Question: File Home Insert Formulas Data Review View Help Open in Desktop App Tell me what you want to do & Editing Com hv Calibri v

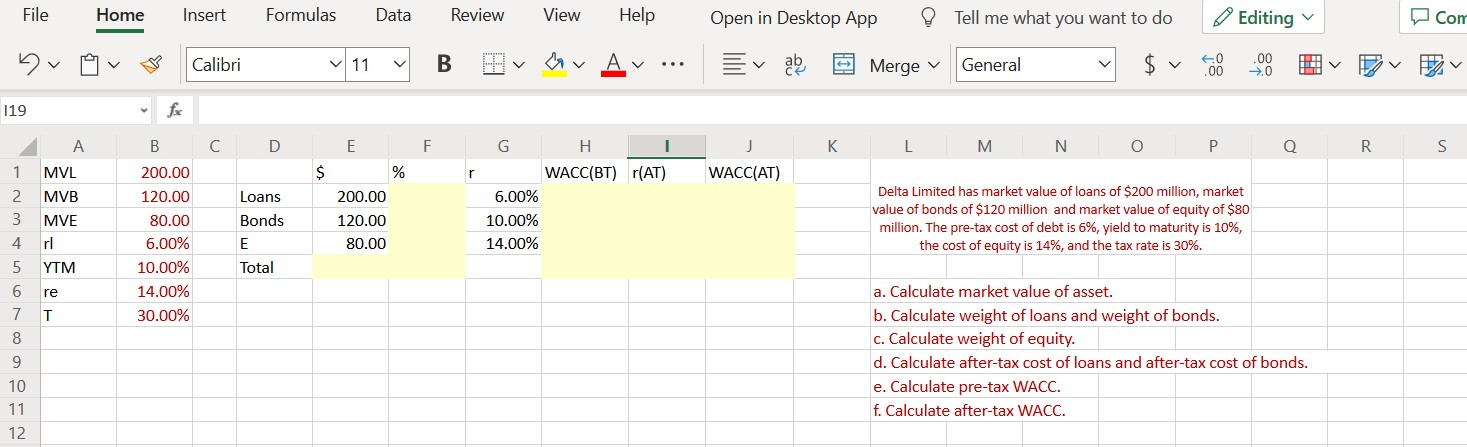

File Home Insert Formulas Data Review View Help Open in Desktop App Tell me what you want to do & Editing Com hv Calibri v 11 B A v V General Merge 60 .00 .00 0 UV 119 B C D F G H - K M N P m Q R S 1 $ % r WACC(BT) r(AT) WACC(AT) 2 3 MVL MVB MVE ri 200.00 120.00 80.00 6.00% 10.00% 14.00% 30.00% Loans Bonds E Total 200.00 120.00 80.00 6.00% 10.00% 14.00% Delta Limited has market value of loans of $200 million, market value of bonds of $120 million and market value of equity of $80 million. The pre-tax cost of debt is 6%, yield to maturity is 10%, the cost of equity is 14%, and the tax rate is 30%. 4 5 YTM 6 re 7 T 8 a. Calculate market value of asset. b. Calculate weight of loans and weight of bonds. c. Calculate weight of equity. d. Calculate after-tax cost of loans and after-tax cost of bonds. e. Calculate pre-tax WACC. f. Calculate after-tax WACC. 9 10 11 12

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts