Question: File Home Insert Page Layout Formulas Data Review View Help Comments Share Calibri v 11 = = AutoSum General ab Wrap Text AT TTX Normal

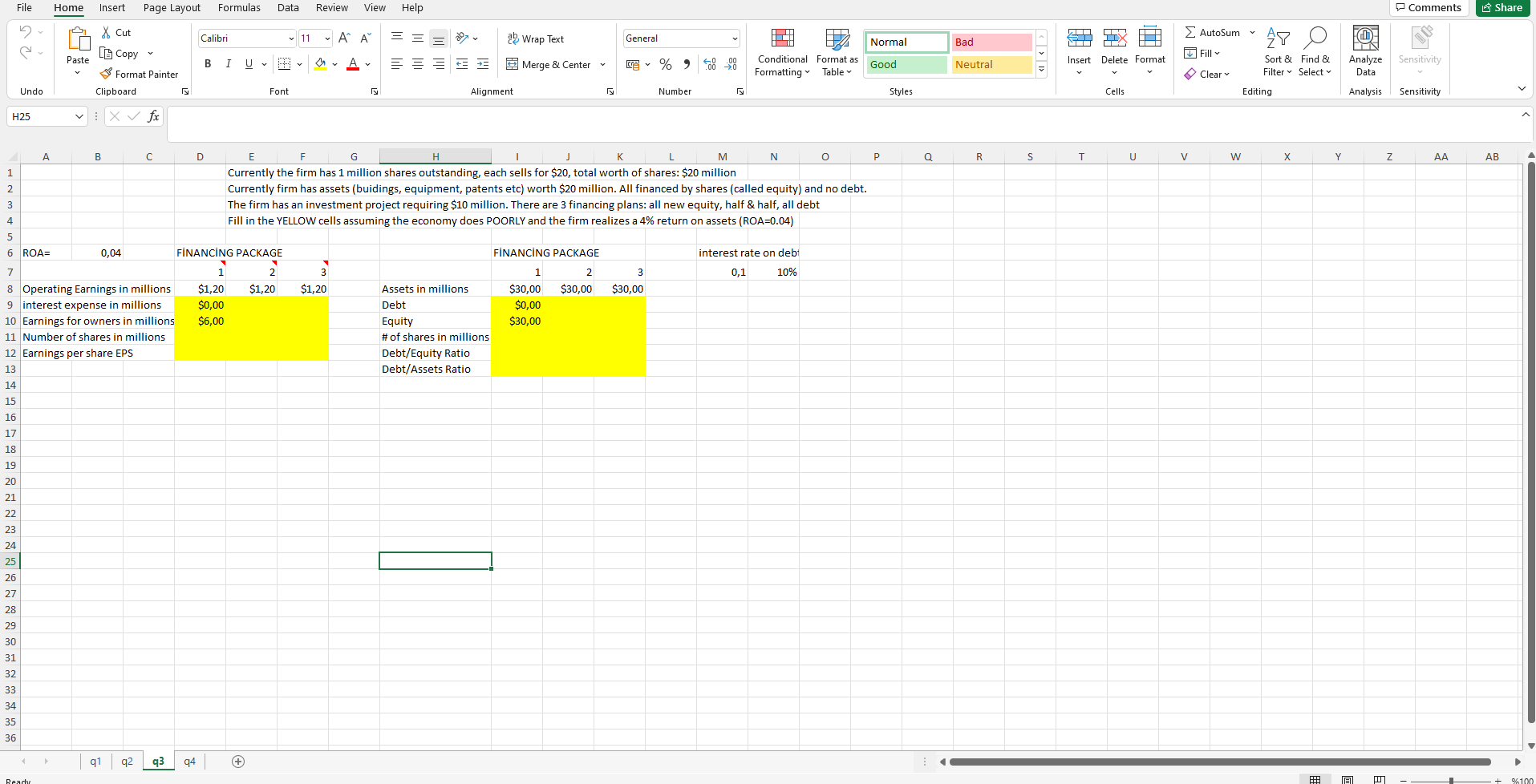

File Home Insert Page Layout Formulas Data Review View Help Comments Share Calibri v 11 = = AutoSum General ab Wrap Text AT TTX Normal Fm Bad AY X Cut L Copy Format Painter Fill Paste B Uv A I ===== = Analyze 68 90 Sensitivity Merge & Center C%) Conditional Format as Formatting Insert Delete Format Good Neutral Table Sort & Find & Filter Select Clear Data Undo Clipboard Font Alignment Number Styles Cells Editing Analysis Sensitivity H25 fx A B D H N 0 P 0 R S U V w Y Z AA AB . 1 2 E F G 1 L M Currently the firm has 1 million shares outstanding, each sells for $20, total worth of shares: $20 million Currently firm has assets (buidings, equipment, patents etc) worth $20 million. All financed by shares (called equity) and no debt. The firm has an investment project requiring $10 million. There are 3 financing plans: all new equity, half & half, all debt Fill in the YELLOW cells assuming the economy does POORLY and the firm realizes a 4% return on assets (ROA=0.04) 3 4 5 6 ROA= 0,04 FINANCING PACKAGE FINANCING PACKAGE interest rate on deb 2 3 0,1 10% 2 $1,20 3 $1,20 $30,00 $30,00 7 8 Operating Earnings in millions 9 interest expense in millions 10 Earnings for owners in millions 11 Number of shares in millions 12 Earnings per share EPS 13 $1,20 $0,00 $6,00 Assets in millions Debt Equity # of shares in millions Debt/Equity Ratio Debt/Assets Ratio 1 $30,00 $0,00 $30,00 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35 36 91 92 q3 94 + Ready %100 File Home Insert Page Layout Formulas Data Review View Help Comments Share Calibri v 11 = = AutoSum General ab Wrap Text AT TTX Normal Fm Bad AY X Cut L Copy Format Painter Fill Paste B Uv A I ===== = Analyze 68 90 Sensitivity Merge & Center C%) Conditional Format as Formatting Insert Delete Format Good Neutral Table Sort & Find & Filter Select Clear Data Undo Clipboard Font Alignment Number Styles Cells Editing Analysis Sensitivity H25 fx A B D H N 0 P 0 R S U V w Y Z AA AB . 1 2 E F G 1 L M Currently the firm has 1 million shares outstanding, each sells for $20, total worth of shares: $20 million Currently firm has assets (buidings, equipment, patents etc) worth $20 million. All financed by shares (called equity) and no debt. The firm has an investment project requiring $10 million. There are 3 financing plans: all new equity, half & half, all debt Fill in the YELLOW cells assuming the economy does POORLY and the firm realizes a 4% return on assets (ROA=0.04) 3 4 5 6 ROA= 0,04 FINANCING PACKAGE FINANCING PACKAGE interest rate on deb 2 3 0,1 10% 2 $1,20 3 $1,20 $30,00 $30,00 7 8 Operating Earnings in millions 9 interest expense in millions 10 Earnings for owners in millions 11 Number of shares in millions 12 Earnings per share EPS 13 $1,20 $0,00 $6,00 Assets in millions Debt Equity # of shares in millions Debt/Equity Ratio Debt/Assets Ratio 1 $30,00 $0,00 $30,00 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35 36 91 92 q3 94 + Ready %100

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts