrowing and more efficiently utilize the firm's cash. Is this a good idea? The Treasurer requests that you review his suggestion with 9 a current market analysis In other words, borrow GBP through the FX Swap mechanism 1 Have the US subsidiary borrow the GBP with Sand lend the GBP to the UK Subsidiary (assume the loan is at 0%) 12 13 Where can you access this information and what specific information do you need? 14 Hint Wall Street lournal Markets Section 5 6 Fill in the following data: FX Contract 2 a.) GBP/USD Spot Rate: 51.4025 US Sub Buys GBP 1,000,000 Sells $1,402, 500 b) USD 90 Day LIBOR: 0.1823 9. c) GBP 90 Day LIBOR: 0.060% d.) GOP/USD Forward Rate: $1.4029 Sells GBP 1,000,000 Buys $1,402,900 1 2. Need to calculate the Foward Points & add or subtract to Spot Rate using 90/360 if you move money from a low interest rate currency to a high interest rate currency you ADD the forward points 4. If you move money from a high interest rate currency to a low interest rate currency you SUBSTRACT the forward points Forward Points Calculation: Interest rate is 90 days (360 year) or 25 years F. Spot Rate (1r(d)/(1+r(0) 1.4025 1 (0.0018225) 1 (0.000625) 1.00046/1.00015 0.00046 0.00015 1.00046 1.00015 File Home Insert Draw Page Layout Formulas Data Review View Help Acrobat K17 Interest rate is 90 days (360 year) or 25 years 25 26 Forward Points Calculatione 22 28 20 20 31 32 - Spot Rate ( 11/11 1.4025 0.00046 0.00015 1.0006 1.00015 1 (0.0018225) 1 (0.0006".25) 1.00046/1.00015 1.0003 1.4029 0.0004 Net 34 35 Analysis of Cash 16 US Subsidiary (Swap) J/ US Subsidiary deposit Deposit Day 1 $1,402.500 $1,402.500 $ $ Day 90 1,402,900.00 $ 1,407,535.00 $ 400 35 0.01N 90 Days 39 UK Subsidiary (Swap (GBP) 40 UK Subsidiary loan 1,000,000 1,000,000 1,000,000 1,002,025 -2025 Loan 0.81% 90 Days 42 Net Benefit to Company GBP 2025 cost reduced or $2.840 $35 lost investment income $400 gained on FX Swap 44 Total Savings: $2,475 46 47 th US Company 51.4025 Day! UK Company GBP 1 50 51 Sells s Buys GOP 1 Bus 5 Sells GOP 1 $1.4025 53 D 46 Total Savings $2,475 US Company $1.4025 Day 1 Sells $ UK Company GBP 1 Ruyss Buys GBP 1 Sells GRP 1 GBP 1 $14025 48 49 50 51 32 53 5 55 56 57 58 Day 360 SL4025 GEP 1 Buys Sells GAP 1 Sells $ Buys GBP 1 US 23 UK IN Interest Rates 2 US +1.0% Over UK $1,4025 x 1% - 0.140 $1.402S+.0140. 14165 Buys $1.4165 Sells GBP 1 Day 360 $1.4165 GBP 1 Sells $ Buys GAP 1 65 66 67 Forward Points $14165 - $1.4025-0140 points are included in FXtates to compensate for Interest rate differential TO 71 72 75 74 Reminder this is a FX Forward contract not a SWAP.There is no spot transaction. The spot rate is used as a base rate to either add or deduct the forward points. The forward rate only is locked in by adding/subtracting the forward points to the spot rate. You have the formula in the last sheet of the excel file & the FX power point. This is assuming you intend to fully or partially hedge your position. You can decide to leave the position unhedged. Please briefly explain the market or economic factors that were the basis for your decision. Remember hedging can be static (fully covered) or dynamic (not fully hedged but requiring monitoring and potentially a series of hedges). Good Luck - There is no single correct answer - however you must determine your firm's risk appetite

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts