Question: File Insert Page Layout Data Review View Automate Help PROTECTED VIEW This file couldn't be verified by Microsoft Defender Advanced Threat Protection. Unless you need

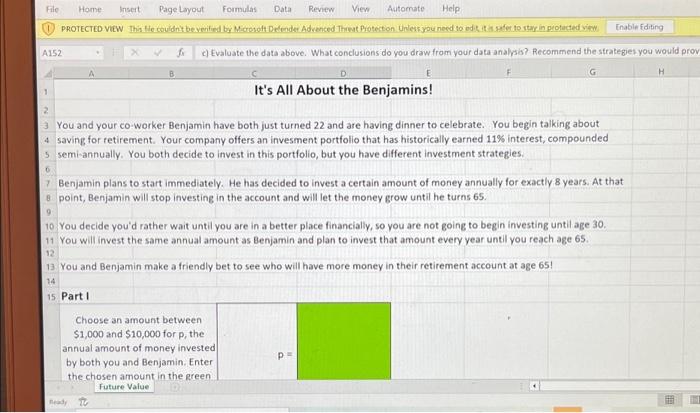

You and your co-worker Benjamin have both just turned 22 and are having dinner to celebrate. You begin talking about saving for retirement. Your company offers an invesment portfolio that has historically earned \11 interest, compounded semi-annually. You both decide to invest in this portfolio, but you have different investment strategies. Benjamin plans to start immediately. He has decided to invest a certain amount of money annually for exactly 8 years. At that point, Benjamin will stop investing in the account and will let the money grow until he turns 65 . You decide you'd rather wait until you are in a better place financially, so you are not going to begin investing until age 30 . You will invest the same annual amount as Benjamin and plan to invest that amount every year until you reach age 65. You and Benjamin make a friendly bet to see who will have more money in their retirement account at age 65 ! Part I Choose an amount between \\( \\$ 1,000 \\) and \\( \\$ 10,000 \\) for \\( p \\), the annual amount of money invested by both you and Benjamin. Enter the chosen amount in the green Future Value

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts